Answered step by step

Verified Expert Solution

Question

1 Approved Answer

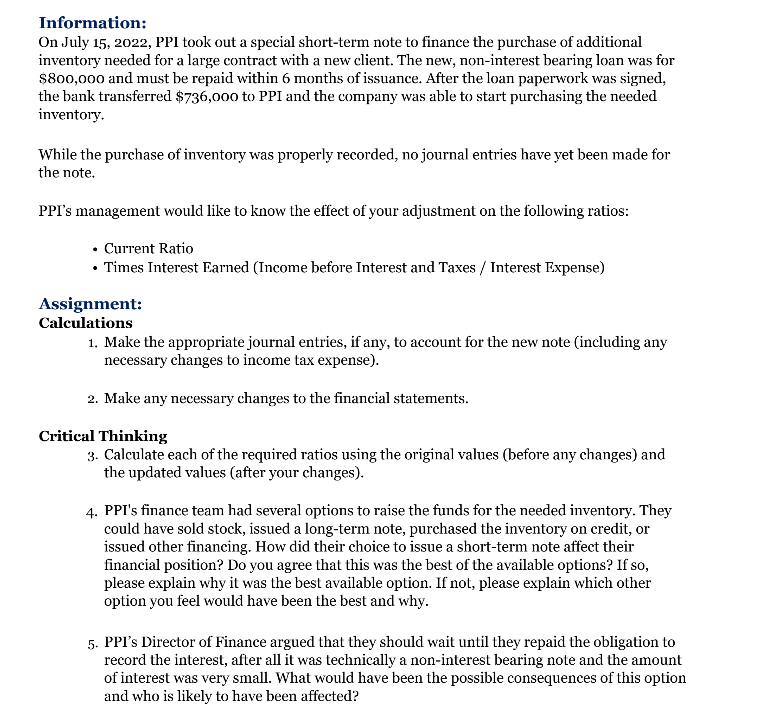

For Year Ended December 31, 2022 Sales Revenue Sales Revenue Less: Sales Discounts Sales Returns Net Sales Revenue Cost of Goods Sold Cost of Goods

