Answered step by step

Verified Expert Solution

Question

1 Approved Answer

For year 2021, CALCULATE THE: - Current Ratio - Quick Ratio - Average Collection Period - Inventory Turnover - Operating Return on Assets - Operating

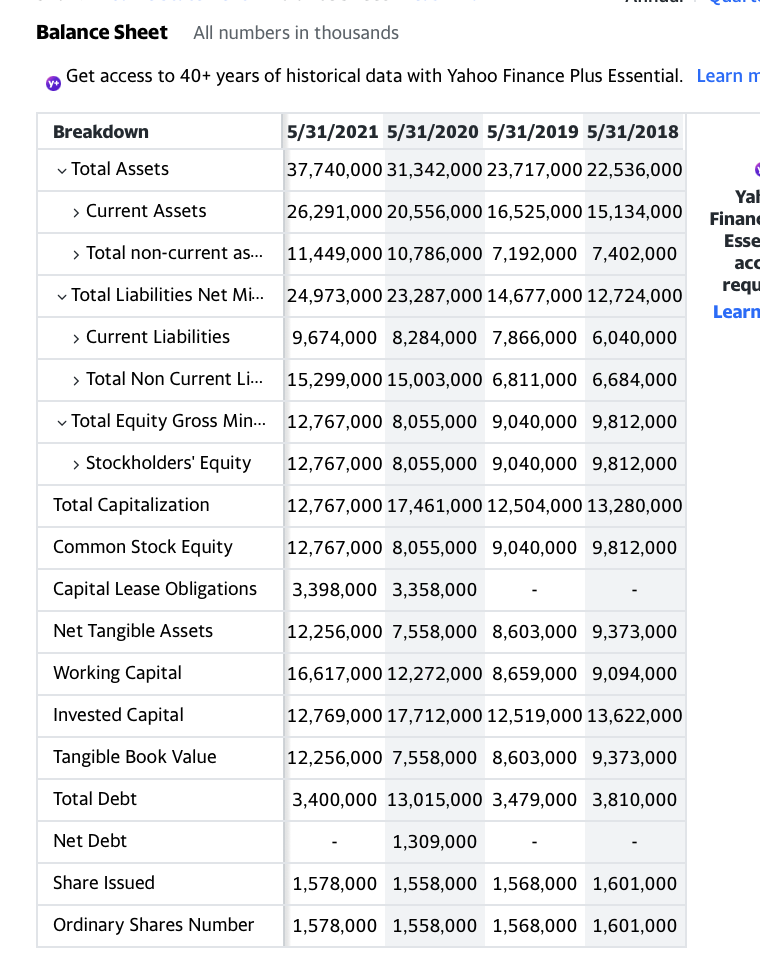

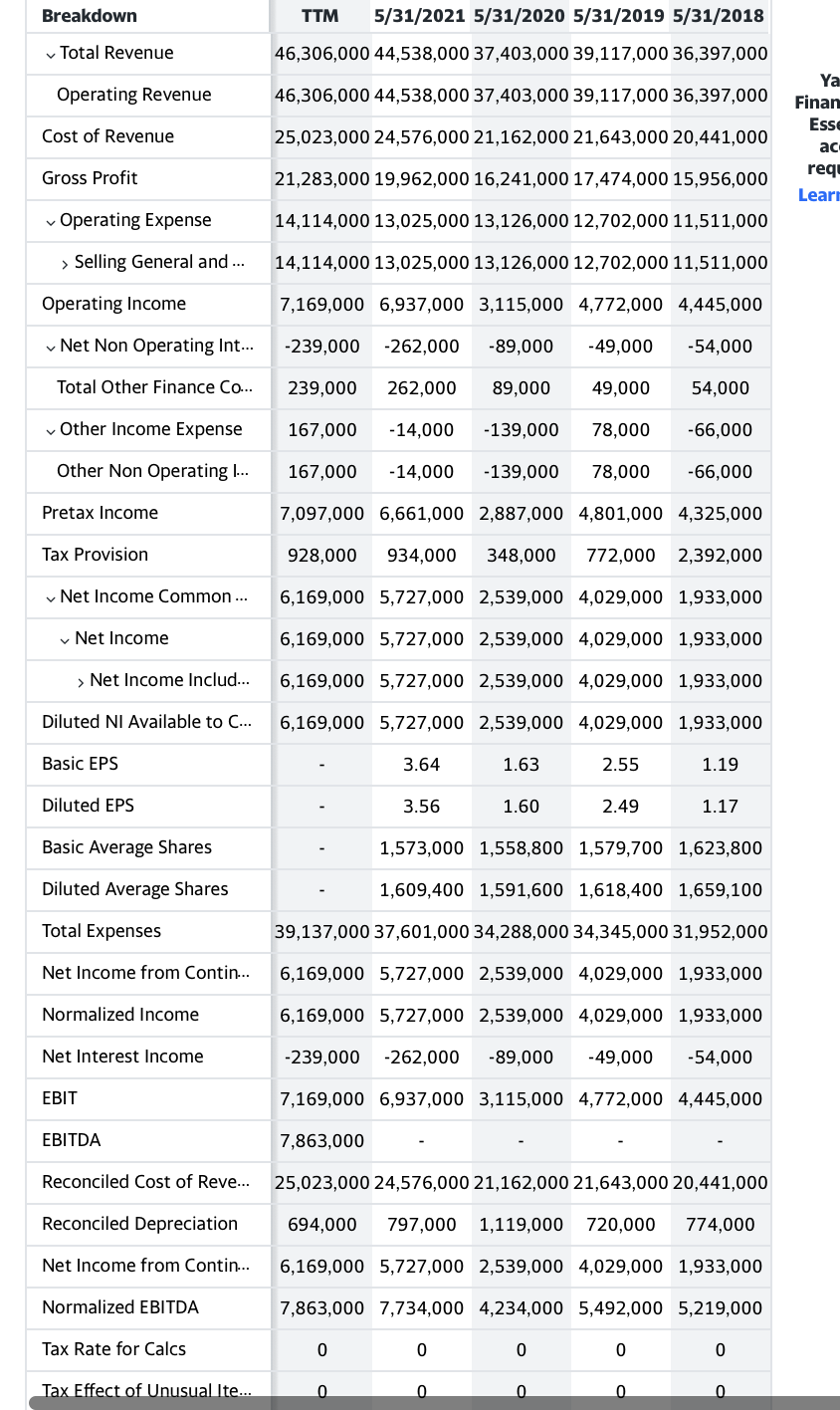

For year 2021, CALCULATE THE:

- Current Ratio

- Quick Ratio

- Average Collection Period

- Inventory Turnover

- Operating Return on Assets

- Operating Profit Margin

- Total asset Turnover

- Fixed Asset Turnover

- Debt Ratio

- Times Interest Earned

- Return on Equity

PLEASE PROVIDE INFORMATION ABOUT WHERE YOU GET THE CURRENT ASSETS, CURRENT LIABILITIES, ETC.

SHOW CALCULATIONS!!!!

