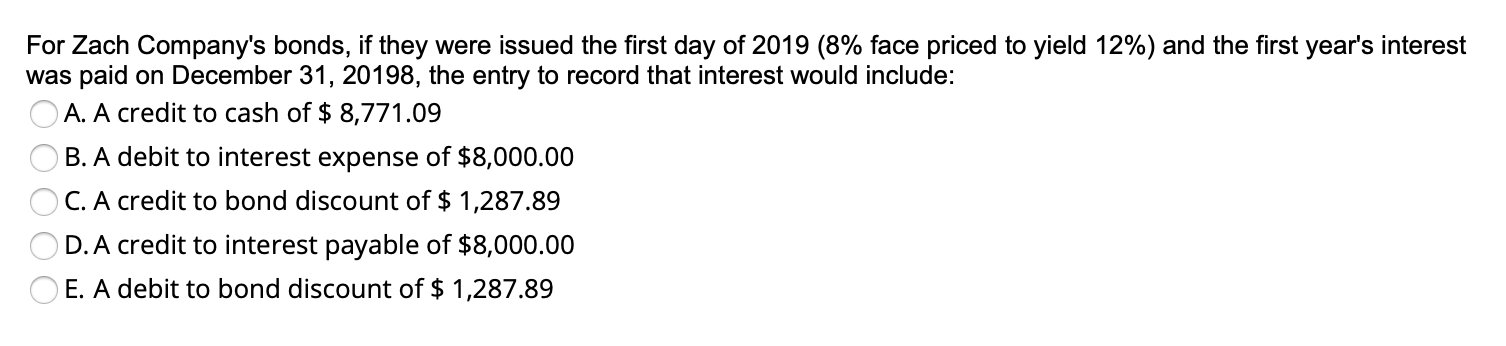

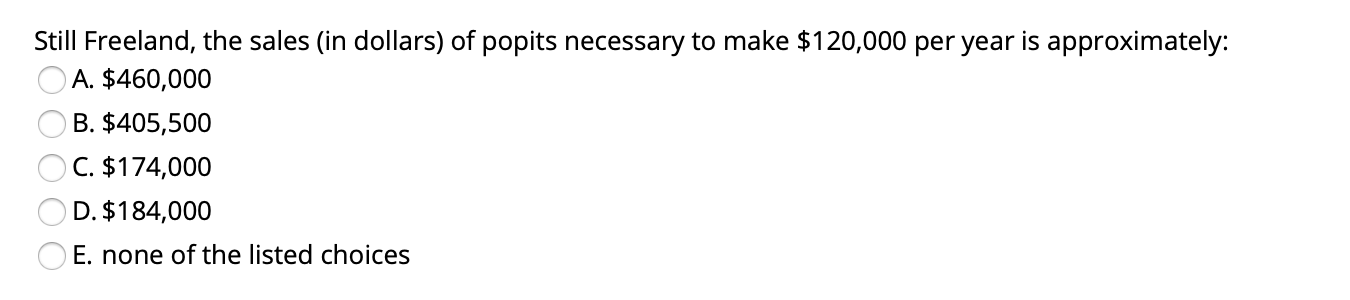

