Answered step by step

Verified Expert Solution

Question

1 Approved Answer

For this situation it is 1.5% Now we will calculate Flotation Cost Adjusted Initial Outlay Flotation Cost Adjusted Initial Outlay = Financing Need/(1-Flotation Cost as

For this situation it is 1.5%

Now we will calculate Flotation Cost Adjusted Initial Outlay

Flotation Cost Adjusted Initial Outlay

= Financing Need/(1-Flotation Cost as percent)

=61 / ( 1-0.020)

=61/0.98

=$ 62.244

Would that be correct so far?

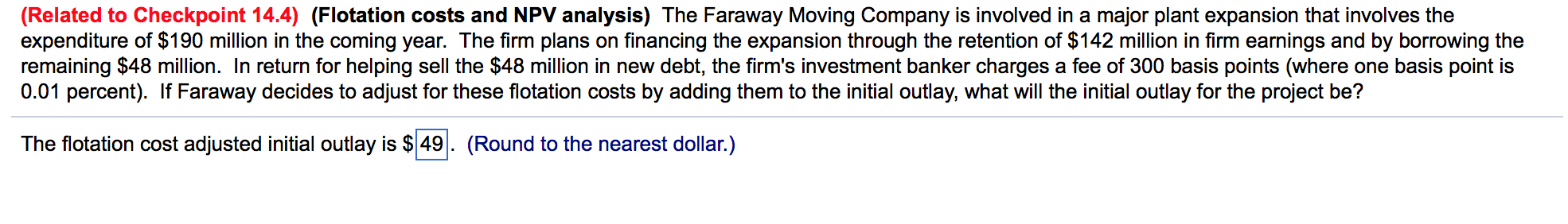

(Related to Checkpoint 14.4) (Flotation costs and NPV analysis) The Faraway Moving Company is involved in a major plant expansion that involves the expenditure of $190 million in the coming year. The firm plans on financing the expansion through the retention of $142 million in firm earnings and by borrowing the remaining $48 million. In return for helping sell the $48 million in new debt, the firm's investment banker charges a fee of 300 basis points (where one basis point is 0.01 percent). If Faraway decides to adjust for these flotation costs by adding them to the initial outlay, what will the initial outlay for the project be? The flotation cost adjusted initial outlay is s49. (Round to the nearest dollar.)Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started