Answered step by step

Verified Expert Solution

Question

1 Approved Answer

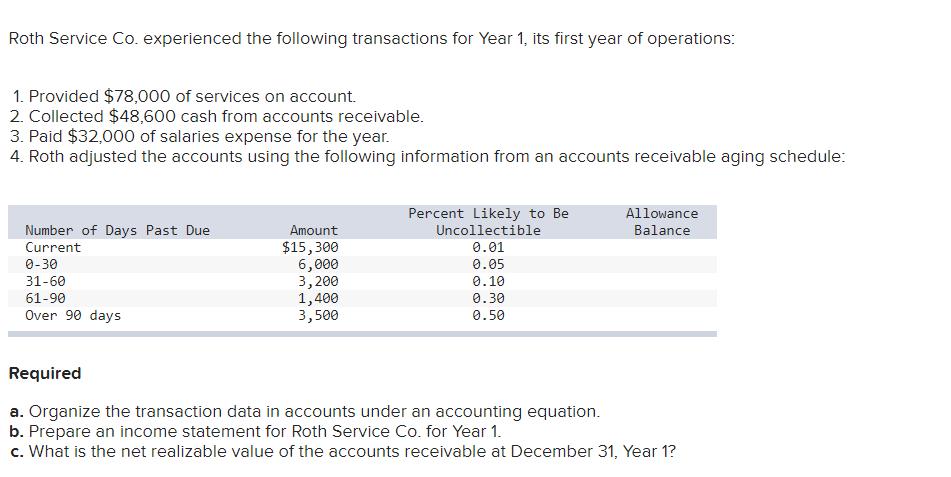

Roth Service Co. experienced the following transactions for Year 1, its first year of operations: 1. Provided $78,000 of services on account. 2. Collected

