Answered step by step

Verified Expert Solution

Question

1 Approved Answer

For this question I saw the solution on Chegg but I dont understand how the answer for 37 is c when in the explanation COGS

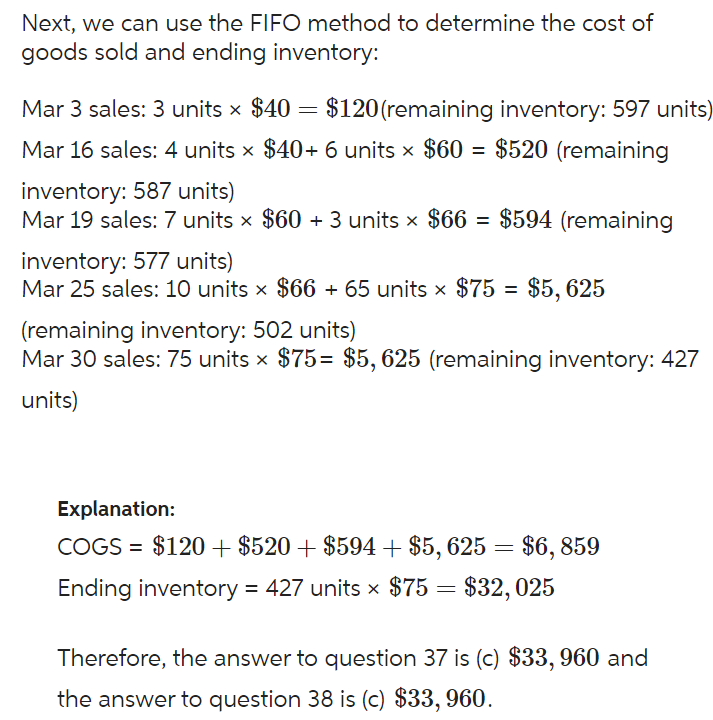

For this question I saw the solution on Chegg but I dont understand how the answer for 37 is c when in the explanation COGS totaled $6,859. where did the 33, 960? Also for the fifo method section I see they have 3 units, then 7 units, etc where did all those units come from?? Because i dont see them in the question itself.

I also don't get how they got the answer for 38. :(

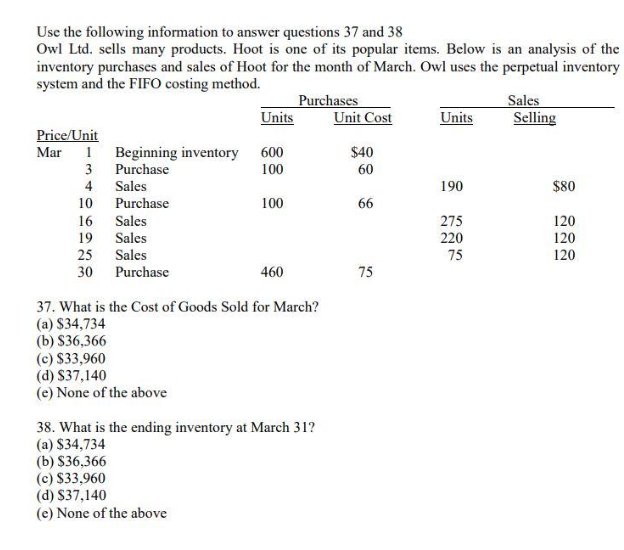

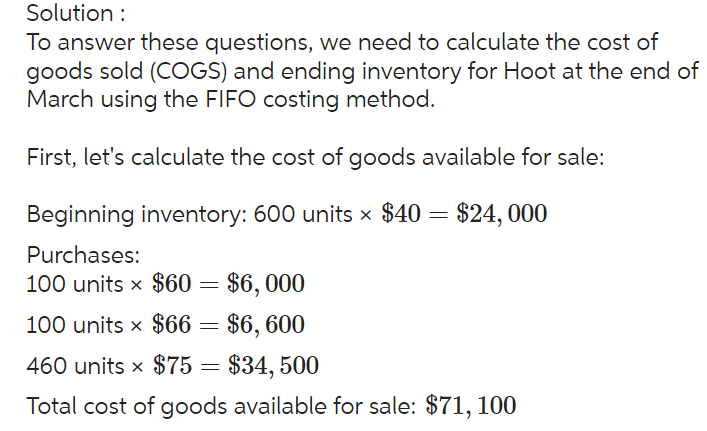

Use the following information to answer questions 37 and 38 Owl Ltd. sells many products. Hoot is one of its popular items. Below is an analysis of the inventory purchases and sales of Hoot for the month of March. Owl uses the perpetual inventory system and the FIFO costing method. 37. What is the Cost of Goods Sold for March? (a) $34,734 (b) $36,366 (c) $33,960 (d) $37,140 (e) None of the above 38. What is the ending inventory at March 31 ? (a) $34,734 (b) $36,366 (c) $33,960 (d) $37,140 (e) None of the above To answer these questions, we need to calculate the cost of goods sold (COGS) and ending inventory for Hoot at the end of March using the FIFO costing method. First, let's calculate the cost of goods available for sale: Beginning inventory: 600 units $40=$24,000 Purchases: 100 units $60=$6,000 100 units $66=$6,600 460 units $75=$34,500 Total cost of goods available for sale: $71,100 Next, we can use the FIFO method to determine the cost of goods sold and ending inventory: Mar 3 sales: 3 units $40=$120 (remaining inventory: 597 units Mar 16 sales: 4 units $40+6 units $60=$520 (remaining inventory: 587 units) Mar 19 sales: 7 units $60+3 units $66=$594 (remaining inventory: 577 units) Mar 25 sales: 10 units $66+65 units $75=$5,625 (remaining inventory: 502 units) Mar 30 sales: 75 units $75=$5,625 (remaining inventory: 427 units) Explanation: COGS=$120+$520+$594+$5,625=$6,859 Ending inventory =427 units $75=$32,025 Therefore, the answer to question 37 is (c) $33,960 and the answer to question 38 is (c) $33,960

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started