Balance Sheet All numbers in thousands V Get access to 40+ years of historical data with Yahoo Finance Plus Essential. Learn m Breakdown 5/31/2021 5/31/2020 5/31/2019 5/31/2018 Total Assets 37,740,000 31,342,000 23,717,000 22,536,000 > Current Assets 26,291,000 20,556,000 16,525,000 15,134,000 > Total non-current as... 11,449,000 10,786,000 7,192,000 7,402,000 Yal Finand Esse requ Learn Total Liabilities Net Mi... 24,973,000 23,287,000 14,677,000 12,724,000 > Current Liabilities 9,674,000 8,284,000 7,866,000 6,040,000 > Total Non Current Li... 15,299,000 15,003,000 6,811,000 6,684,000 Total Equity Gross Min... 12,767,000 8,055,000 9,040,000 9,812,000 > Stockholders' Equity 12,767,000 8,055,000 9,040,000 9,812,000 Total Capitalization 12,767,000 17,461,000 12,504,000 13,280,000 Common Stock Equity 12,767,000 8,055,000 9,040,000 9,812,000 Capital Lease Obligations 3,398,000 3,358,000 Net Tangible Assets 12,256,000 7,558,000 8,603,000 9,373,000 Working Capital 16,617,000 12,272,000 8,659,000 9,094,000 Invested Capital 12,769,000 17,712,000 12,519,000 13,622,000 Tangible Book Value 12,256,000 7,558,000 8,603,000 9,373,000 Total Debt 3,400,000 13,015,000 3,479,000 3,810,000 Net Debt 1,309,000 Share Issued 1,578,000 1,558,000 1,568,000 1,601,000 Ordinary Shares Number 1,578,000 1,558,000 1,568,000 1,601,000 Breakdown TTM 5/31/2021 5/31/2020 5/31/2019 5/31/2018 Total Revenue 46,306,000 44,538,000 37,403,000 39,117,000 36,397,000 Operating Revenue 46,306,000 44,538,000 37,403,000 39,117,000 36,397,000 Cost of Revenue 25,023,000 24,576,000 21,162,000 21,643,000 20,441,000 Ya Finan Ess ac req Learn Gross Profit 21,283,000 19,962,000 16,241,000 17,474,000 15,956,000 Operating Expense 14,114,000 13,025,000 13,126,000 12,702,000 11,511,000 > Selling General and ... 14,114,000 13,025,000 13,126,000 12,702,000 11,511,000 Operating Income 7,169,000 6,937,000 3,115,000 4,772,000 4,445,000 Net Non Operating Int... -239,000 -262,000 -89,000 -49,000 -54,000 Total Other Finance Co... 239,000 262,000 89,000 49,000 54,000 Other Income Expense 167,000 - 14,000 -139,000 78,000 -66,000 Other Non Operating ... 167,000 - 14,000 - 139,000 78,000 -66,000 Pretax Income 7,097,000 6,661,000 2,887,000 4,801,000 4,325,000 Tax Provision 928,000 934,000 348,000 772,000 2,392,000 Net Income Common ... 6,169,000 5,727,000 2,539,000 4,029,000 1,933,000 Net Income 6,169,000 5,727,000 2,539,000 4,029,000 1,933,000 Net Income Includ... 6,169,000 5,727,000 2,539,000 4,029,000 1,933,000 Diluted NI Available to C... 6,169,000 5,727,000 2,539,000 4,029,000 1,933,000 Basic EPS 3.64 1.63 2.55 1.19 Diluted EPS 3.56 1.60 2.49 1.17 Basic Average Shares 1,573,000 1,558,800 1,579,700 1,623,800 Diluted Average Shares 1,609,400 1,591,600 1,618,400 1,659,100 Total Expenses 39,137,000 37,601,000 34,288,000 34,345,000 31,952,000 Net Income from Contin... 6,169,000 5,727,000 2,539,000 4,029,000 1,933,000 Normalized Income 6,169,000 5,727,000 2,539,000 4,029,000 1,933,000 Net Interest Income -239,000 -262,000 -89,000 -49,000 -54,000 EBIT 7,169,000 6,937,000 3,115,000 4,772,000 4,445,000 EBITDA 7,863,000 Reconciled Cost of Reve... 25,023,000 24,576,000 21,162,000 21,643,000 20,441,000 Reconciled Depreciation 694,000 797,000 1,119,000 1,119,000 720,000 774,000 Net Income from Contin... 