Answered step by step

Verified Expert Solution

Question

1 Approved Answer

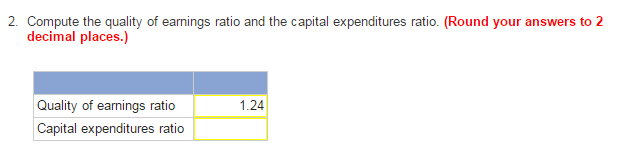

*For this question, I need help in finding capital expenditures ratio. The rest are correct. Selected financial information for Frank Corporation is presented below: Selected

*For this question, I need help in finding capital expenditures ratio. The rest are correct.

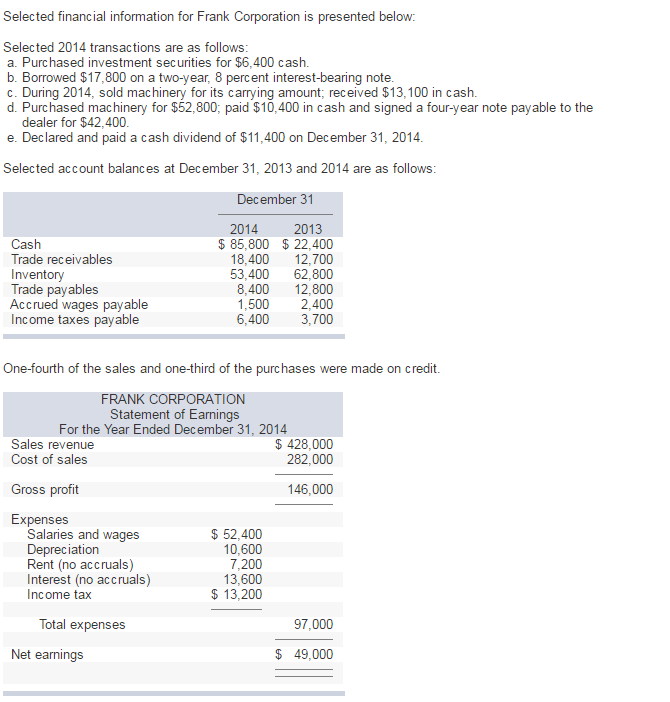

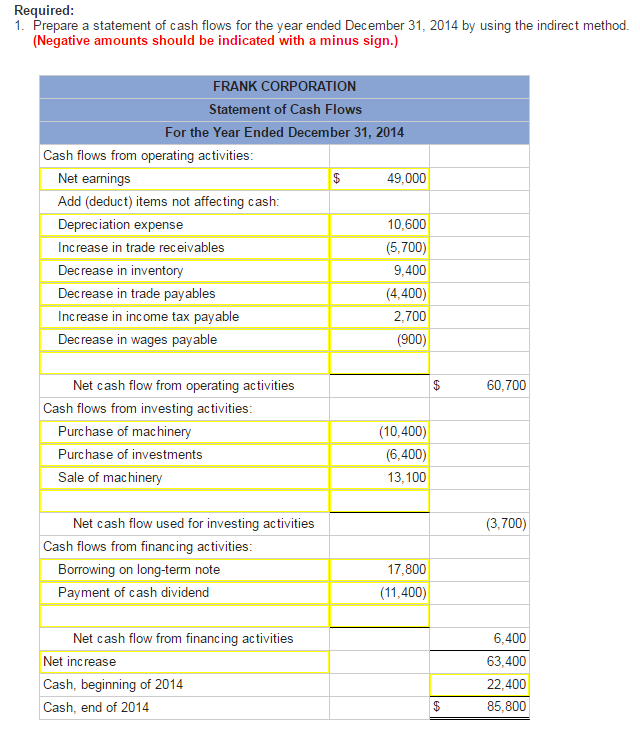

Selected financial information for Frank Corporation is presented below: Selected 2014 transactions are as follows: a. Purchased investment securities for $6,400 cash. b. Borrowed $17,800 on a two-year, 8 percent interest-bearing note. c. During 2014, sold machinery for its carrying amount; received $13,100 in cash. d. Purchased machinery for $52,800; paid $10,400 in cash and signed a four-year note payable to the dealer for $42,400. e. Declared and paid a cash dividend of $11,400 on December 31, 2014. Selected account balances at December 31, 2013 and 2014 are as follows December 31 2014 2013 Cash 85,800 22,400 Trade receivables 18,400 12,700 Inventory 53,400 62,800 Trade payables 8,400 12,800 Accrued wages payable 1.500 2,400 Income taxes payable 6.400 3,700 One-fourth of the sales and one-third of the purchases were made on credit. FRANK CORPORATION Statement of Earnings For the Year Ended December 31, 2014 Sales revenue 428,000 Cost of sales 282,000 146,000 Gross profit Expenses 52,400 Salaries and wages Depreciation 10,600 Rent (no accruals) 7,200 13,600 Interest (no accruals Income tax 13,200 Total expenses 97,000 Net earnings 49,000Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started