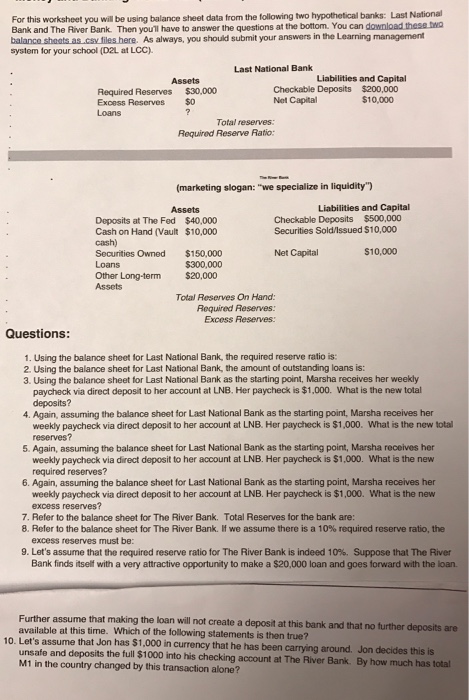

For this worksheet you will be using balance sheet data from the following two hypothetical banks Last National Bank and The River Bank Then you'll haw to answer the questions at the bottom You can download these two balance sheets as csv files here. As always, you should submit your answers in the Learning management system for your school (D2L at LCC). Using the balance sheet for Last National Bank, the required reserve ratio is: Using the balance sheet for Last National Bank, the amount of outstanding loans is: Using the balance sheet for Last National Bank as the starling pant. Marsha receives her weekly paycheck via direct deport to her account at LNB. Her paycheck is $1.000. What is the new total deposits? Again assuming the balance sheet for Last National Bank as the starting point. Marsha receives her weekly paycheck via direct deposit to her account at LNB Her paycheck is $1.000 What is the new total reserves? Again, assuming the balance sheet for Last National Bank as the starting point, Marsha receives her weekly paycheck via direct deposit to her account at LNB. Her paycheck is $1,000. What is the new required reserves? Again, assuming the balance sheet for Last National Bank as the starting point. Marsha receives her weekly paycheck via direct deposit to her account at LNB. Her paycheck is $1,000. What is the new excess reserves? Refer to the balance sheet for The River Bank. Total Reserves for the bank are: Refer to the balance sheet for The River Bank If we assume there is a 10% required reserve ratio, the excess reserves must be Let's assume that the required reserve ratio for The River Bank is indeed 10%. Suppose that The River Bank finds itself with a very attractive opportunity to make a $20,000 loan and goes forward with the loan. Further assume that making the loan will not create a deposit at the bank and that no further deposits are available at this time. Which of the following statements is then true? Let s assume that Jon has $ 1.000 in currency that he has been carrying around. Jon decides this is unsafe and deposits the full $1000 into his checking account at the River Bank. By how much has total Ml in the country changed by this transaction alone