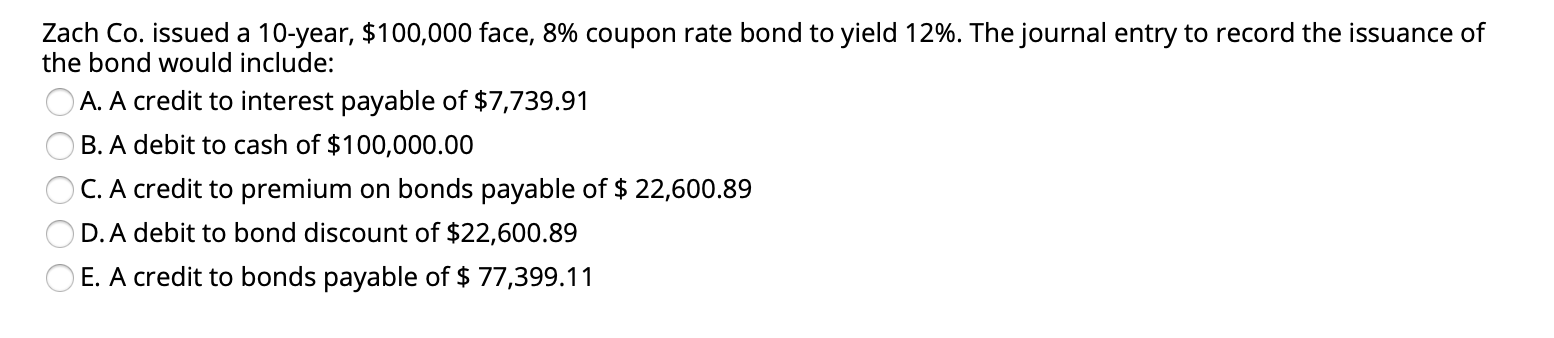

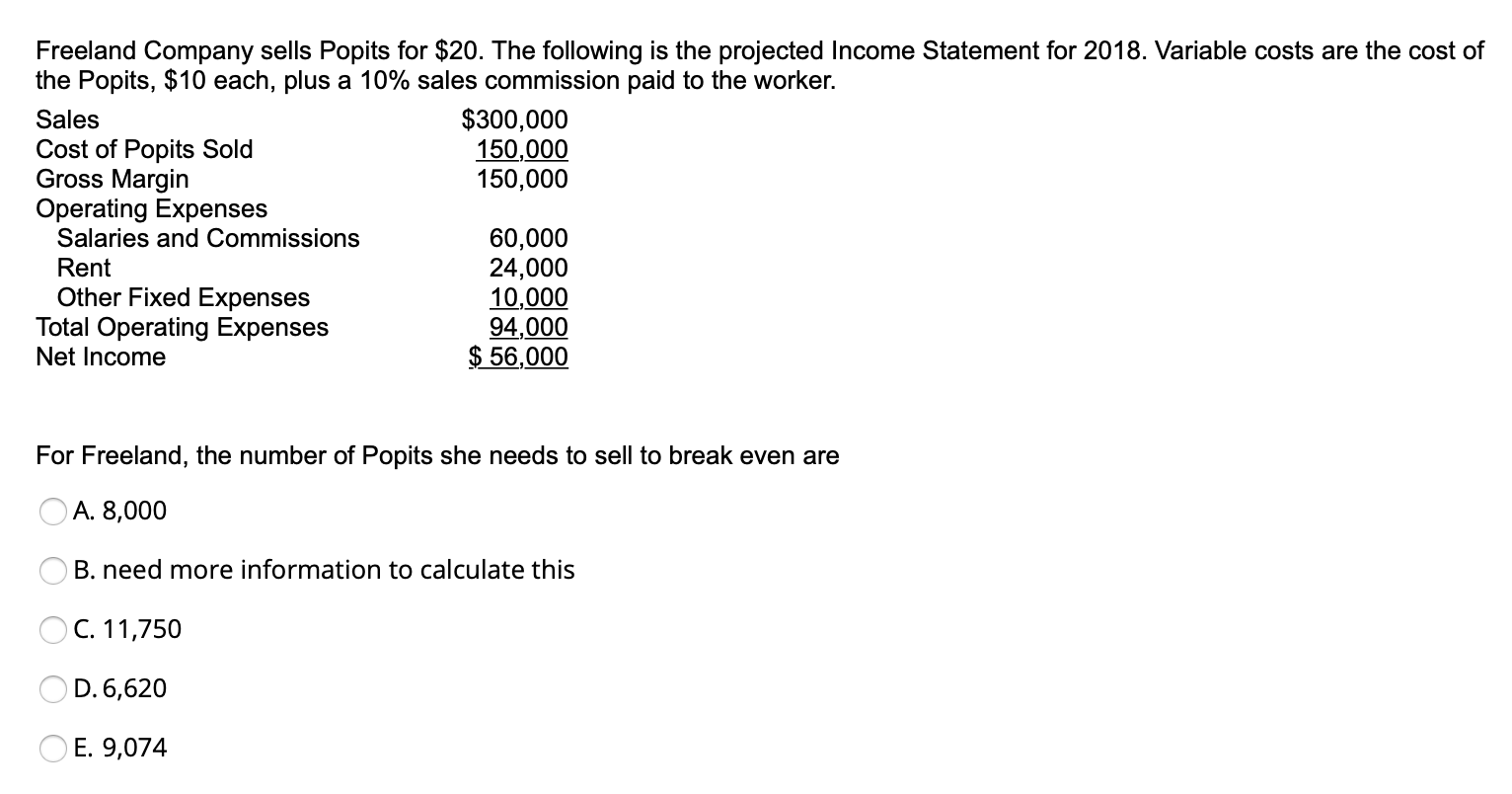

