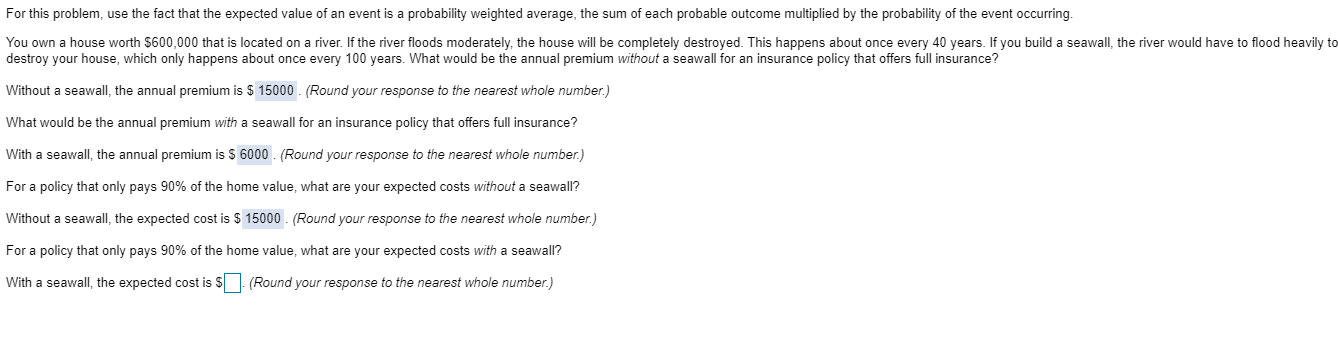

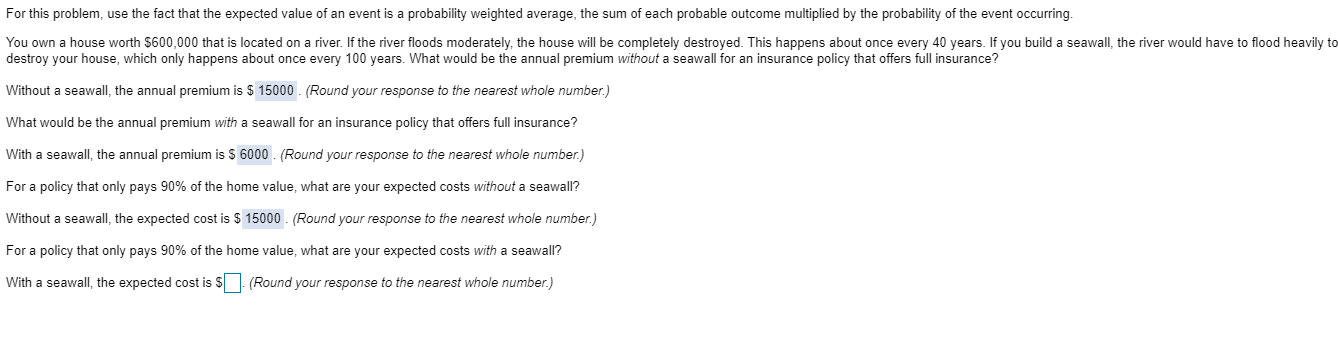

For this problem, use the fact that the expected value of an event is a probability weighted average, the sum of each probable outcome multiplied by the probability of the event occurring. You own a house worth $600,000 that is located on a river. If the river floods moderately, the house will be completely destroyed. This happens about once every 40 years. If you build a seawall, the river would have to flood heavily to destroy your house, which only happens about once every 100 years. What would be the annual premium without a seawall for an insurance policy that offers full insurance? Without a seawall, the annual premium is $ 15000 (Round your response to the nearest whole number.) What would be the annual premium with a seawall for an insurance policy that offers full insurance? With a seawall, the annual premium is $ 6000 (Round your response to the nearest whole number) For a policy that only pays 90% of the home value, what are your expected costs without a seawall? Without a seawall, the expected cost is $15000 (Round your response to the nearest whole number.) For a policy that only pays 90% of the home value, what are your expected costs with a seawall? With a seawall, the expected cost is S(Round your response to the nearest whole number.) For this problem, use the fact that the expected value of an event is a probability weighted average, the sum of each probable outcome multiplied by the probability of the event occurring. You own a house worth $600,000 that is located on a river. If the river floods moderately, the house will be completely destroyed. This happens about once every 40 years. If you build a seawall, the river would have to flood heavily to destroy your house, which only happens about once every 100 years. What would be the annual premium without a seawall for an insurance policy that offers full insurance? Without a seawall, the annual premium is $ 15000 (Round your response to the nearest whole number.) What would be the annual premium with a seawall for an insurance policy that offers full insurance? With a seawall, the annual premium is $ 6000 (Round your response to the nearest whole number) For a policy that only pays 90% of the home value, what are your expected costs without a seawall? Without a seawall, the expected cost is $15000 (Round your response to the nearest whole number.) For a policy that only pays 90% of the home value, what are your expected costs with a seawall? With a seawall, the expected cost is S(Round your response to the nearest whole number.)