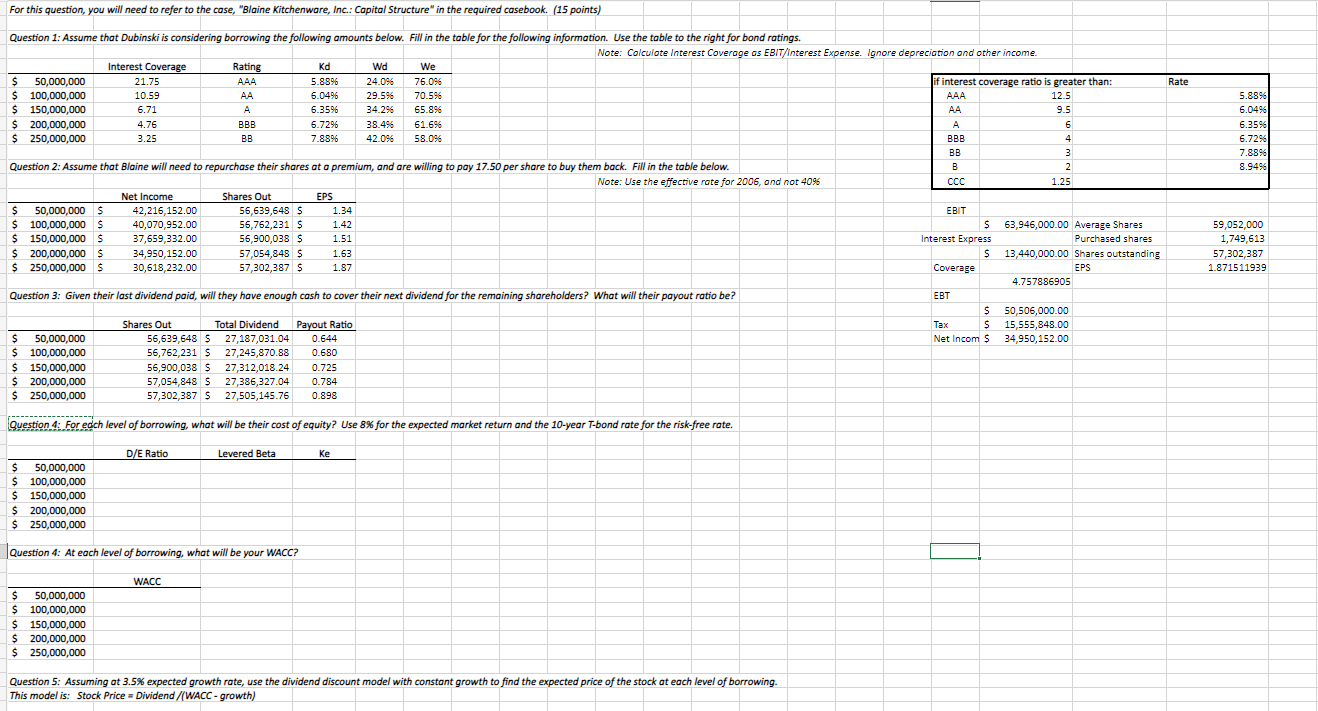

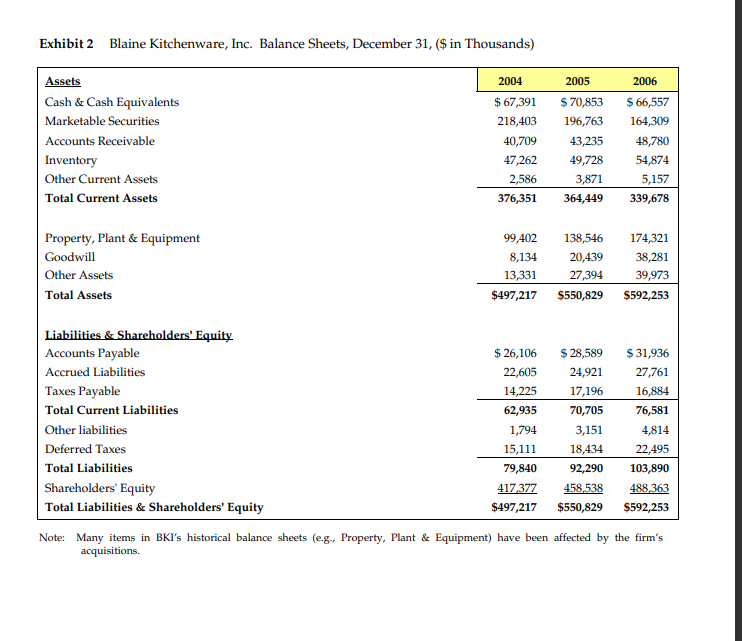

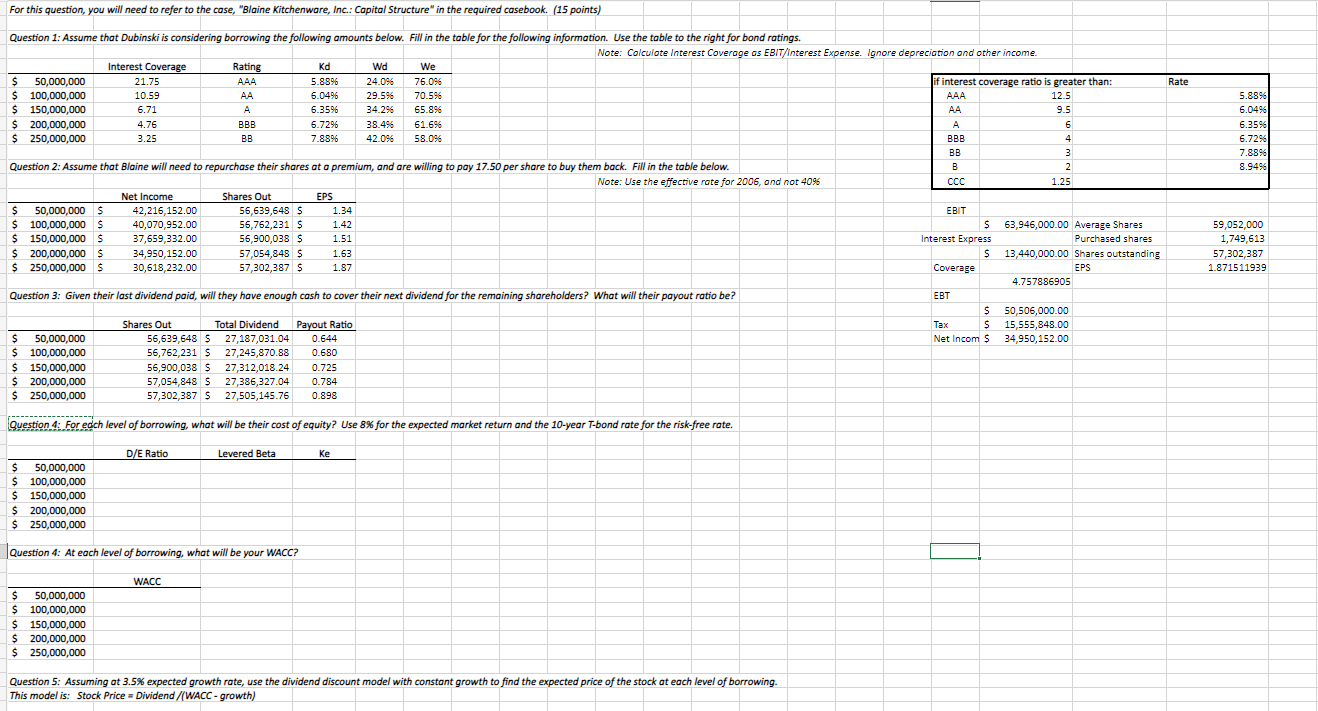

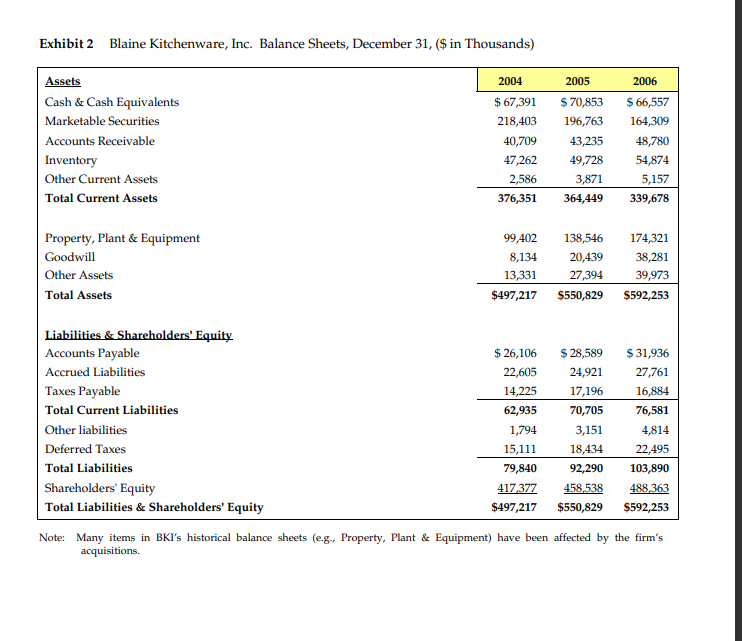

For this question, you will need to refer to the case, "Blaine Kitchenware, Inc.: Capital Structure" in the required casebook. (15 points) Question 1: Assume that Dubinski is considering borrowing the following amounts below. Fill in the table for the following information. Use the table to the right for bond ratings. \begin{tabular}{|l|c|c|c|c|c|c|} \hline & & Interest Coverage & Rating & Kd & Wd & We \\ \hline$ & 50,000,000 & 21.75 & AAA & 5.88% & 24.0% & 76.0% \\ \hline$ & 100,000,000 & 10.59 & AA & 6.04% & 29.5% & 70.5% \\ \hline$ & 150,000,000 & 6.71 & A & 6.35% & 34.2% & 65.8% \\ \hline$200,000,000 & 4.76 & BBB & 6.72% & 38.4% & 61.6% \\ \hline$250,000,000 & 3.25 & BB & 7.88% & 42.0% & 58.0% \\ \hline \end{tabular} Note: Colculote Interest Coverage as EBIT/Interest Expense. Ignore depreciation and other income. Question 2: Assume that Blaine will need to repurchase their shares at a premium, and are willing to pay 17.50 per share to buy them back. Fill in the table below. Note: Use the effective rate for 2006 , and not 40% Question 3: Given their last dividend paid, will they have enough cash to cover their next dividend for the remaining shareholders? What will their payout ratio be? \begin{tabular}{|l|r|r|r|c|c|} \hline & \multicolumn{1}{|c|}{ Shares Out } & \multicolumn{2}{|c|}{ Total Dividend } & Payout Ratio \\ \hline$ & 50,000,000 & 56,639,648 & $ & 