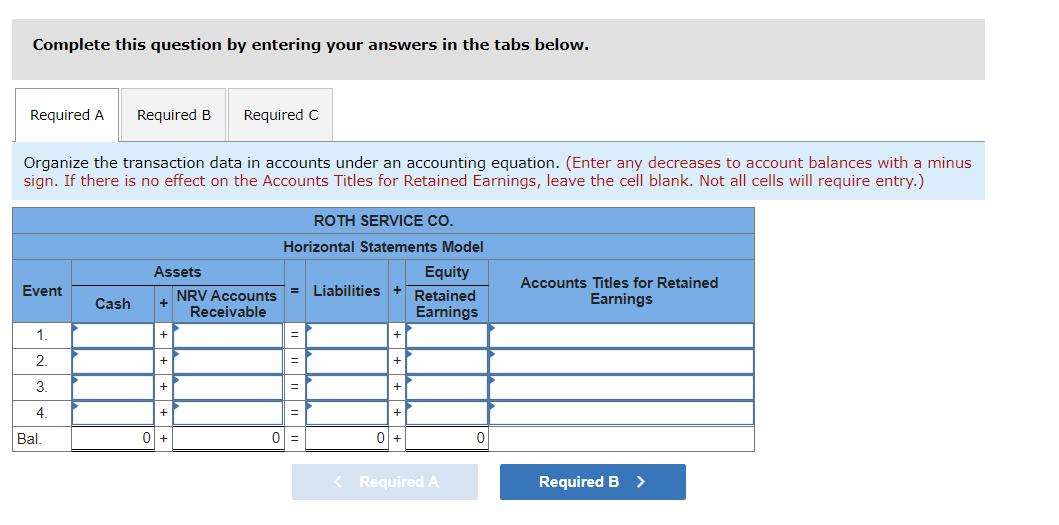

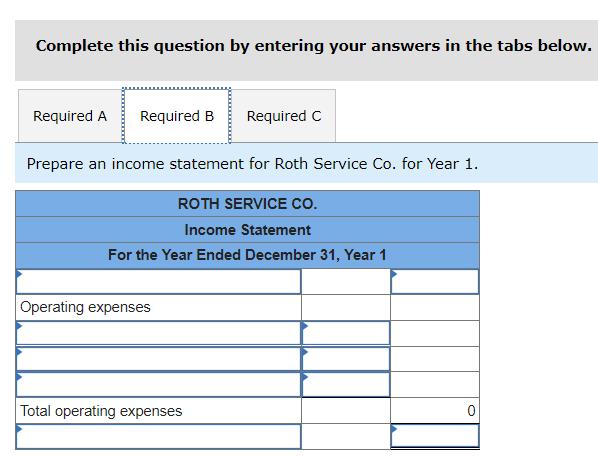

Roth Service Co. experienced the following transactions for Year 1, its first year of operations: 1. Provided $78,000 of services on account. 2. Collected $48,600 cash from accounts receivable. 3. Paid $32,000 of salaries expense for the year. 4. Roth adjusted the accounts using the following information from an accounts receivable aging schedule: Number of Days Past Due Current 0-30 31-60 61-90 Over 90 days Amount $15,300 6,000 3,200 1,400 3,500 Percent Likely to Be Uncollectible 0.01 0.05 0.10 0.30 0.50 Allowance Balance Required a. Organize the transaction data in accounts under an accounting equation. b. Prepare an income statement for Roth Service Co. for Year 1. c. What is the net realizable value of the accounts receivable at December 31, Year 1? Complete this question by entering your answers in the tabs below. Required A Required B Required C Organize the transaction data in accounts under an accounting equation. (Enter any decreases to account balances with a minus sign. If there is no effect on the Accounts Titles for Retained Earnings, leave the cell blank. Not all cells will require entry.) Event 1. 2. 3. 4. Bal. Cash Assets NRV Accounts Receivable + + + + 0 + ROTH SERVICE CO. Horizontal Statements Model = Liabilities = = = = 0] = 0 + + + + Equity Retained Earnings < Required A 0 Accounts Titles for Retained Earnings Required B > Complete this question by entering your answers in the tabs below. Required A Required B Prepare an income statement for Roth Service Co. for Year 1. ROTH SERVICE CO. Income Statement For the Year Ended December 31, Year 1 Operating expenses Required C Total operating expenses 0 Required A Required B Required C What is the net realizable value of the accounts receivable at December 31, Year 1? Net realizable value Roth Service Co. experienced the following transactions for Year 1, its first year of operations: 1. Provided $78,000 of services on account. 2. Collected $48,600 cash from accounts receivable. 3. Paid $32,000 of salaries expense for the year. 4. Roth adjusted the accounts using the following information from an accounts receivable aging schedule: Number of Days Past Due Current 0-30 31-60 61-90 Over 90 days Amount $15,300 6,000 3,200 1,400 3,500 Percent Likely to Be Uncollectible 0.01 0.05 0.10 0.30 0.50 Allowance Balance Required a. Organize the transaction data in accounts under an accounting equation. b. Prepare an income statement for Roth Service Co. for Year 1. c. What is the net realizable value of the accounts receivable at December 31, Year 1? Complete this question by entering your answers in the tabs below. Required A Required B Required C Organize the transaction data in accounts under an accounting equation. (Enter any decreases to account balances with a minus sign. If there is no effect on the Accounts Titles for Retained Earnings, leave the cell blank. Not all cells will require entry.) Event 1. 2. 3. 4. Bal. Cash Assets NRV Accounts Receivable + + + + 0 + ROTH SERVICE CO. Horizontal Statements Model = Liabilities = = = = 0] = 0 + + + + Equity Retained Earnings < Required A 0 Accounts Titles for Retained Earnings Required B > Complete this question by entering your answers in the tabs below. Required A Required B Prepare an income statement for Roth Service Co. for Year 1. ROTH SERVICE CO. Income Statement For the Year Ended December 31, Year 1 Operating expenses Required C Total operating expenses 0 Required A Required B Required C What is the net realizable value of the accounts receivable at December 31, Year 1? Net realizable value

Step by Step Solution

★★★★★

3.41 Rating (151 Votes )

There are 3 Steps involved in it

Step: 1

A B Number of days past due Amount a b Current 030 3160 6190 Over 90 days Event 1 2 3 4 Bal Cash Est...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Document Format ( 2 attachments)

635dc2ab1e3d2_178636.pdf

180 KBs PDF File

635dc2ab1e3d2_178636.docx

120 KBs Word File

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started