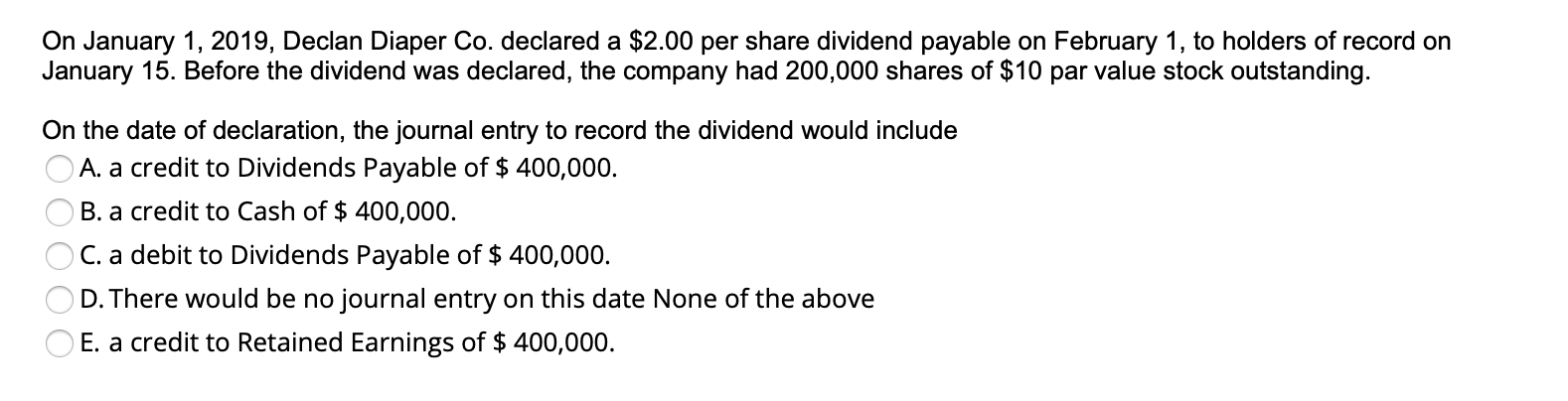

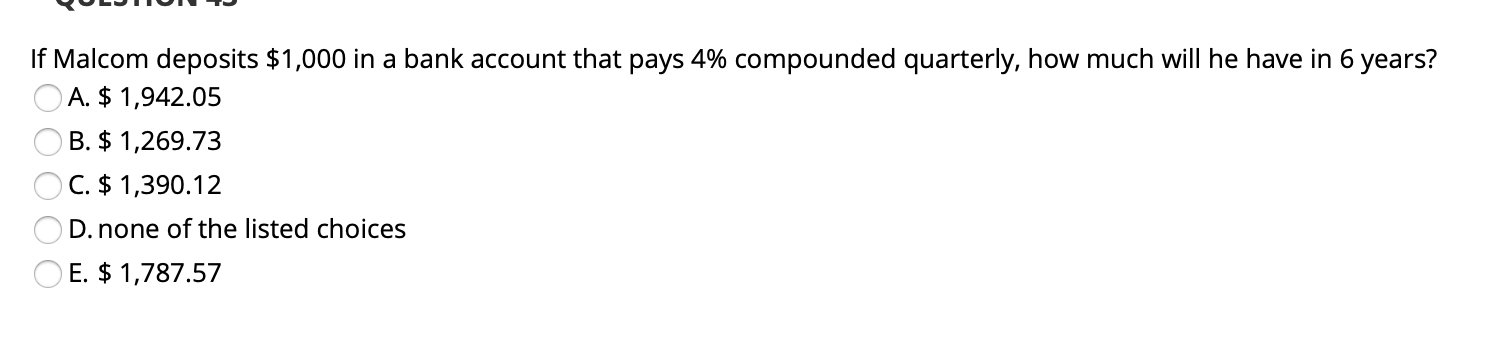

