Answered step by step

Verified Expert Solution

Question

1 Approved Answer

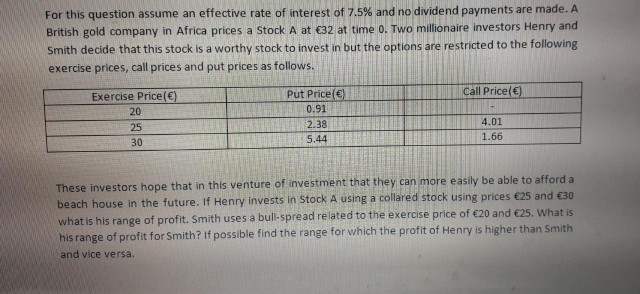

For this question assume an effective rate of interest of 7.5% and no dividend payments are made. A British gold company in Africa prices a

For this question assume an effective rate of interest of 7.5% and no dividend payments are made. A British gold company in Africa prices a Stock A at 32 at time 0. Two millionaire investors Henry and Smith decide that this stock is a worthy stock to invest in but the options are restricted to the following exercise prices, call prices and put prices as follows. Call Price ) Exercise Price () 20 25 30 Put Price ) 0.91 2.38 5.44 4.01 1.66 These investors hope that in this venture of investment that they can more easily be able to afford a beach house in the future. If Henry invests in Stock A using a collared stock using prices 25 and 30 what is his range of profit. Smith uses a bull-spread related to the exercise price of 20 and 25. What is his range of profit for Smith? If possible find the range for which the profit of Henry is higher than Smith and vice versa

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started