Question

A firm recorded its sales (Qt) in monthly observations from January 2013 to August 2014. The data collected is shown in the table below: Sales

A firm recorded its sales (Qt) in monthly observations from January 2013 to August 2014. The data collected is shown in the table below:

Sales ($ Thousands)

Qt | |

Jan-13 | 46 |

Feb-13 | 56 |

Mar-13 | 72 |

May-13 | 67 |

Jun-13 | 77 |

Aug-13 | 66 |

Sep-13 | 69 |

Oct-13 | 79 |

Dec-13 | 88 |

Jan-14 | 91 |

Mar-14 | 94 |

Apr-14 | 104 |

Jun-14 | 100 |

Jul-14 | 113 |

Aug-14 | 120 |

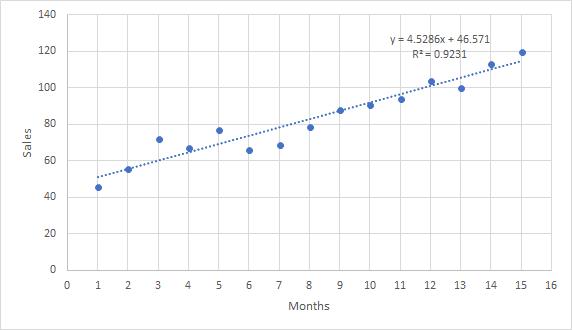

a. Below is the output:

| Regression Statistics | |

| Multiple R | 0.960795768 |

| R Square | 0.923128508 |

| Adjusted R Square | 0.917215316 |

| Standard Error | 6.064850994 |

| Observations | 15 |

| ANOVA | |||||

| df | SS | MS | F | Significance F | |

| Regression | 1 | 5742.228571 | 5742.228571 | 156.1134082 | 1.28554E-08 |

| Residual | 13 | 478.1714286 | 36.78241758 | ||

| Total | 14 | 6220.4 |

| Dependent var: Qt | Coefficients | Standard Error | t Stat | P-value |

| Intercept | 46.57 | 3.30 | 14.13 | 2.87E-09 |

| t | 4.53 | 0.36 | 12.49 | 1.29E-08 |

b. The intercept (a) is 46.57. It tells us the value of Sales that is not dependent on time.

c. The slope term (b) is 4.53. It tells us the change in Sales when the time increases by 1 month.

d.

|

e. Forecast the level of sales in August 2015. Show your result in the chart.

f. Forecast the level of sales for August 2018. Don’t need to show it in the chart.

g. Which forecast is more reliable, 2015 or 2018? Why? Explain.

140 y= 4.5286x + 46.571 120 R= 0.9231 100 80 60 40 20 3 4 6. 7 10 11 12 13 14 15 16 Months Sales

Step by Step Solution

3.45 Rating (168 Votes )

There are 3 Steps involved in it

Step: 1

aExcel Data Data Analysis Regression Select the appro...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Document Format ( 2 attachments)

635dc2b5b27cc_178637.pdf

180 KBs PDF File

635dc2b5b27cc_178637.docx

120 KBs Word File

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started