27,187,031.04 & 0.644 \\ \hline$ & 100,000,000 & 56,762,231 & $ & 27,245,870.88 & 0.680 \\ \hline$ & 150,000,000 & 56,900,038 & $ & 27,312,018.24 & 0.725 \\ \hline$ & 200,000,000 & 57,054,848 & $ & 27,386,327.04 & 0.784 \\ \hline$ & 250,000,000 & 57,302,387 & $ & 27,505,145.76 & 0.898 \\ \hline \end{tabular} Question 4: For edch level of borrowing, what will be their cost of equity? Use 8% for the expected market return and the 10-year T-bond rate for the risk-free rate. Question 4: At each level of borrowing, what will be your WACC? WACC Question 5: Assuming at 3.5\% expected growth rate, use the dividend discount model with constant growth to find the expected price of the stock at each level of borrowing. This model is: Stock Price = Dividend /( WACC - growth ) Exhibit 2 Blaine Kitchenware. Inc. Balance Sheets. December 31. (\$ in Thousands) acquisitions. For this question, you will need to refer to the case, "Blaine Kitchenware, Inc.: Capital Structure" in the required casebook. (15 points) Question 1: Assume that Dubinski is considering borrowing the following amounts below. Fill in the table for the following information. Use the table to the right for bond ratings. \begin{tabular}{|l|c|c|c|c|c|c|} \hline & & Interest Coverage & Rating & Kd & Wd & We \\ \hline$ & 50,000,000 & 21.75 & AAA & 5.88% & 24.0% & 76.0% \\ \hline$ & 100,000,000 & 10.59 & AA & 6.04% & 29.5% & 70.5% \\ \hline$ & 150,000,000 & 6.71 & A & 6.35% & 34.2% & 65.8% \\ \hline$200,000,000 & 4.76 & BBB & 6.72% & 38.4% & 61.6% \\ \hline$250,000,000 & 3.25 & BB & 7.88% & 