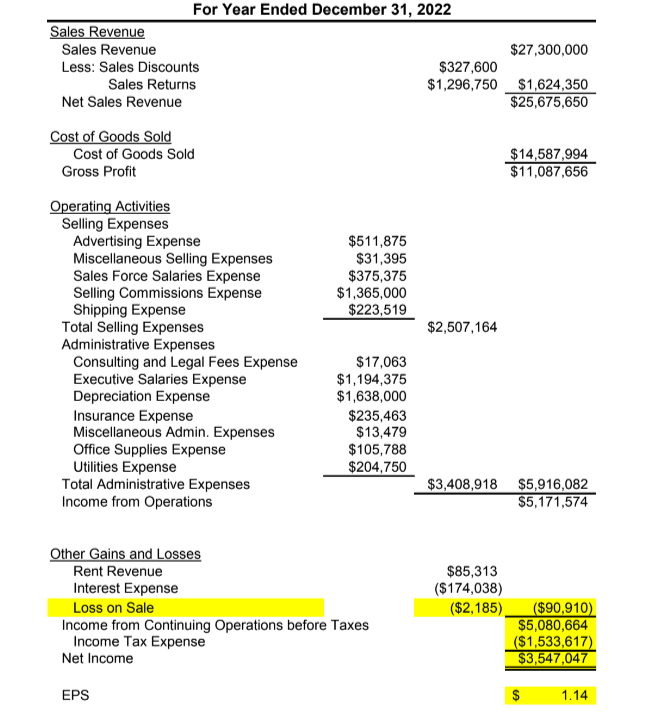

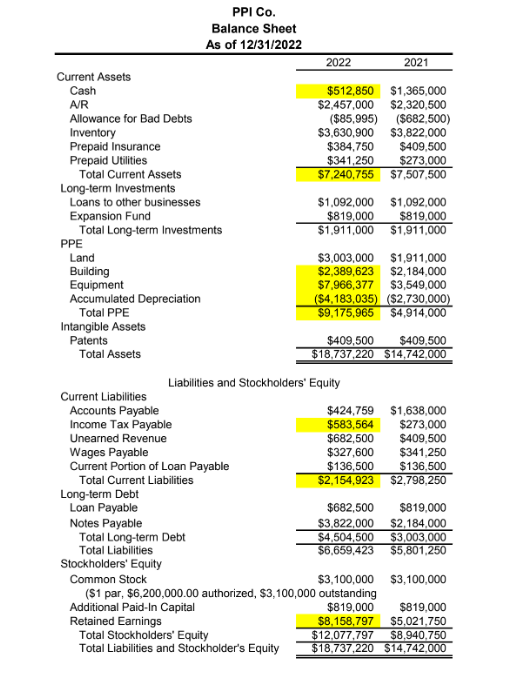

For Year Ended December 31, 2022 Sales Revenue Sales Revenue Less: Sales Discounts Sales Returns Net Sales Revenue Cost of Goods Sold Cost of Goods Sold Gross Profit Operating Activities Selling Expenses Advertising Expense Miscellaneous Selling Expenses Sales Force Salaries Expense Selling Commissions Expense Shipping Expense Total Selling Expenses Administrative Expenses Consulting and Legal Fees Expense Executive Salaries Expense Depreciation Expense Insurance Expense Miscellaneous Admin. Expenses Office Supplies Expense Utilities Expense Total Administrative Expenses Income from Operations \[ \begin{array}{rr} \$ 327,600 & \$ 27,300,000 \\ \$ 1,296,750 & \$ 1,624,350 \\ \cline { 2 - 2 } \$ 25,675,650 \\ \\ \frac{\$ 14,587,994}{\$ 11,087,656} \end{array} \] Other Gains and Losses Rent Revenue Interest Expense Loss on Sale Income from Continuing Operations before Taxes Income Tax Expense Net Income $511,875$31,395$375,375$1,365,000$223,519 $2,507,164 $17,063$1,194,375$1,638,000$235,463$13,479$105,788$204,750 EPS $ 1.14 PPI Co. Balance Sheet As of 12/31/2022 \begin{tabular}{lrr} \hline & \multicolumn{1}{c}{2022} & \multicolumn{1}{c}{2021} \\ \cline { 2 - 3 } Current Assets & & \\ Cash & $512,850 & $1,365,000 \\ A/R & $2,457,000 & $2,320,500 \\ Allowance for Bad Debts & ($85,995) & ($682,500) \\ Inventory & $3,630,900 & $3,822,000 \\ Prepaid Insurance & $384,750 & $409,500 \\ Prepaid Utilities & $341,250 & $273,000 \\ Total Current Assets & $7,240,755 & $7,507,500 \\ Long-term Investments & & \\ Loans to other businesses & $1,092,000 & $1,092,000 \\ Expansion Fund & $819,000 & $819,000 \\ Total Long-term Investments & $1,911,000 & $1,911,000 \\ PPE & & \\ Land & $3,003,000 & $1,911,000 \\ Building & $2,389,623 & $2,184,000 \\ Equipment & $7,966,377 & $3,549,000 \\ Accumulated Depreciation & ($4,183,035) & ($2,730,000) \\ Total PPE & $9,175,965 & $4,914,000 \\ Intangible Assets & \multicolumn{3}{|c|}{} \\ Patents & $409,500 & $409,500 \\ Total Assets & $18,737,220 & $14,742,000 \\ \hline \end{tabular} Liabilities and Stockholders' Equity Current Liabilities Accounts Payable Income Tax Payable Unearned Revenue Wages Payable Current Portion of Loan Payable Total Current Liabilities Long-term Debt Loan Payable Notes Payable Total Long-term Debt Total Liabilities Stockholders' Equity Common Stock (\$1 par, \$6,200,000.00 authorized, \$3,100,000 outstanding Additional Paid-In Capital Retained Earnings Total Stockholders' Equity Total Liabilities and Stockholder's Equity \begin{tabular}{rr} $424,759 & $1,638,000 \\ $583,564 & $273,000 \\ $682,500 & $409,500 \\ $327,600 & $341,250 \\ $136,500 & $136,500 \\ \hline$2,154,923 & $2,798,250 \\ & \\ $682,500 & $819,000 \\ $3,822,000 & $2,184,000 \\ \hline$4,504,500 & $3,003,000 \\ \hline$6,659,423 & $5,801,250 \end{tabular} $3,100,000 $819,000 \begin{tabular}{rr} $819,000 & $819,000 \\ $8,158,797 & $5,021,750 \\ \hline$12,077,797 & $8,940,750 \\ \hline$18,737,220 & $14,742,000 \\ \hline \hline \end{tabular} PPI Co. For