Question

For this question using the following table of default probability (data from S&P Global Ratings) and assume that the recovery rate of a defaulted bond

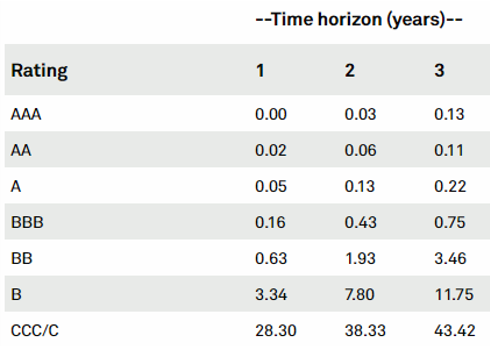

For this question using the following table of default probability (data from S&P Global Ratings) and assume that the recovery rate of a defaulted bond is 60%:

The table shows that there are fairly large differences between the default rates of bonds rated BBB or higher and bonds rated BB or lower. Accordingly, investors looking for safety shy away from purchasing low-rated bonds, which are sometimes called ( 1 ).

The table shows that there are fairly large differences between the default rates of bonds rated BBB or higher and bonds rated BB or lower. Accordingly, investors looking for safety shy away from purchasing low-rated bonds, which are sometimes called ( 1 ).

Having said that, investors may wish to buy such risky bonds if there are properly compensated for the risk. For example, based on the default rate on the table, an investor buying a B-rated bond maturing in one year should expect a loss rate of ( 2 )% (round to two decimal places). This means that if the risk-free rate is 1.1000%, the investor should be receiving adequate compensation for default risk if the yield of the bond is at least ( 3 ) %.

--Time horizon (years)-- Rating 1 2 3 0.00 0.03 0.13 0.02 0.06 0.11 A 0.05 0.13 0.22 0.16 0.43 0.75 0.63 1.93 3.46 B 3.34 7.80 11.75 CCC/C 28.30 38.33 43.42Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started