Answered step by step

Verified Expert Solution

Question

1 Approved Answer

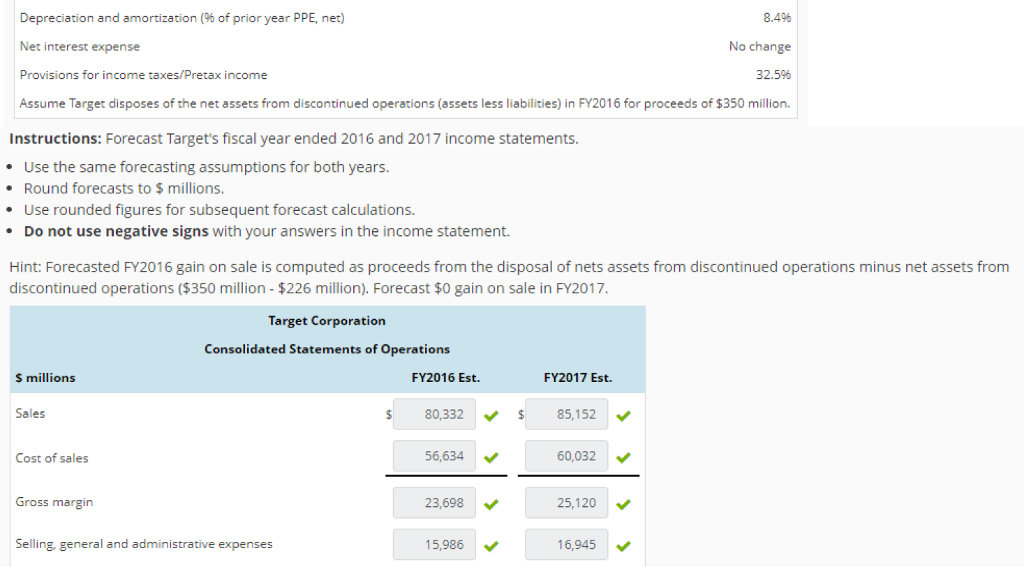

For this question pertaining to two-year ahead forecasting of financial statement, please let me know how to calculate the Current portion of LT debt and

