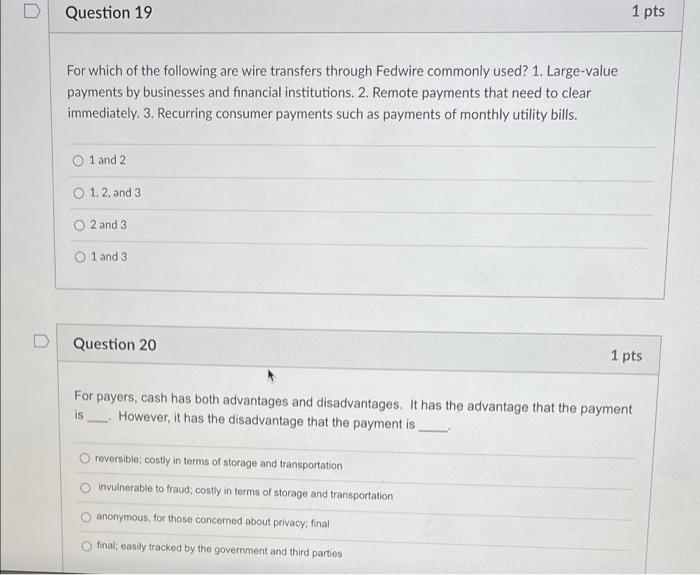

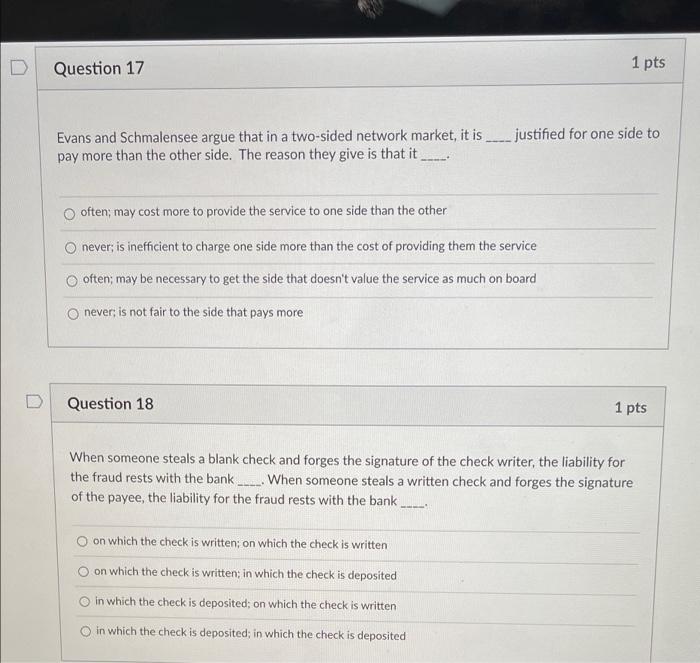

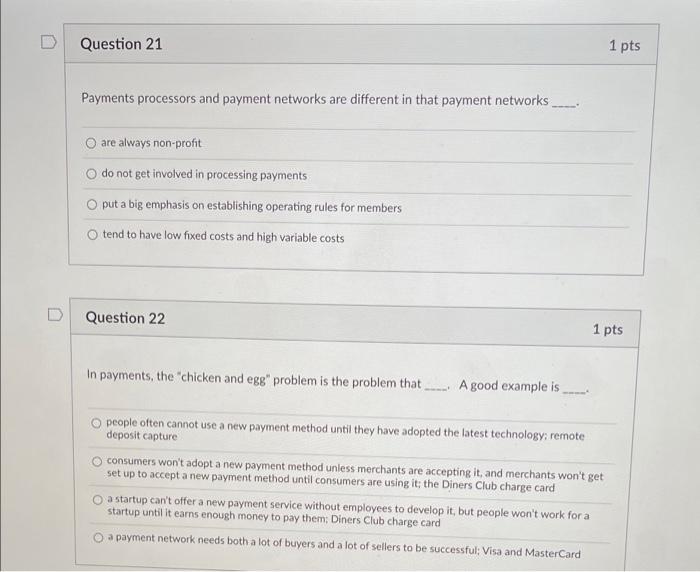

For which of the following are wire transfers through Fedwire commonly used? 1. Large-value payments by businesses and financial institutions. 2. Remote payments that need to clear immediately. 3. Recurring consumer payments such as payments of monthly utility bills. 1 and 2 1,2 , and 3 2 and 3 1 and 3 Question 20 1 pts For payers, cash has both advantages and disadvantages. It has the advantage that the payment is _. However, it has the disadvantage that the payment is revorsible; costly in terms of storage and transportation invulnerable to fraud; costly in terms of storage and transportation anonymous, for those concerned about privacy; final final; easily tracked by the government and third parties Evans and Schmalensee argue that in a two-sided network market, it is justified for one side to pay more than the other side. The reason they give is that it often; may cost more to provide the service to one side than the other never; is inefficient to charge one side more than the cost of providing them the service often; may be necessary to get the side that doesn't value the service as much on board never, is not fair to the side that pays more Question 18 When someone steals a blank check and forges the signature of the check writer, the liability for the fraud rests with the bank When someone steals a written check and forges the signature of the payee, the liability for the fraud rests with the bank on which the check is written; on which the check is written on which the check is written; in which the check is deposited in which the check is deposited; on which the check is written in which the check is deposited; in which the check is deposited Payments processors and payment networks are different in that payment networks are always non-profit do not get involved in processing payments put a big emphasis on establishing operating rules for members tend to have low fixed costs and high variable costs Question 22 In payments, the "chicken and egg" problem is the problem that A good example is people often cannot use a new payment method until they have adopted the latest technology; remote deposit capture consumers won't adopt a new payment method unless merchants are accepting it, and merchants won't get set up to accept a new payment method until consumers are using it; the Diners Club charge card a startup can't offer a new payment service without employees to develop it, but people won't work for a startup until it earns enough money to pay them; Diners Club charge card a payment network needs both a lot of buyers and a lot of sellers to be successful; Visa and MasterCard