Answered step by step

Verified Expert Solution

Question

1 Approved Answer

For this question, continue to use the annual discount rate of 10% to discount FCFFS. EMD, under the leadership of Edna Mode, its CEO,

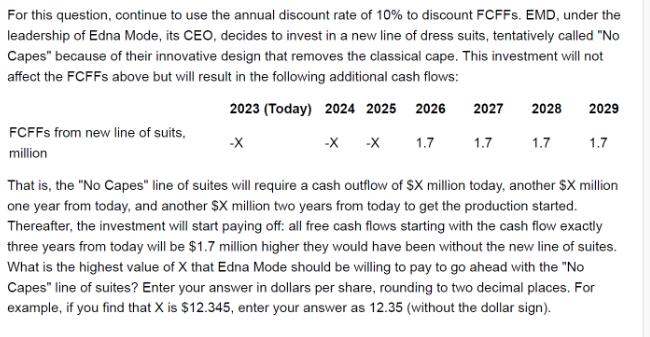

For this question, continue to use the annual discount rate of 10% to discount FCFFS. EMD, under the leadership of Edna Mode, its CEO, decides to invest in a new line of dress suits, tentatively called "No Capes" because of their innovative design that removes the classical cape. This investment will not affect the FCFFS above but will result in the following additional cash flows: 2023 (Today) 2024 2025 2026 2027 2028 2029 FCFFs from new line of suits, million -X -X -X 1.7 1.7 1.7 1.7 That is, the "No Capes" line of suites will require a cash outflow of SX million today, another $X million one year from today, and another $X million two years from today to get the production started. Thereafter, the investment will start paying off: all free cash flows starting with the cash flow exactly three years from today will be $1.7 million higher they would have been without the new line of suites. What is the highest value of X that Edna Mode should be willing to pay to go ahead with the "No Capes" line of suites? Enter your answer in dollars per share, rounding to two decimal places. For example, if you find that X is $12.345, enter your answer as 12.35 (without the dollar sign).

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started