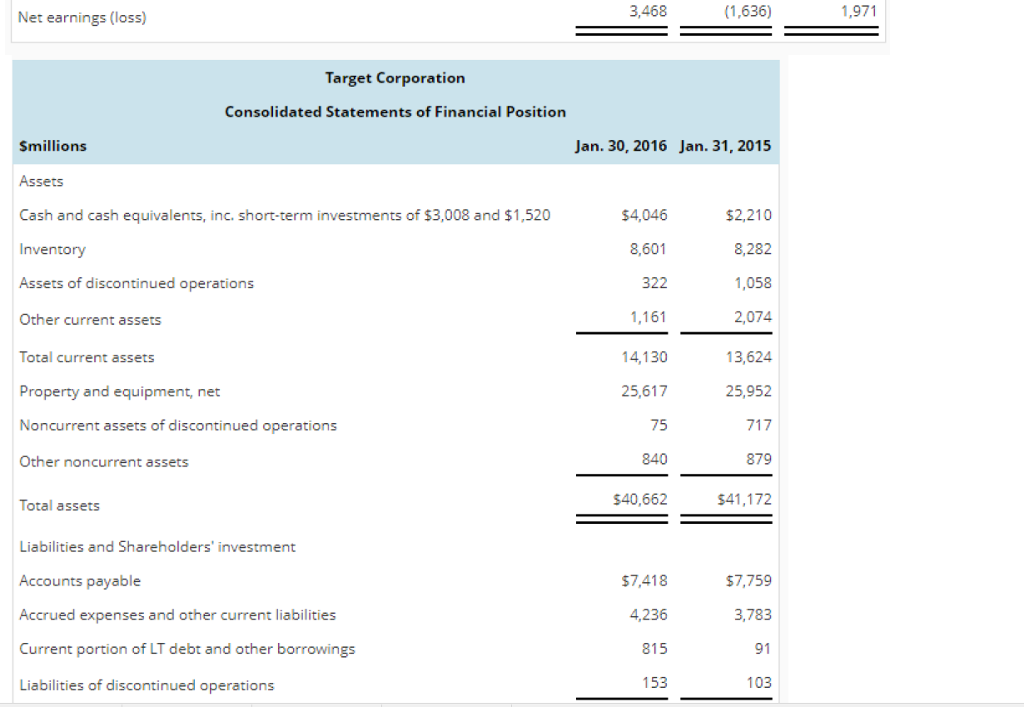

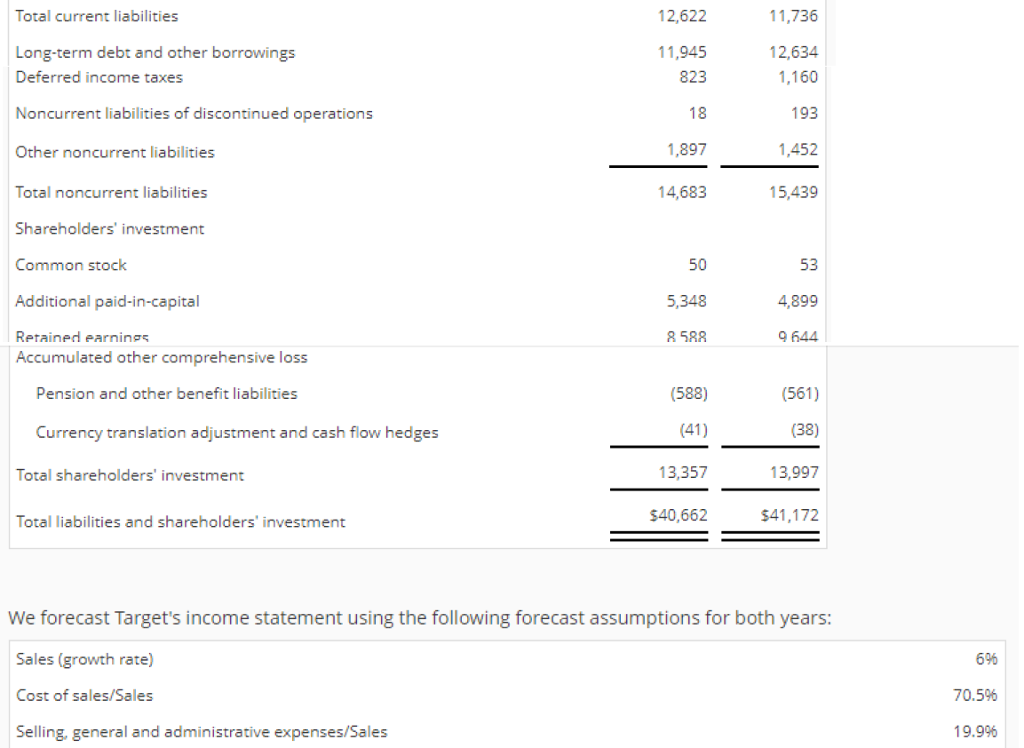

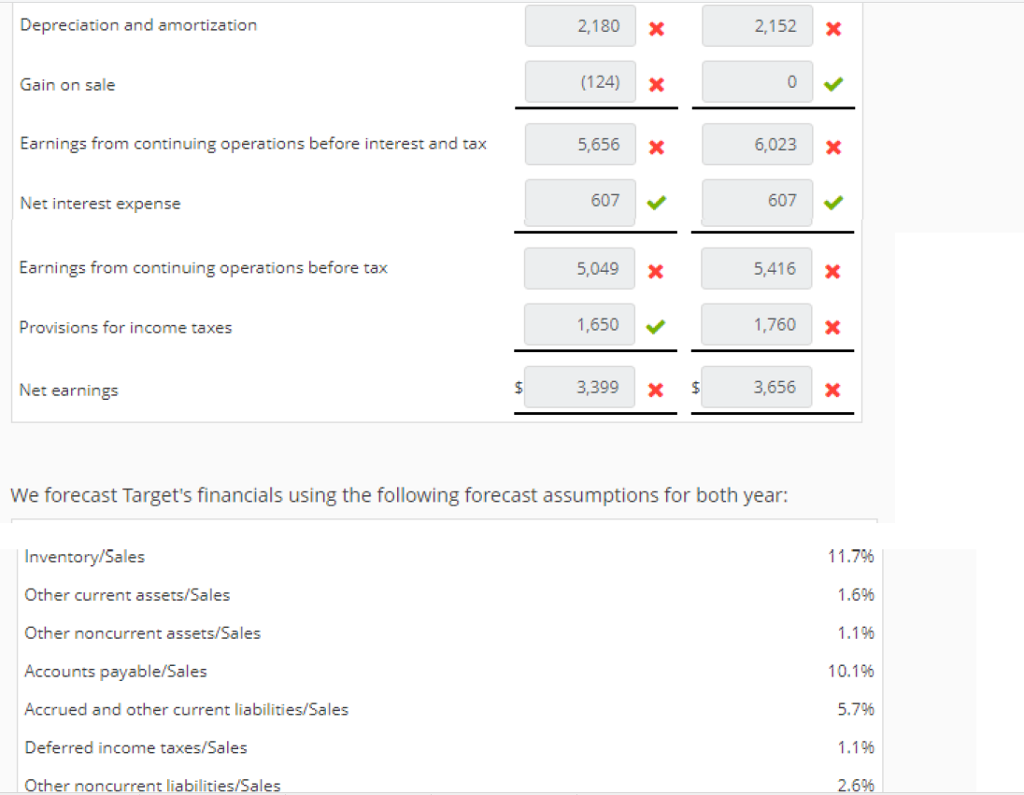

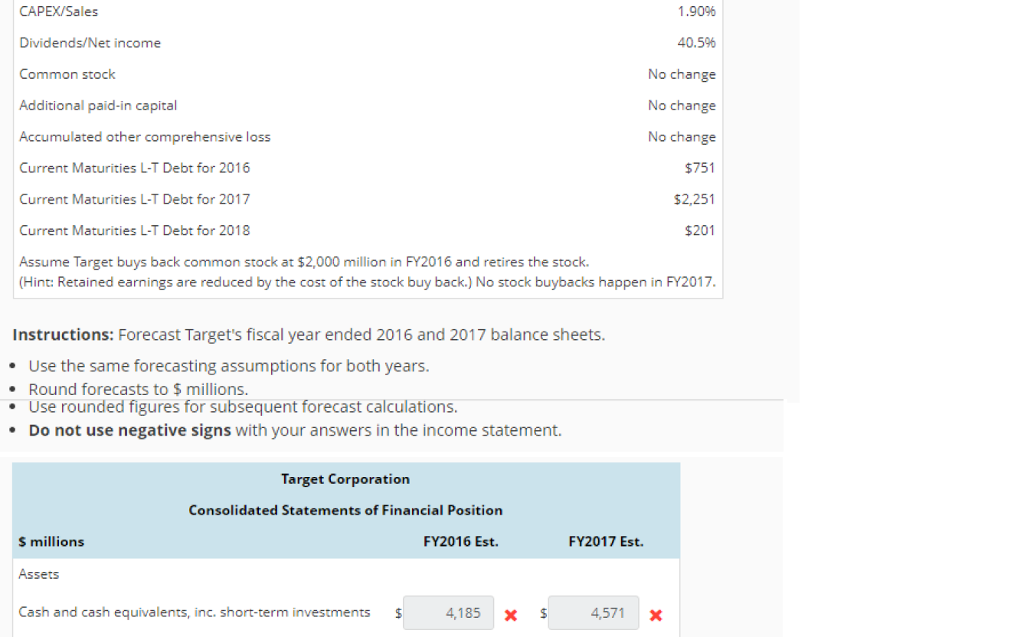

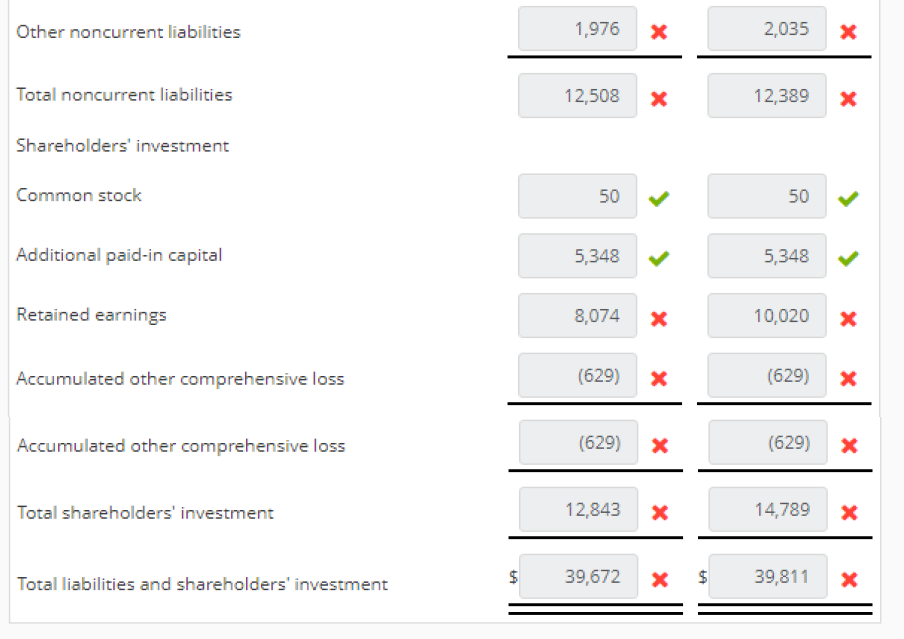

For this question pertaining to two-year ahead forecasting of financial statement, please let me know how to calculate the Current portion of LT debt and other borrowings (FY2016 Est. and FY2017 Est.), Long-term debt and other borrowings (FY2016 Est. and FY2017 Est.), and Retained Earnings (FY2016 Est. and FY2017 Est.).

