Answered step by step

Verified Expert Solution

Question

1 Approved Answer

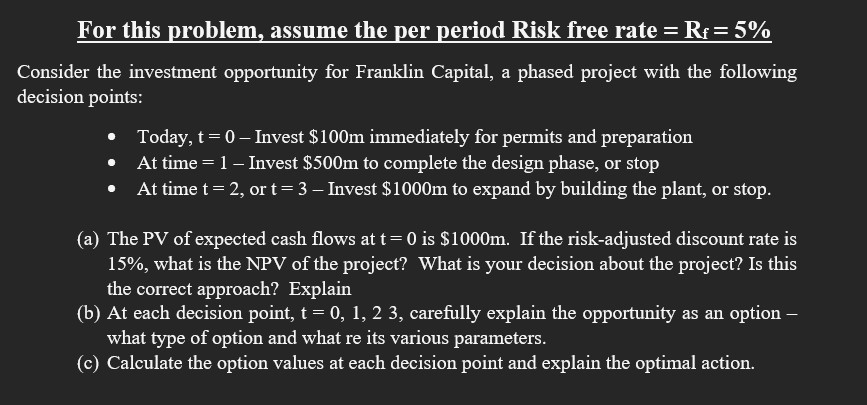

For this problem, assume the per period Risk free rate =Rf=5% Consider the investment opportunity for Franklin Capital, a phased project with the following lecision

For this problem, assume the per period Risk free rate =Rf=5% Consider the investment opportunity for Franklin Capital, a phased project with the following lecision points: - Today, t=0 - Invest $100m immediately for permits and preparation - At time =1 Invest $500m to complete the design phase, or stop - At time t=2, or t=3 - Invest $1000m to expand by building the plant, or stop. (a) The PV of expected cash flows at t=0 is $1000m. If the risk-adjusted discount rate is 15%, what is the NPV of the project? What is your decision about the project? Is this the correct approach? Explain (b) At each decision point, t=0,1,23, carefully explain the opportunity as an option what type of option and what re its various parameters. (c) Calculate the option values at each decision point and explain the optimal action

For this problem, assume the per period Risk free rate =Rf=5% Consider the investment opportunity for Franklin Capital, a phased project with the following lecision points: - Today, t=0 - Invest $100m immediately for permits and preparation - At time =1 Invest $500m to complete the design phase, or stop - At time t=2, or t=3 - Invest $1000m to expand by building the plant, or stop. (a) The PV of expected cash flows at t=0 is $1000m. If the risk-adjusted discount rate is 15%, what is the NPV of the project? What is your decision about the project? Is this the correct approach? Explain (b) At each decision point, t=0,1,23, carefully explain the opportunity as an option what type of option and what re its various parameters. (c) Calculate the option values at each decision point and explain the optimal action Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started