For this question as you can see i have the solution, i would just like to know for number 6 c, how did he get eh (0.0741) when finding the BV of year 4.

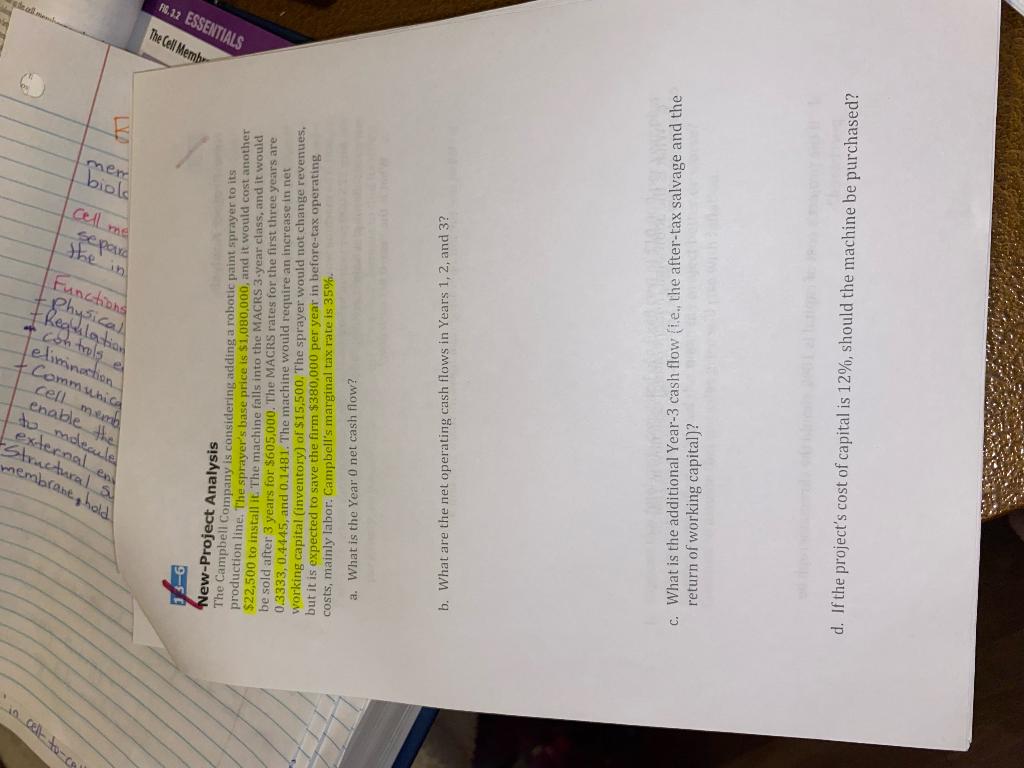

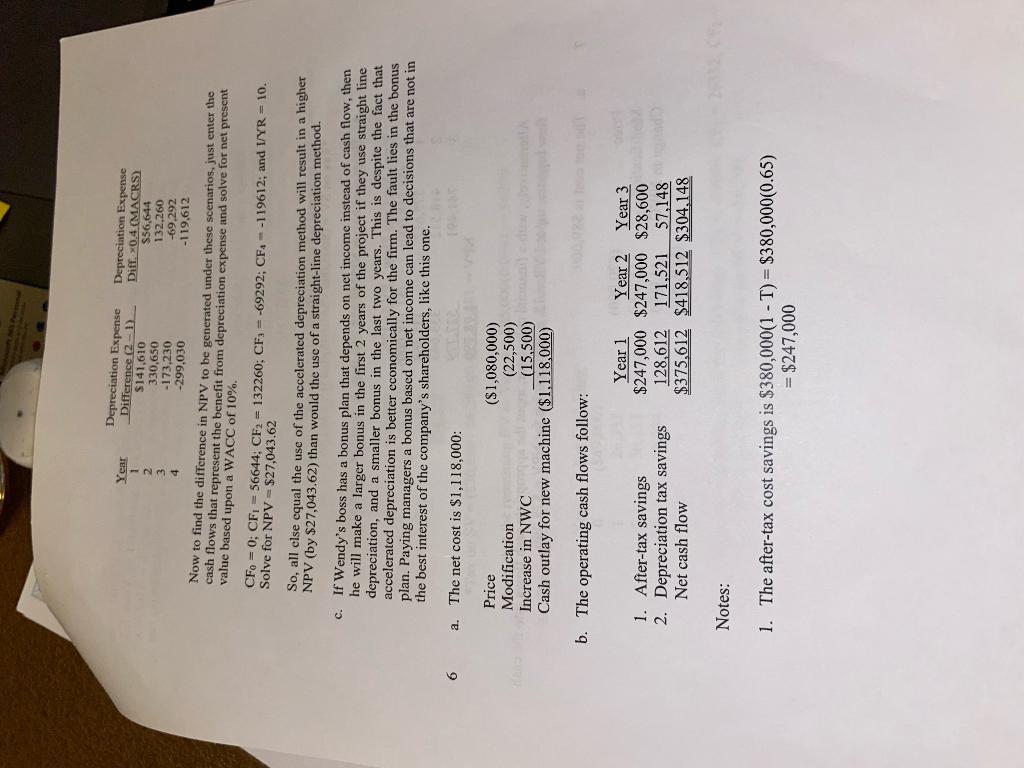

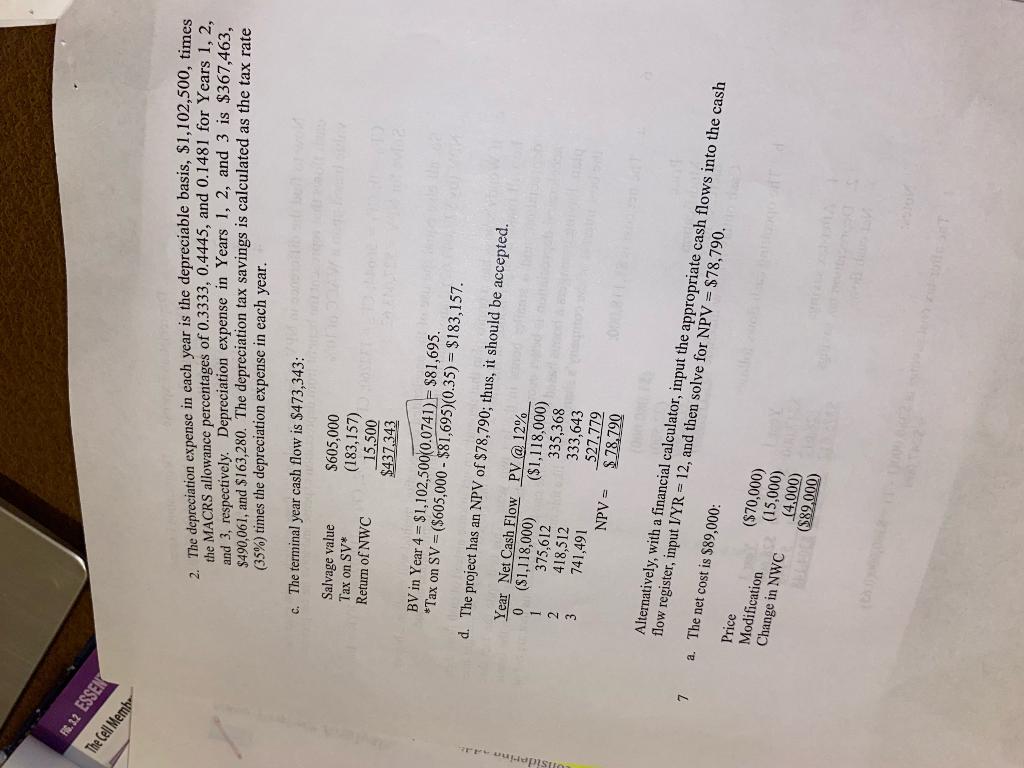

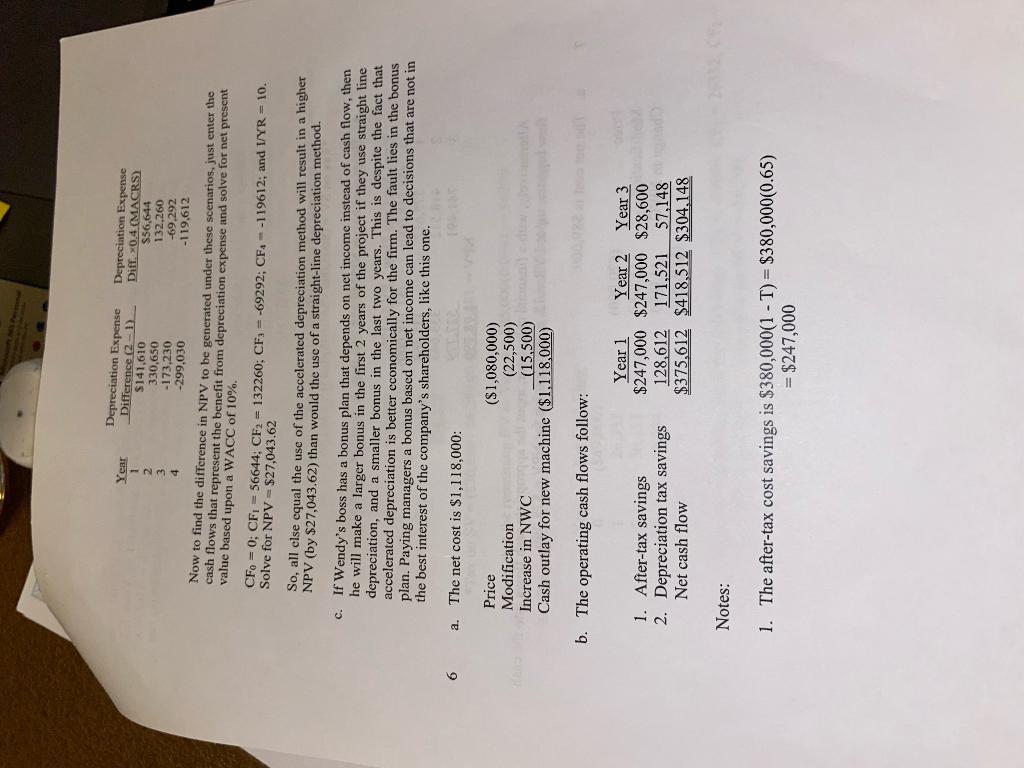

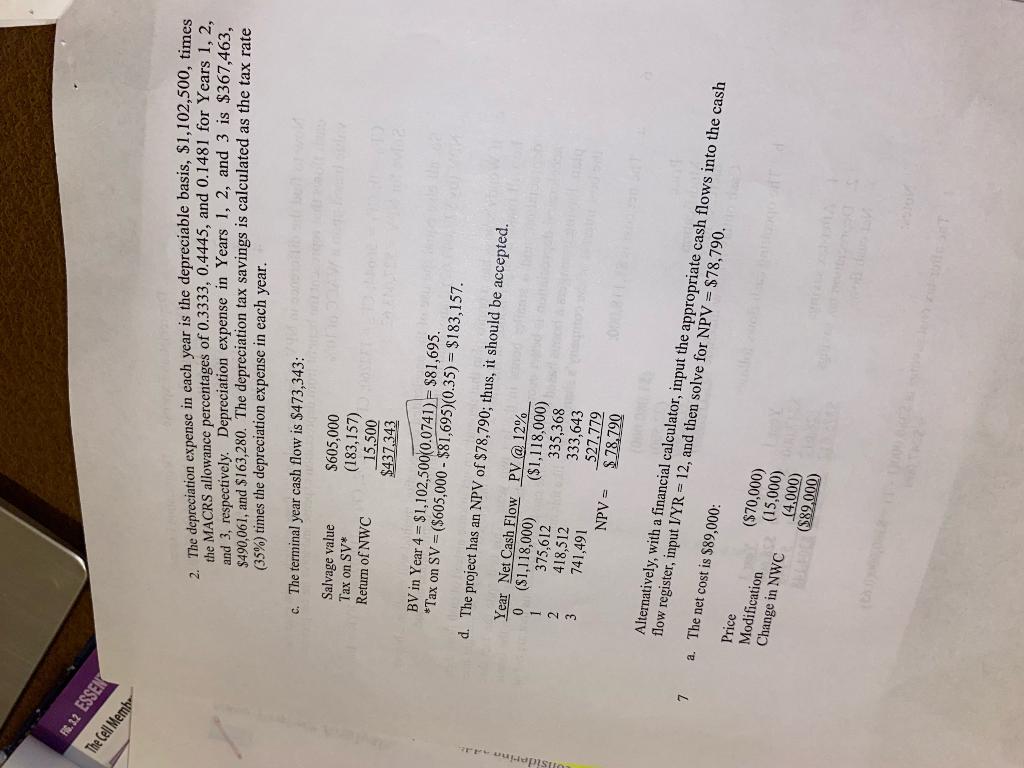

in celt to-cal Chol abrane hold Como cell nable the mschis elimine Regislation Ephysical Functions pod if cell S biolo mem ON The Cell Member 2 ESSENTIALS J 3-6 New-Project Analysis The Campbell Company is considering adding a robotic paint sprayer to its production line. The sprayer's base price is $1,000,000, and it would cost another $22,500 to install it. The machine falls into the MACRS 3.year class, and it would be sold after 3 years for $605,000. The MACRS rates for the first three years are 0.3333, 0.4445, and 0.1481. The machine would require an increase in net working capital inventory) of $15.500. The sprayer would not change