Answered step by step

Verified Expert Solution

Question

1 Approved Answer

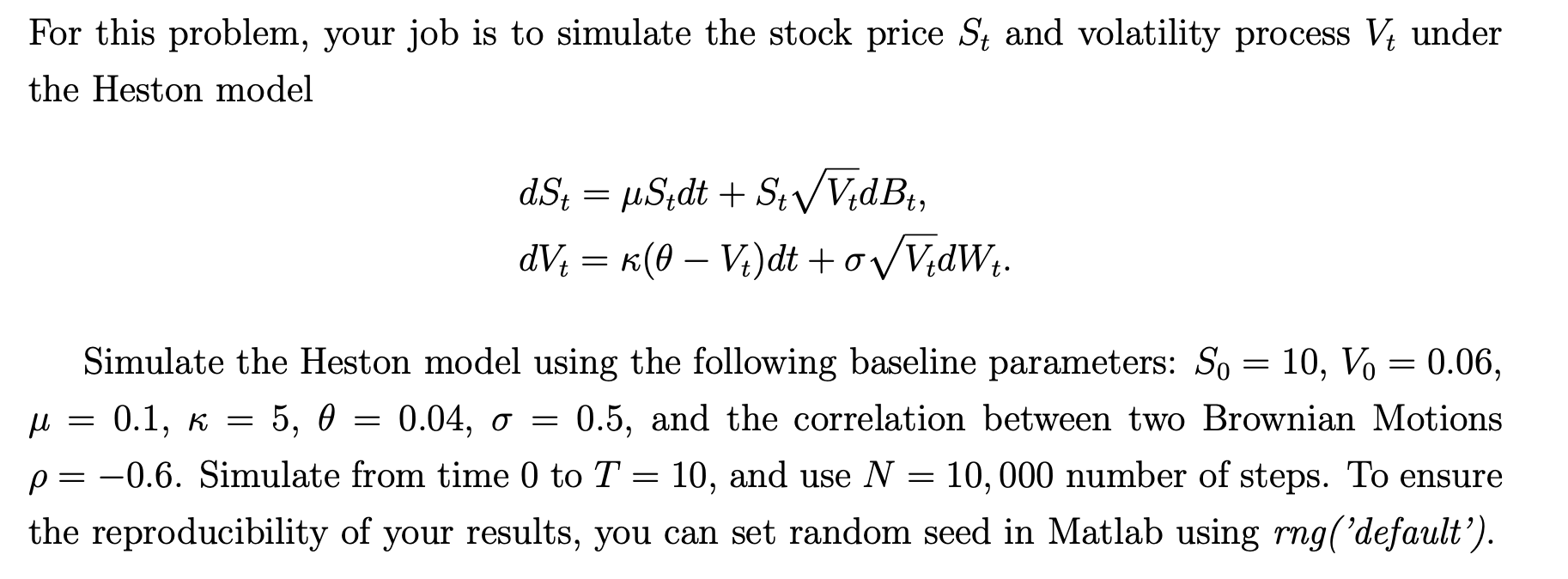

For this problem, your job is to simulate the stock price St and volatility process V under the Heston model dSt = Stdt +

