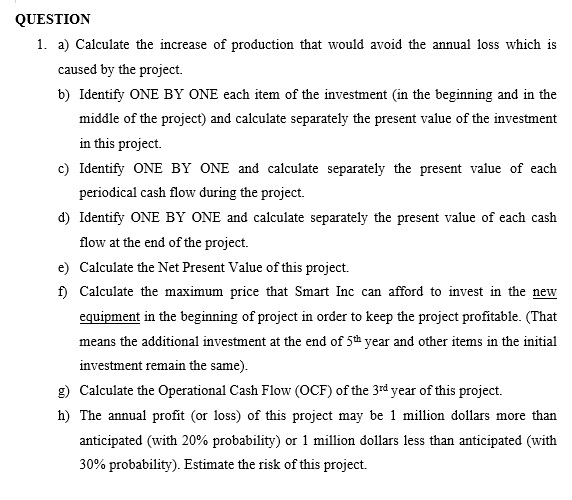

Question

For this problem I have to show my work - i need to show how i got operating cash flow, use one of the methods,

For this problem I have to show my work - i need to show how i got operating cash flow, use one of the methods, tax shield, declining method, linear method etc. Present value of losses of tax savings and also present value of tax savings...i need to show the present values for the beginning, during and end of the project as well and then finally add up all to get the net present value.. The questions for this problem are posted at the bottom of the problem. A lot of individuals have kindly tried to help me with this problem on Chegg, but unfortunately the answers are incorrect, if someone could please thoroughly go through the problem and step by step answer it..it would be very helpful and informative to help me understand this mess of a problem haha! Thanks very much, my final is next week and I need to be able to solve one of these problems!

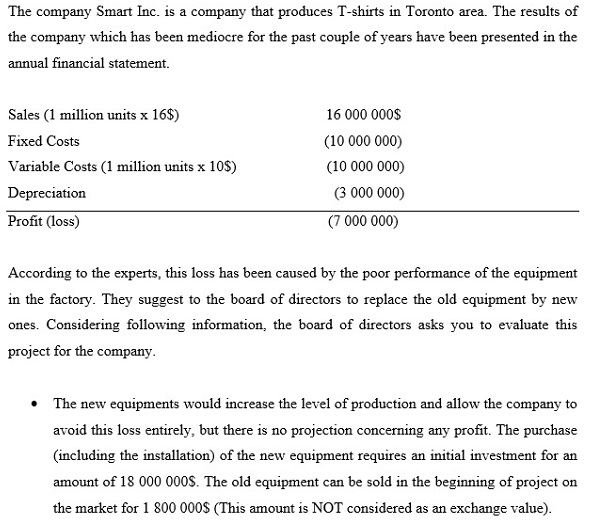

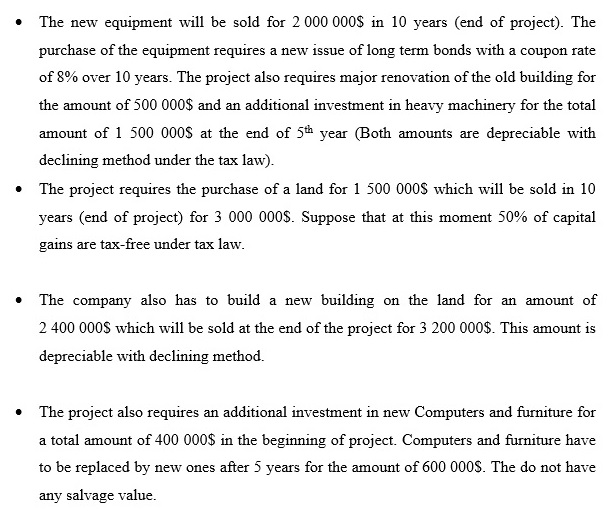

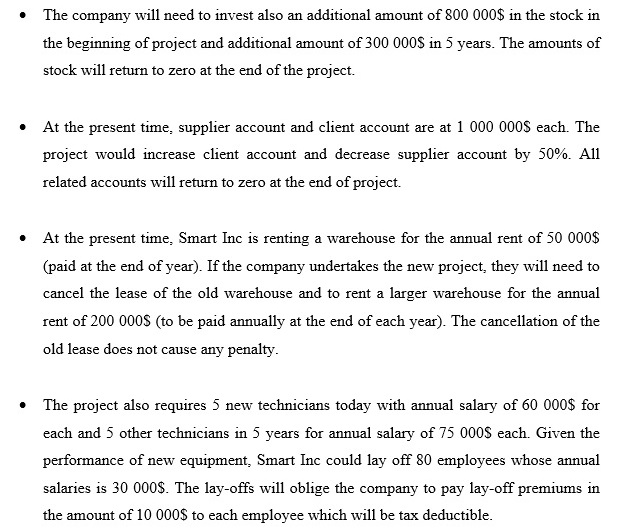

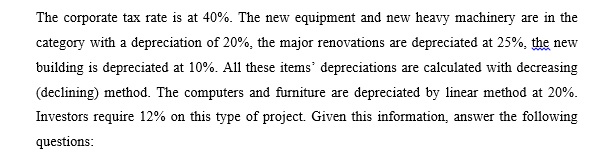

The company Smart Inc. is a company that produces T-shirts in Toronto area. The results of the company which has been mediocre for the past couple of years have been presented in the annual financial statement. Sales (1 million units x 168) Fixed Costs Variable Costs (1 million units x 10S) Depreciation Profit (loss) 16 000 000S (10 000 000) (10 000 000) (3 000 000) (7 000 000) According to the experts, this loss has been caused by the poor performance of the equipment in the factory. They suggest to the board of directors to replace the old equipment by new ones. Considering following information, the board of directors asks you to evaluate this project for the company The new equipments would increase the level of production and allow the company to avoid this loss entirely, but there is no projection concerning any profit. The purchase (including the installation) of the new equipment requires an initial investment for an amount of 18 000 000S. The the market for 1 800 000S (This amount is NOT considered as an exchange value) old equipment can be sold in the beginning of project on

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started