6,169,000 5,727,000 2,539,000 4,029,000 1,933,000 Normalized EBITDA 7,863,000 7,734,000 4,234,000 5,492,000 5,219,000 Tax Rate for Calcs 0 0 0 0 0 Tax Effect of Unusual Ite... 0 0 0 0 0 Balance Sheet All numbers in thousands V Get access to 40+ years of historical data with Yahoo Finance Plus Essential. Learn m Breakdown 5/31/2021 5/31/2020 5/31/2019 5/31/2018 Total Assets 37,740,000 31,342,000 23,717,000 22,536,000 > Current Assets 26,291,000 20,556,000 16,525,000 15,134,000 > Total non-current as... 11,449,000 10,786,000 7,192,000 7,402,000 Yal Finand Esse requ Learn Total Liabilities Net Mi... 24,973,000 23,287,000 14,677,000 12,724,000 > Current Liabilities 9,674,000 8,284,000 7,866,000 6,040,000 > Total Non Current Li... 15,299,000 15,003,000 6,811,000 6,684,000 Total Equity Gross Min... 12,767,000 8,055,000 9,040,000 9,812,000 > Stockholders' Equity 12,767,000 8,055,000 9,040,000 9,812,000 Total Capitalization 12,767,000 17,461,000 12,504,000 13,280,000 Common Stock Equity 12,767,000 8,055,000 9,040,000 9,812,000 Capital Lease Obligations 3,398,000 3,358,000 Net Tangible Assets 12,256,000 7,558,000 8,603,000 9,373,000 Working Capital 16,617,000 12,272,000 8,659,000 9,094,000 Invested Capital 12,769,000 17,712,000 12,519,000 13,622,000 Tangible Book Value 12,256,000 7,558,000 8,603,000 9,373,000 Total Debt 3,400,000 13,015,000 3,479,000 3,810,000 Net Debt 1,309,000 Share Issued 1,578,000 1,558,000 1,568,000 1,601,000 Ordinary Shares Number 1,578,000 1,558,000 1,568,000 1,601,000 Breakdown TTM 5/31/2021 5/31/2020 5/31/2019 5/31/2018 Total Revenue 46,306,000 44,538,000 37,403,000 39,117,000 36,397,000 Operating Revenue 46,306,000 44,538,000 37,403,000 39,117,000 36,397,000 Cost of Revenue 25,023,000 24,576,000 21,162,000 21,643,000 20,441,000 Ya Finan Ess ac req Learn Gross Profit 21,283,000 19,962,000 16,241,000 17,474,000 15,956,000 Operating Expense 14,114,000 13,025,000 13,126,000 12,702,000 11,511,000 > Selling General and ... 14,114,000 13,025,000 13,126,000 12,702,000 11,511,000 Operating Income 7,169,000 6,937,000 3,115,000 4,772,000 4,445,000 Net Non Operating Int... -239,000 -262,000 -89,000 -49,000 -54,000 Total Other Finance Co... 239,000 262,000 89,000 49,000 54,000 Other Income Expense 167,000 - 14,000 -139,000 78,000 -66,000 Other Non Operating ... 167,000 - 14,000 - 139,000 78,000 -66,000 Pretax Income 7,097,000 6,661,000 2,887,000 4,801,000 4,325,000 Tax Provision 928,000 934,000 348,000 772,000 2,392,000 Net Income Common ... 6,169,000 5,727,000 2,539,000 4,029,000 1,933,000 Net Income 6,169,000 5,727,000 2,539,000 4,029,000 1,933,000 Net Income Includ... 6,169,000 5,727,000 2,539,000 4,029,000 1,933,000 Diluted NI Available to C... 6,169,000 5,727,000 2,539,000 4,029,000 1,933,000 Basic EPS 3.64 1.63 2.55 1.19 Diluted EPS 3.56 1.60 2.49 1.17 Basic Average Shares 1,573,000 1,558,800 1,579,700 1,623,800 Diluted Average Shares 1,609,400 1,591,600 1,618,400 1,659,100 Total Expenses 39,137,000 37,601,000 34,288,000 34,345,000 31,952,000 Net Income from Contin... 6,169,000 5,727,000 2,539,000 4,029,000 1,933,000 Normalized Income 6,169,000 5,727,000 2,539,000 4,029,000 1,933,000 Net Interest Income -239,000 -262,000 -89,000 -49,000 -54,000 EBIT 7,169,000 6,937,000 3,115,000 4,772,000 4,445,000 EBITDA 7,863,000 Reconciled Cost of Reve... 25,023,000 24,576,000 21,162,000 21,643,000 20,441,000 Reconciled Depreciation 694,000 797,000 1,119,000 1,119,000 720,000 774,000 Net Income from Contin... 6,169,000 5,727,000 2,539,000 4,029,000 1,933,000 Normalized EBITDA 7,863,000 7,734,000 4,234,000 5,492,000 5,219,000 Tax Rate for Calcs 0 0 0 0 0 Tax Effect of Unusual Ite... 0 0 0 0 0Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started