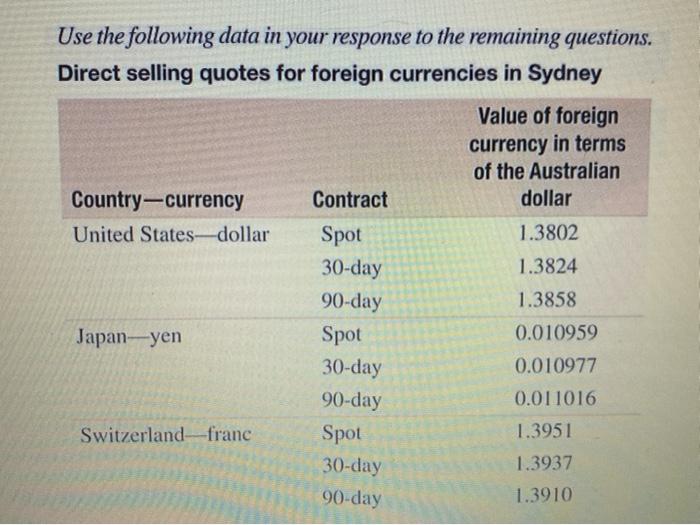

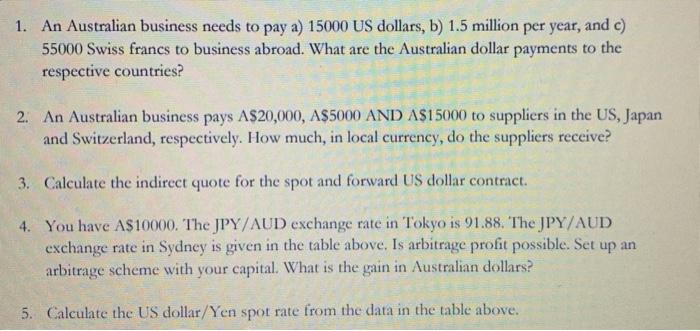

For your job as the business reporter for a local newspaper, you are given the assignment of putting together a series of articles on multinational finance and the international cur- rency markets for your readers. Much recent local press cov- erage has been given to losses in the foreign exchange markets by JGAR, a local firm that is the subsidiary of Daed- lufetarg, a large German manufacturing firm. Your editor would like you to address several specific questions dealing with multinational finance. Prepare a response to the follow- ing memorandum from your editor: TO: Business Reporter FROM: Perry White, Editor, Daily Planet RE: Upcoming series on multinational finance In your upcoming series on multinational finance, I would like to make sure you cover several specific points. In addition, before you begin this assignment, I want to make sure we are all on the same page, as accuracy has always been the comerstone of the Daily Planet. I'd like a response to the following questions before we proceed: Use the following data in your response to the remaining questions. Direct selling quotes for foreign currencies in Sydney Value of foreign currency in terms of the Australian Country-currency Contract dollar United States-dollar Spot 1.3802 30-day 1.3824 90-day 1.3858 Japan-yen Spot 0.010959 30-day 0.010977 90-day 0.011016 Switzerland-franc Spot 1.3951 30-day 1.3937 1.3910 90-day 1. An Australian business needs to pay a) 15000 US dollars, b) 1.5 million per year, and c) 55000 Swiss francs to business abroad. What are the Australian dollar payments to the respective countries? 2. An Australian business pays A$20,000, A$5000 AND A$15000 to suppliers in the US, Japan and Switzerland, respectively. How much, in local currency, do the suppliers receive? 3. Calculate the indirect quote for the spot and forward US dollar contract. 4. You have A$10000. The JPY/AUD exchange rate in Tokyo is 91.88. The JPY/AUD exchange rate in Sydney is given in the table above. Is arbitrage profit possible. Set up an arbitrage scheme with your capital. What is the gain in Australian dollars? 5. Calculate the US dollar/Yen spot rate from the data in the table above