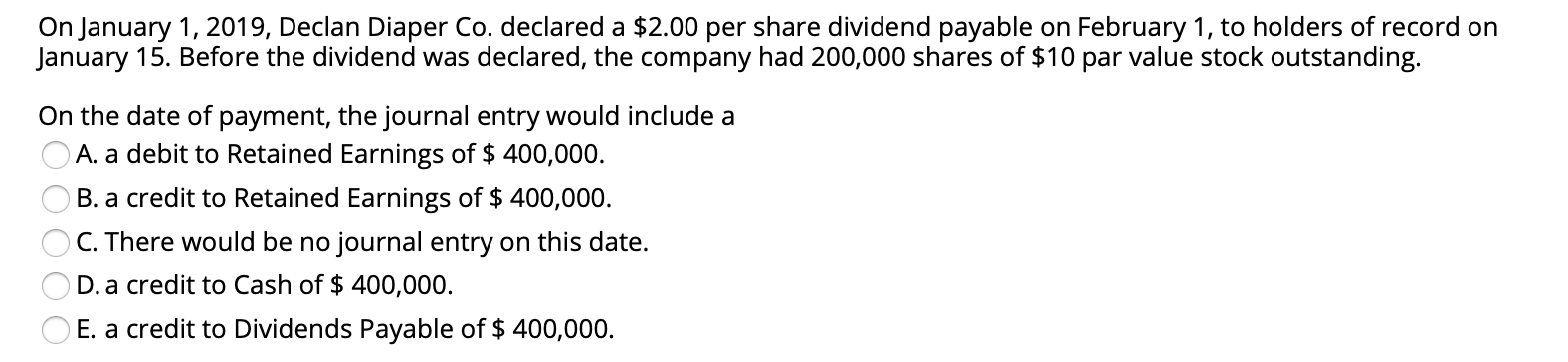

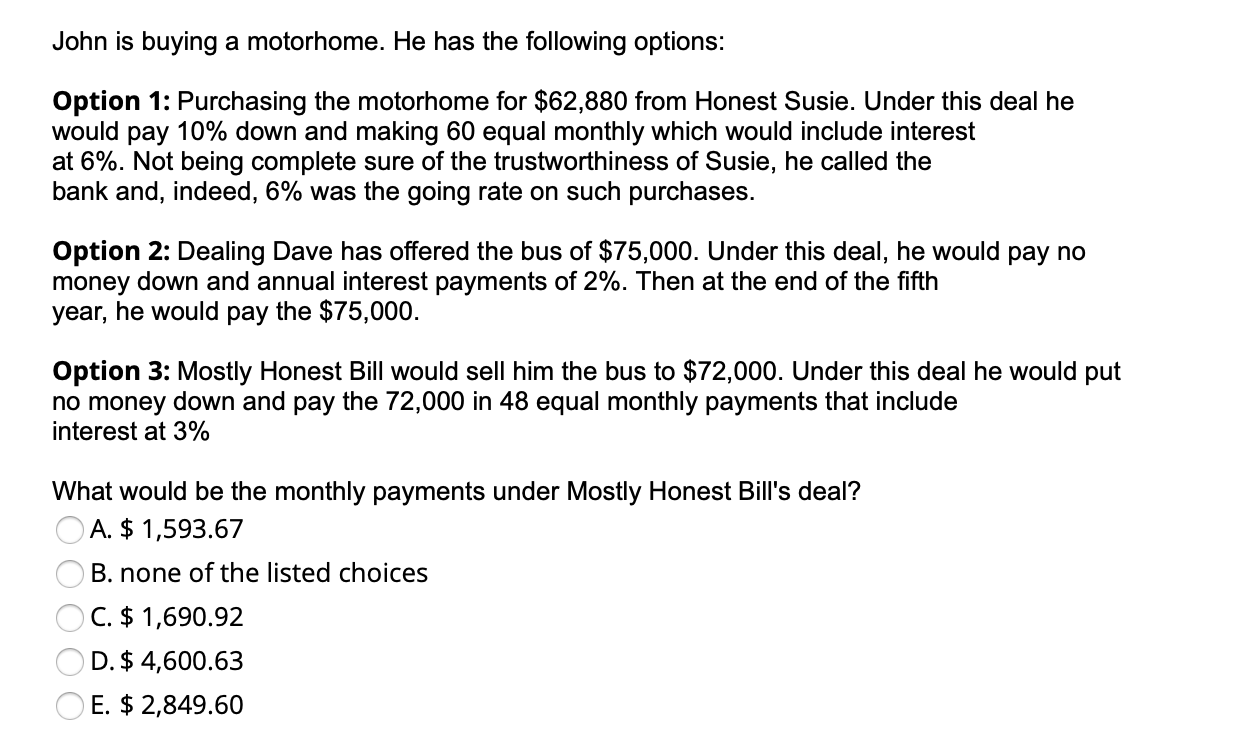

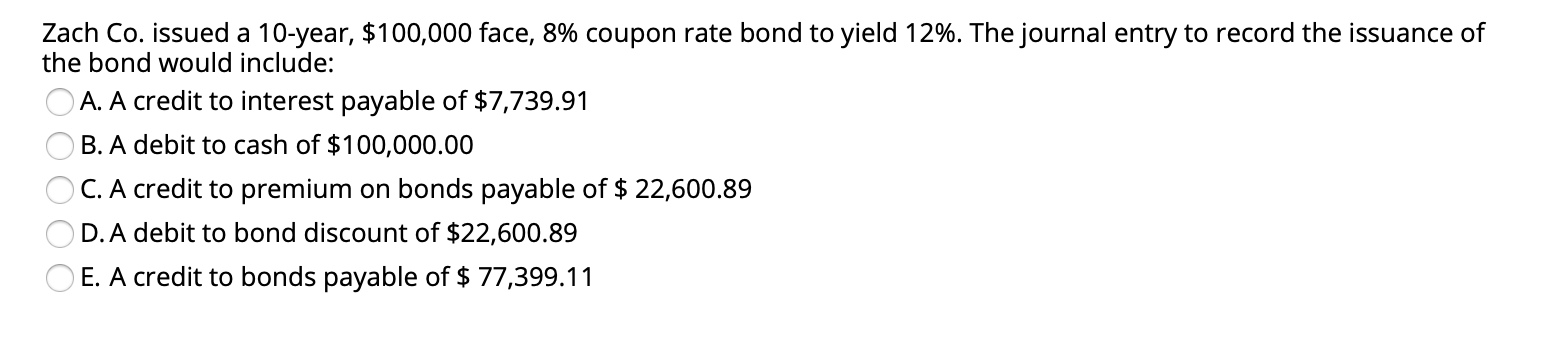

