Question

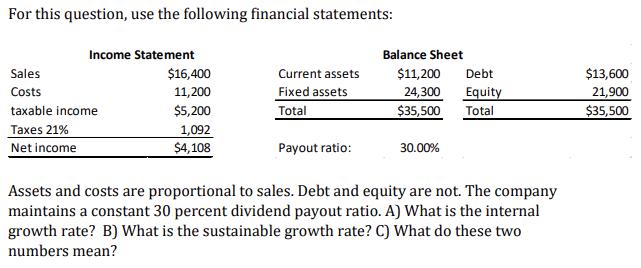

For this question, use the following financial statements: Income Statement Balance Sheet Sales $16,400 Current assets $11,200 Debt $13,600 Costs 11,200 Fixed assets taxable

For this question, use the following financial statements: Income Statement Balance Sheet Sales $16,400 Current assets $11,200 Debt $13,600 Costs 11,200 Fixed assets taxable income $5,200 Total 24,300 $35,500 Equity 21,900 Total $35,500 Taxes 21% 1,092 Net income $4,108 Payout ratio: 30.00% Assets and costs are proportional to sales. Debt and equity are not. The company maintains a constant 30 percent dividend payout ratio. A) What is the internal growth rate? B) What is the sustainable growth rate? C) What do these two numbers mean?

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Principles of Finance

Authors: Scott Besley, Eugene F. Brigham

6th edition

9781305178045, 1285429648, 1305178041, 978-1285429649

Students also viewed these Finance questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App