Year Ended December 31, 2022 \begin{tabular}{lcr} \hline Cash Flow from Operations & & \\ Net Income & & $3,547,047 \\ Adjustments: & ($733,005) & \\ Change in AVR & $191,100 & \\ Change in Inventory & $24,750 & ($68,250) \\ Change in Prepaid Insurance & $1,638,000 \\ Change in Prepaid Utilities & ($1,213,241) \\ Depreciation & $310,564 \\ Change in A/P & $273,000 \\ Change in Income Tax Payable & ($13,650) & \\ Change in Unearned Revenue & $2,185 & $411,453 \\ Change in Wages Payable & & $3,958,500 \\ \hline Loss on Sale & & \\ Net Cash Flow from Operations & & \end{tabular} \begin{tabular}{|c|c|c|} \hline & & \\ \hline Sale of Equipment & $21,850 & \\ \hline Purchase of Land & ($1,092,000) & \\ \hline Purchase of Building & ($205,623) & \\ \hline Purchase of Equipment & ($4,626,377) & \\ \hline Net Cash Flow from Investments & & ($5,902,150) \\ \hline Cash Flow from Financing & & \\ \hline Repayment of Loans & ($136,500) & \\ \hline Issuance of Notes Payable & $1,638,000 & \\ \hline Payments of Dividends & ($410,000) & \\ \hline Net Cash Flow from Financing & & $1,091,500 \\ \hline \end{tabular} Net Increase (Decrease) in Cash Cash, January 1, 2022 Cash, December 31, 2022 ($852,150)$1,365,000$512,850 Information: On July 15,2022 , PPI took out a special short-term note to finance the purchase of additional inventory needed for a large contract with a new client. The new, non-interest bearing loan was for $800,000 and must be repaid within 6 months of issuance. After the loan paperwork was signed, the bank transferred $736,000 to PPI and the company was able to start purchasing the needed inventory. While the purchase of inventory was properly recorded, no journal entries have yet been made for the note. PPI's management would like to know the effect of your adjustment on the following ratios: - Current Ratio - Times Interest Earned (Income before Interest and Taxes / Interest Expense) Assignment: Calculations 1. Make the appropriate journal entries, if any, to account for the new note (including any necessary changes to income tax expense). 2. Make any necessary changes to the financial statements. Critical Thinking 3. Calculate each of the required ratios using the original values (before any changes) and the updated values (after your changes). 4. PPI's finance team had several options to raise the funds for the needed inventory. They could have sold stock, issued a long-term note, purchased the inventory on credit, or issued other financing. How did their choice to issue a short-term note affect their financial position? Do you agree that this was the best of the available options? If so, please explain why it was the best available option. If not, please explain which other option you feel would have been the best and why. 5. PPI's Director of Finance argued that they should wait until they repaid the obligation to record the interest, after all it was technically a non-interest bearing note and the amount of interest was very small. What would have been the possible consequences of this option and who is likely to have been affected