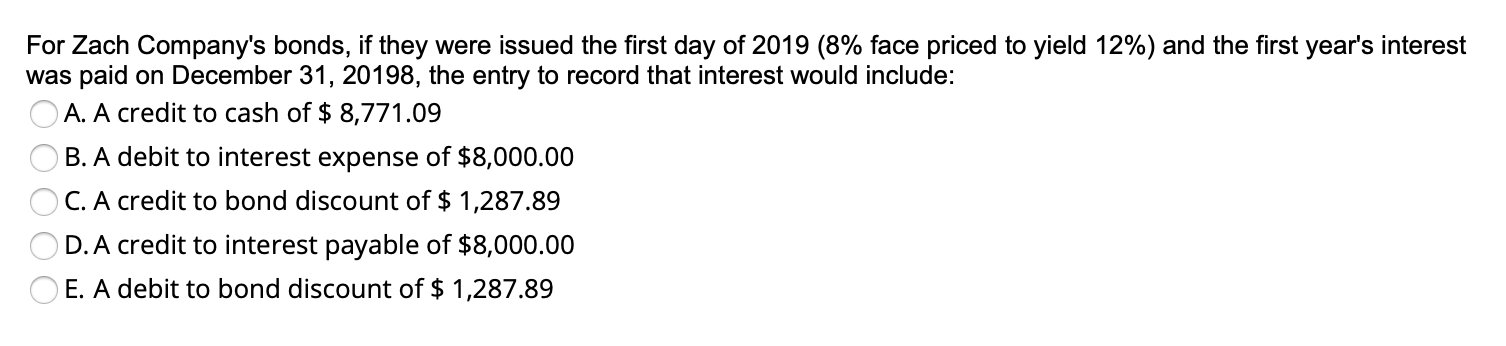

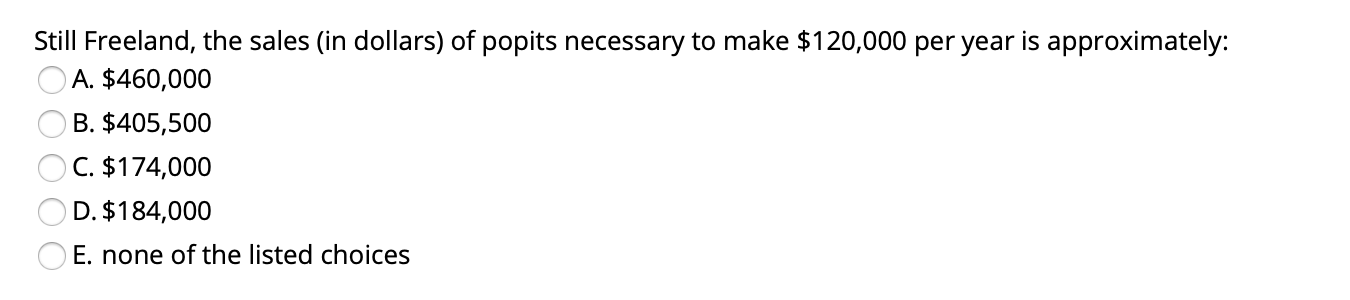