42.0% & 58.0% \\ \hline \end{tabular} Note: Colculote Interest Coverage as EBIT/Interest Expense. Ignore depreciation and other income. Question 2: Assume that Blaine will need to repurchase their shares at a premium, and are willing to pay 17.50 per share to buy them back. Fill in the table below. Note: Use the effective rate for 2006 , and not 40% Question 3: Given their last dividend paid, will they have enough cash to cover their next dividend for the remaining shareholders? What will their payout ratio be? \begin{tabular}{|l|r|r|r|c|c|} \hline & \multicolumn{1}{|c|}{ Shares Out } & \multicolumn{2}{|c|}{ Total Dividend } & Payout Ratio \\ \hline$ & 50,000,000 & 56,639,648 & $ & 27,187,031.04 & 0.644 \\ \hline$ & 100,000,000 & 56,762,231 & $ & 27,245,870.88 & 0.680 \\ \hline$ & 150,000,000 & 56,900,038 & $ & 27,312,018.24 & 0.725 \\ \hline$ & 200,000,000 & 57,054,848 & $ & 27,386,327.04 & 0.784 \\ \hline$ & 250,000,000 & 57,302,387 & $ & 27,505,145.76 & 0.898 \\ \hline \end{tabular} Question 4: For edch level of borrowing, what will be their cost of equity? Use 8% for the expected market return and the 10-year T-bond rate for the risk-free rate. Question 4: At each level of borrowing, what will be your WACC? WACC Question 5: Assuming at 3.5\% expected growth rate, use the dividend discount model with constant growth to find the expected price of the stock at each level of borrowing. This model is: Stock Price = Dividend /( WACC - growth ) Exhibit 2 Blaine Kitchenware. Inc. Balance Sheets. December 31. (\$ in Thousands) acquisitions