For Year Ended December 31, 2022 Sales Revenue Sales Revenue Less: Sales Discounts Sales Returns Net Sales Revenue Cost of Goods Sold Cost of Goods Sold Gross Profit Operating Activities Selling Expenses Advertising Expense Miscellaneous Selling Expenses Sales Force Salaries Expense Selling Commissions Expense Shipping Expense Total Selling Expenses Administrative Expenses Consulting and Legal Fees Expense Executive Salaries Expense Depreciation Expense Insurance Expense Miscellaneous Admin. Expenses Office Supplies Expense Utilities Expense Total Administrative Expenses Income from Operations \[ \begin{array}{rr} \$ 327,600 & \$ 27,300,000 \\ \$ 1,296,750 & \$ 1,624,350 \\ \cline { 2 - 2 } \$ 25,675,650 \\ \\ \frac{\$ 14,587,994}{\$ 11,087,656} \end{array} \] Other Gains and Losses Rent Revenue Interest Expense Loss on Sale Income from Continuing Operations before Taxes Income Tax Expense Net Income $511,875$31,395$375,375$1,365,000$223,519 $2,507,164 $17,063$1,194,375$1,638,000$235,463$13,479$105,788$204,750 EPS $ 1.14 PPI Co. Balance Sheet As of 12/31/2022 \begin{tabular}{lrr} \hline & \multicolumn{1}{c}{2022} & \multicolumn{1}{c}{2021} \\ \cline { 2 - 3 } Current Assets & & \\ Cash & $512,850 & $1,365,000 \\ A/R & $2,457,000 & $2,320,500 \\ Allowance for Bad Debts & ($85,995) & ($682,500) \\ Inventory & $3,630,900 & $3,822,000 \\ Prepaid Insurance & $384,750 & $409,500 \\ Prepaid Utilities & $341,250 & $273,000 \\ Total Current Assets & $7,240,755 & $7,507,500 \\ Long-term Investments & & \\ Loans to other businesses & $1,092,000 & $1,092,000 \\ Expansion Fund & $819,000 & $819,000 \\ Total Long-term Investments & $1,911,000 & $1,911,000 \\ PPE & & \\ Land & $3,003,000 & $1,911,000 \\ Building & $2,389,623 & $2,184,000 \\ Equipment & $7,966,377 & $3,549,000 \\ Accumulated Depreciation & ($4,183,035) & ($2,730,000) \\ Total PPE & $9,175,965 & $4,914,000 \\ Intangible Assets & \multicolumn{3}{|c|}{} \\ Patents & $409,500 & $409,500 \\ Total Assets & $18,737,220 & $14,742,000 \\ \hline \end{tabular} Liabilities and Stockholders' Equity Current Liabilities Accounts Payable Income Tax Payable Unearned Revenue Wages Payable Current Portion of Loan Payable Total Current Liabilities Long-term Debt Loan Payable Notes Payable Total Long-term Debt Total Liabilities Stockholders' Equity Common Stock (\$1 par, \$6,200,000.00 authorized, \$3,100,000 outstanding Additional Paid-In Capital Retained Earnings Total Stockholders' Equity Total Liabilities and Stockholder's Equity \begin{tabular}{rr} $424,759 & $1,638,000 \\ $583,564 & $273,000 \\ $682,500 & $409,500 \\ $327,600 & $341,250 \\ $136,500 & $136,500 \\ \hline$2,154,923 & $2,798,250 \\ & \\ $682,500 & $819,000 \\ $3,822,000 & $2,184,000 \\ \hline$4,504,500 & $3,003,000 \\ \hline$6,659,423 & $5,801,250 \end{tabular} $3,100,000 $819,000 \begin{tabular}{rr} $819,000 & $819,000 \\ $8,158,797 & $5,021,750 \\ \hline$12,077,797 & $8,940,750 \\ \hline$18,737,220 & $14,742,000 \\ \hline \hline \end{tabular} PPI Co. For Year Ended December 31, 2022 \begin{tabular}{lcr} \hline Cash Flow from Operations & & \\ Net Income & & $3,547,047 \\ Adjustments: & ($733,005) & \\ Change in AVR & $191,100 & \\ Change in Inventory & $24,750 & ($68,250) \\ Change in Prepaid Insurance & $1,638,000 \\ Change in Prepaid Utilities & ($1,213,241) \\ Depreciation & $310,564 \\ Change in A/P & $273,000 \\ Change in Income Tax Payable & ($13,650) & \\ Change in Unearned Revenue & $2,185 & $411,453 \\ Change in Wages Payable & & $3,958,500 \\ \hline Loss on Sale & & \\ Net Cash Flow from Operations & & \end{tabular} \begin{tabular}{|c|c|c|} \hline & & \\ \hline Sale of Equipment & $21,850 & \\ \hline Purchase of Land & ($1,092,000) & \\ \hline Purchase of Building & ($205,623) & \\ \hline Purchase of Equipment & ($4,626,377) & \\ \hline Net Cash Flow from Investments & & ($5,902,150) \\ \hline Cash Flow from Financing & & \\ \hline Repayment of Loans & ($136,500) & \\ \hline Issuance of Notes Payable & $1,638,000 & \\ \hline Payments of Dividends & ($410,000) & \\ \hline Net Cash Flow from Financing & & $1,091,500 \\ \hline \end{tabular} Net Increase (Decrease) in Cash Cash, January 1, 2022 Cash, December 31, 2022 ($852,150)$1,365,000$512,850 Information: On July 15,2022 , PPI took out a special short-term note to finance the purchase of additional inventory needed for a large contract with a new client. The new, non-interest bearing loan was for $800,000 and must be repaid within 6 months of issuance. After the loan paperwork was signed, the bank transferred $736,000 to PPI and the company was able to start purchasing the needed inventory. While the purchase of inventory was properly recorded, no journal entries have yet been made for the note. PPI's management would like to know the effect of your adjustment on the following ratios: - Current Ratio - Times Interest Earned (Income before Interest and Taxes / Interest Expense) Assignment: Calculations 1. Make the appropriate journal entries, if any, to account for the new note (including any necessary changes to income tax expense). 2. Make any necessary changes to the financial statements. Critical Thinking 3. Calculate each of the required ratios using the original values (before any changes) and the updated values (after your changes). 4. PPI's finance team had several options to raise the funds for the needed inventory. They could have sold stock, issued a long-term note, purchased the inventory on credit, or issued other financing. How did their choice to issue a short-term note affect their financial position? Do you agree that this was the best of the available options? If so, please explain why it was the best available option. If not, please explain which other option you feel would have been the best and why. 5. PPI's Director of Finance argued that they should wait until they repaid the obligation to record the interest, after all it was technically a non-interest bearing note and the amount of interest was very small. What would have been the possible consequences of this option and who is likely to have been affected Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started