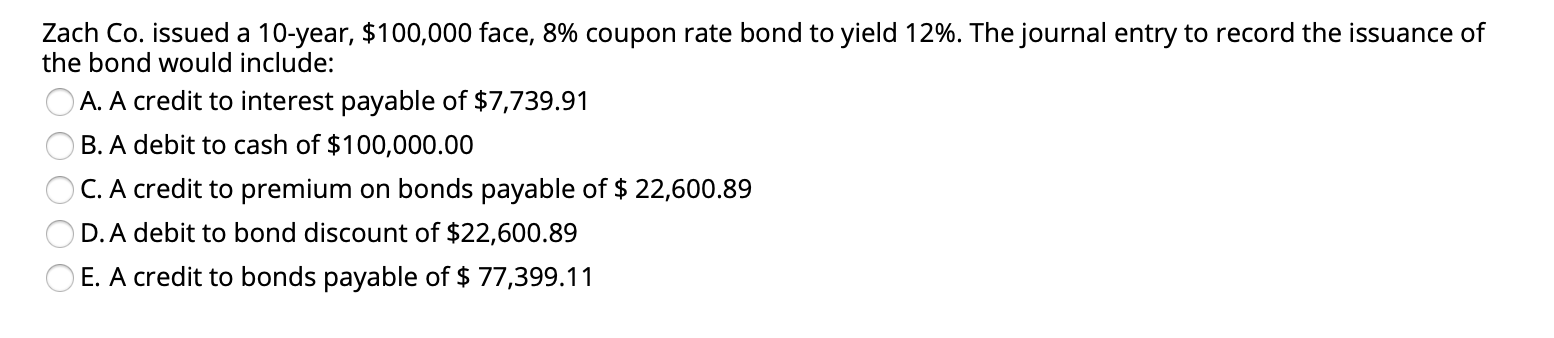

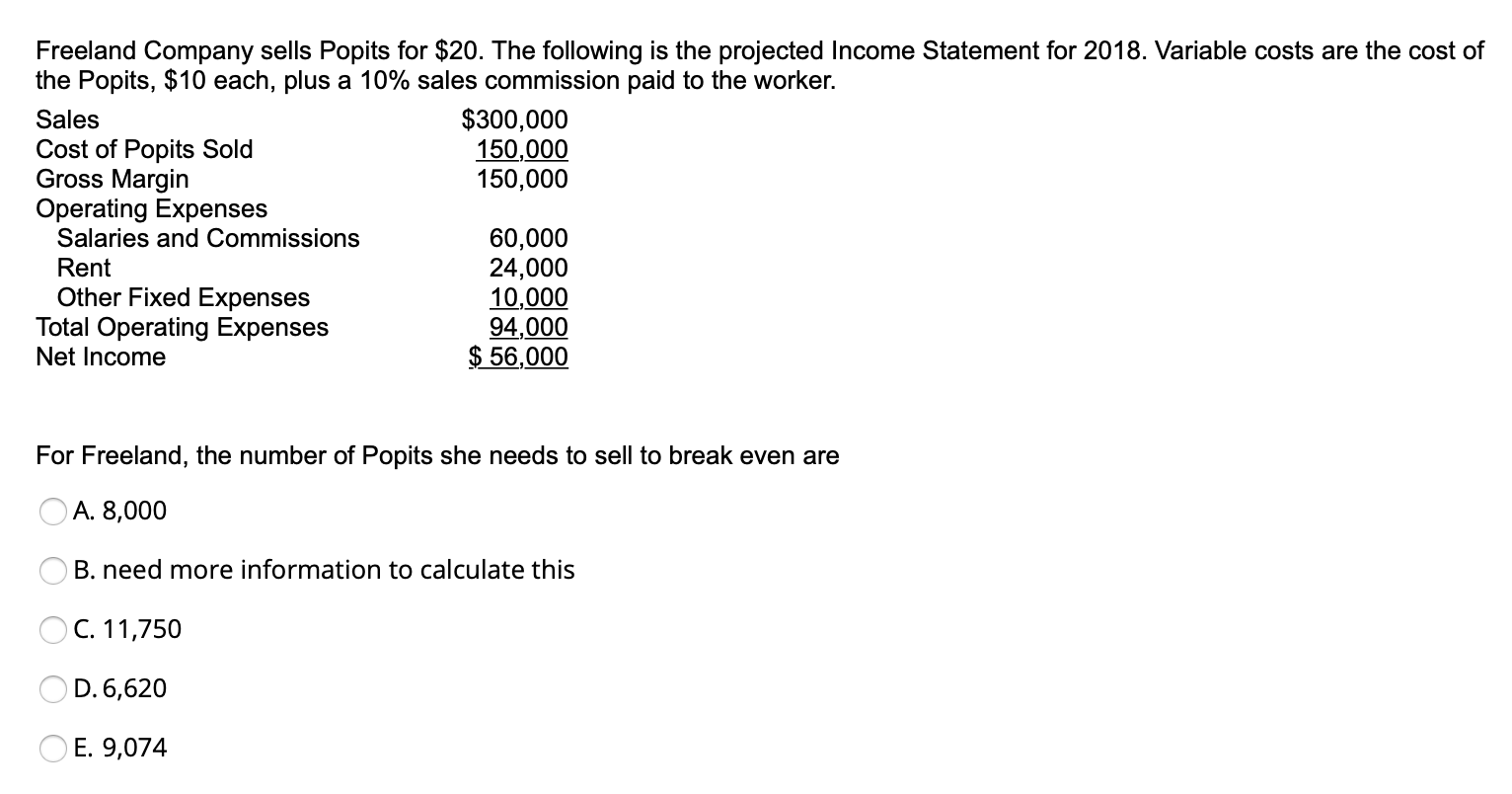