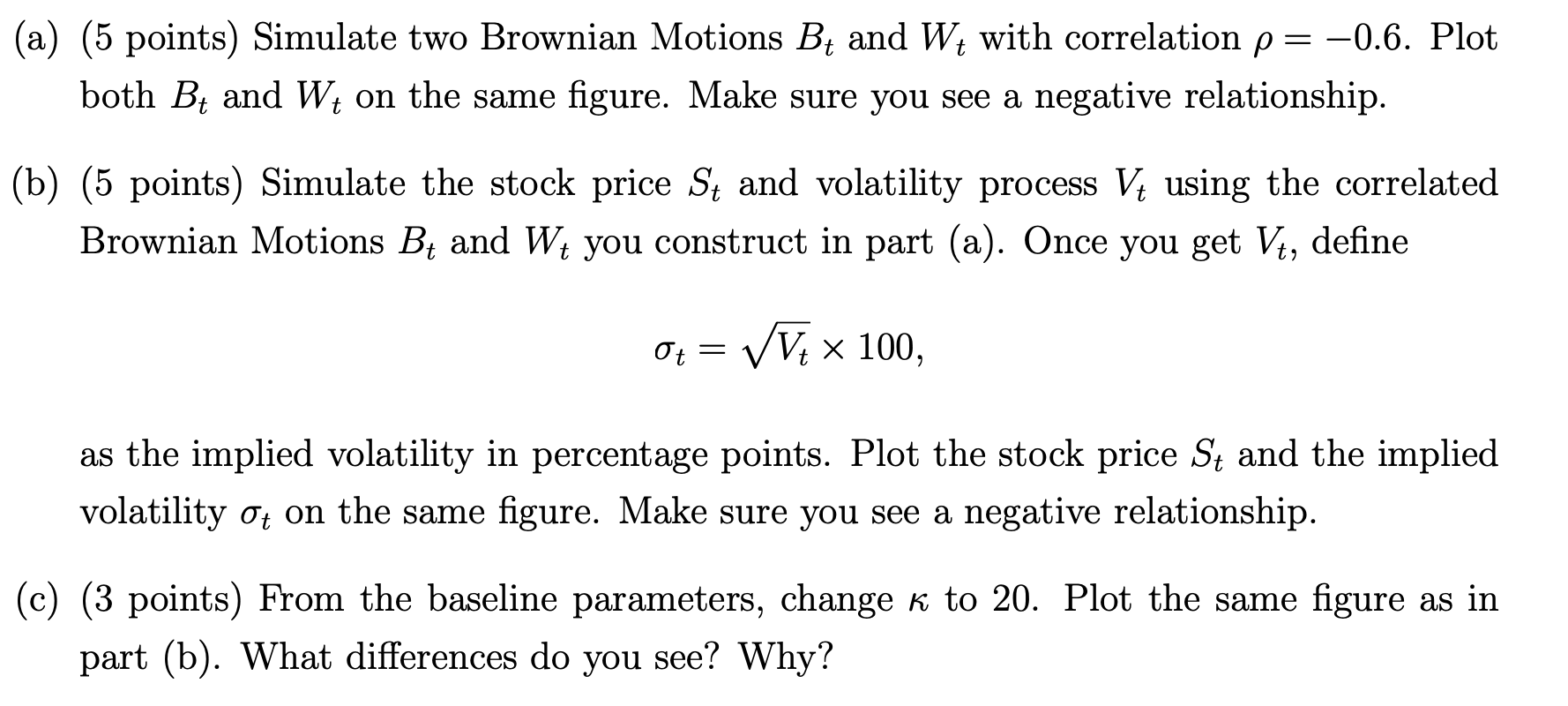

For this problem, your job is to simulate the stock price St and volatility process V under the Heston model dSt = Stdt + StVtdBt, dV = K (0-V)dt + oVidW. = Simulate the Heston model using the following baseline parameters: So 10, Vo = 0.06, l 0.1, K = 5, 00.04, o = 0.5, and the correlation between two Brownian Motions p= -0.6. Simulate from time 0 to T = 10, and use N = 10,000 number of steps. To ensure the reproducibility of your results, you can set random seed in Matlab using rng('default'). = t (a) (5 points) Simulate two Brownian Motions B and W with correlation p= -0.6. Plot both B and W, on the same figure. Make sure you see a negative relationship. t (b) (5 points) Simulate the stock price St and volatility process V using the correlated Brownian Motions B, and Wt you construct in part (a). Once you get V, define = V 100, as the implied volatility in percentage points. Plot the stock price S, and the implied volatility of on the same figure. Make sure you see a negative relationship. (c) (3 points) From the baseline parameters, change to 20. Plot the same figure as in part (b). What differences do you see? Why? (d) (3 points) From the baseline parameters, change p to 0.6. Plot the same figure as in part (b). What differences do you see? Why?

Step by Step Solution

★★★★★

3.39 Rating (158 Votes )

There are 3 Steps involved in it

Step: 1

Here is the code to simulate the Heston model and plot the results Set random seed for reproducibili...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started