revenues, but it is expected to save the firm $380,000 per year in before-tax operating costs, mainly labor. Campbell's marginal tax rate is 35%. a. What is the Year 0 net cash flow? b. What are the net operating cash flows in Years 1, 2, and 3? c. What is the additional Year-3 cash flow (i.e. the after-tax salvage and the return of working capital)? d. If the project's cost of capital is 12%, should the machine be purchased? Depreciation Expense Depreciation Expense Year Difference (2-1) Diff, 04 (MACRS) 1 $141,610 $56,644 2 330,650 132,260 3 - 173,230 -69,292 -299.030 -119,612 Now to find the difference in NPV to be generated under these scenarios. just enter the cash flows that represent the benefit from depreciation expense and solve for net present value based upon a WACC of 10%. CF = 0; CF. 56644; CF2 - 132260, CF3 = -69292; CF. --119612; and 1/YR = 10. Solve for NPV =$27,043.62 So, all else cqual the use of the accelerated depreciation method will result in a higher NPV (by $27,043.62) than would the use of a straight-line depreciation method. c. If Wendy's boss has a bonus plan that depends on net income instead of cash flow, then he will make a larger bonus in the first 2 years of the project if they use straight line depreciation, and a smaller bonus in the last two years. This is despite the fact that accelerated depreciation is better economically for the firm. The fault lies in the bonus plan. Paying managers a bonus based on net income can lead to decisions that are not in the best interest of the company's shareholders, like this The net cost is $1,118,000: 1 one. 6 a. Price ($1,080,000) Modification (22,500) Increase in NWC (15,500) Cash outlay for new machine ($1,118,000) b. The operating cash flows follow: 1. After-tax savings 2. Depreciation tax savings Net cash flow Year 1 Year 2 Year 3 $247,000 $247,000 $28,600 128,612 171,521 57,148 $375,612 $418,512 $304,148 Notes: 1. The after-tax cost savings is $380,000(1 - T) = $380,000(0.65) = $247,000 FG. 2:2 ESSEN The Cell Memb 2. The depreciation expense in each year is the depreciable basis, $1,102,500, times the MACRS allowance percentages of 0.3333, 0.4445, and 0.1481 for Years 1, 2, and 3, respectively. Depreciation expense in Years 1, 2, and 3 is $367,463, $490,061, and $163,280. The depreciation tax savings is calculated as the tax rate (35%) times the depreciation expense in each year. c. The terminal year cash flow is $473,343: Salvage value Tax on SV* Retum of NWC $605,000 (183,157) 15,500 $437.343 BV in Year 4 = $1,102,500(0.0741) - $81,695. *Tax on SV = ($605,000 - $81,695)(0.35) = $183,157. d. The project has an NPV of $78,790; thus, it should be accepted. Year Net Cash Flow PV @ 12% 0 ($1,118,000) ($1,118,000) 375,612 335,368 2 418,512 333,643 3 741,491 527.779 NPV - $78,790 7 a. The net cost is $89,000: Alternatively, with a financial calculator, input the appropriate cash flows into the cash flow register, input I/YR - 12, and then solve for NPV = $78,790. Price Modification Change in NWC ($70,000) (15,000) (4,000) (889.000