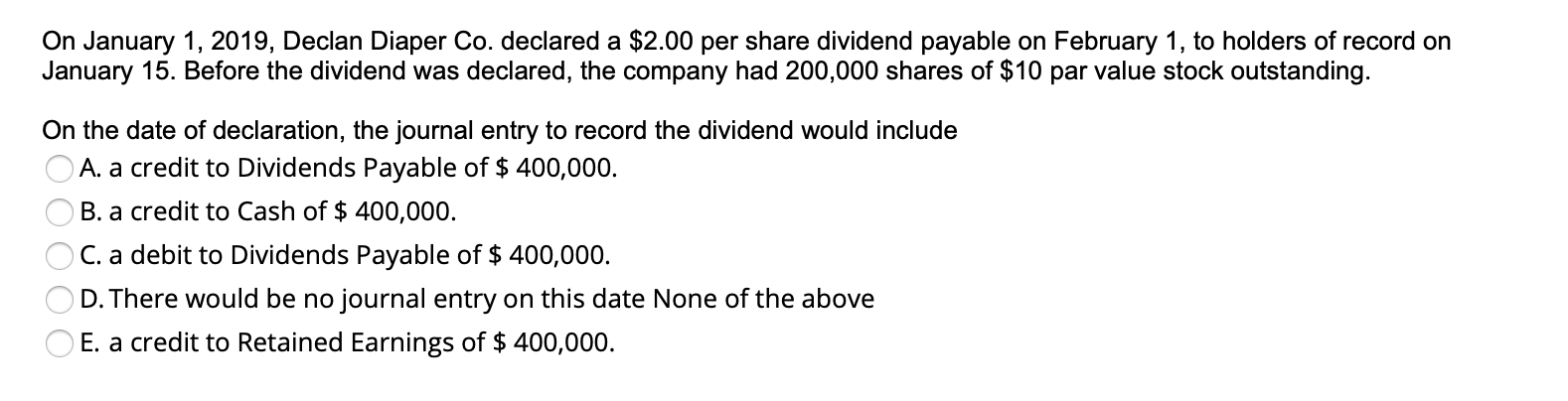

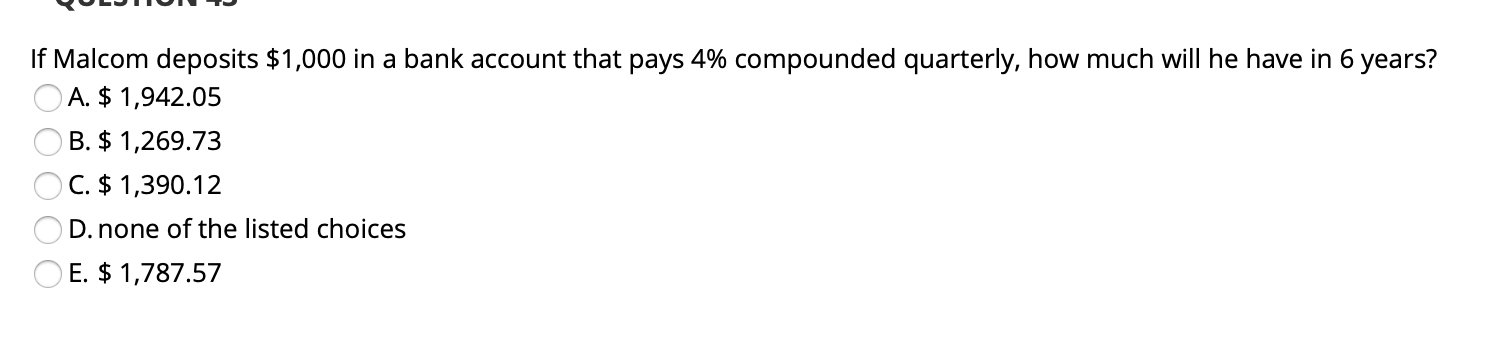