Please solve those problems in its entirity and show your steps to your calculations. I understand how to calculate everything else except for those three.

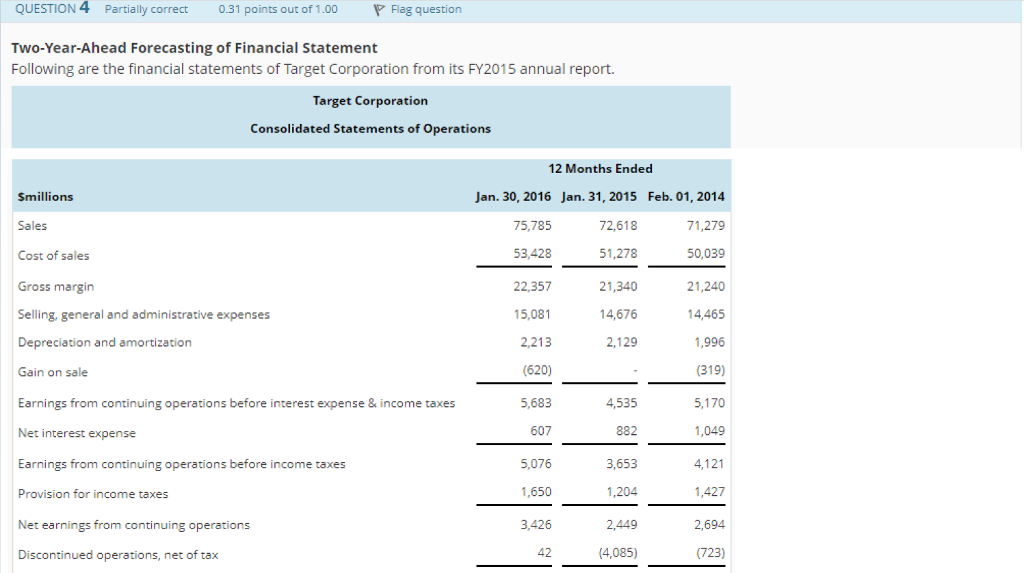

QUESTION 4 Partially correct 031 points out of 1.00 P Flag question Two-Year-Ahead Forecasting of Financial Statement Following are the financial statements of Target Corporation from its FY2015 annual report. Target Corporation Consolidated Statements of Operations 12 Months Ended Smillions Sales Cost of sales Gross margin Selling, general and administrative expenses Depreciation and amortization Jan. 30, 2016 Jan. 31, 2015 72,618 51,278 21,340 14,676 2,129 75,785 53,428 22,357 15,081 2,213 (620) 5,683 607 5,076 1,650 3,426 42 Feb. 01, 2014 71,279 50,039 21,240 14,465 1,996 (319) 5,170 1,049 4,121 1,427 2,694 (723) Gain on sale Earnings from continuing operations before interest expense & income taxes Net interest expense Earnings from continuing operations before income taxes Provision for income taxes Net earnings from continuing operations Discontinued operations, net of tax 4,535 882 3,653 1,204 2,449 (4,085) QUESTION 4 Partially correct 031 points out of 1.00 P Flag question Two-Year-Ahead Forecasting of Financial Statement Following are the financial statements of Target Corporation from its FY2015 annual report. Target Corporation Consolidated Statements of Operations 12 Months Ended Smillions Sales Cost of sales Gross margin Selling, general and administrative expenses Depreciation and amortization Jan. 30, 2016 Jan. 31, 2015 72,618 51,278 21,340 14,676 2,129 75,785 53,428 22,357 15,081 2,213 (620) 5,683 607 5,076 1,650 3,426 42 Feb. 01, 2014 71,279 50,039 21,240 14,465 1,996 (319) 5,170 1,049 4,121 1,427 2,694 (723) Gain on sale Earnings from continuing operations before interest expense & income taxes Net interest expense Earnings from continuing operations before income taxes Provision for income taxes Net earnings from continuing operations Discontinued operations, net of tax 4,535 882 3,653 1,204 2,449 (4,085)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started