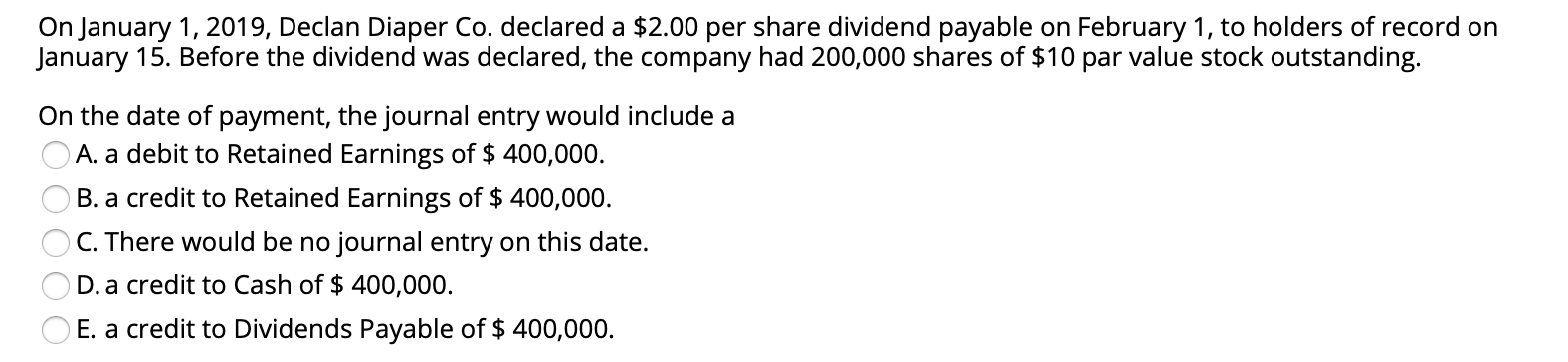

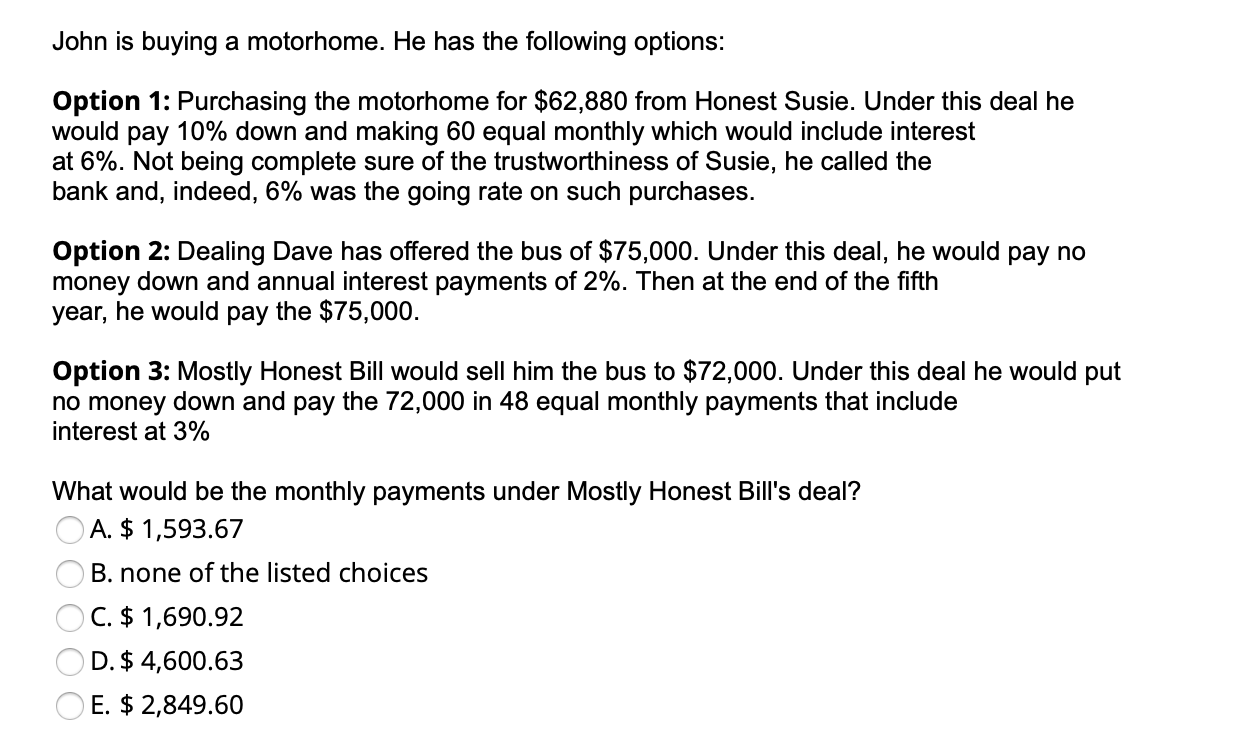

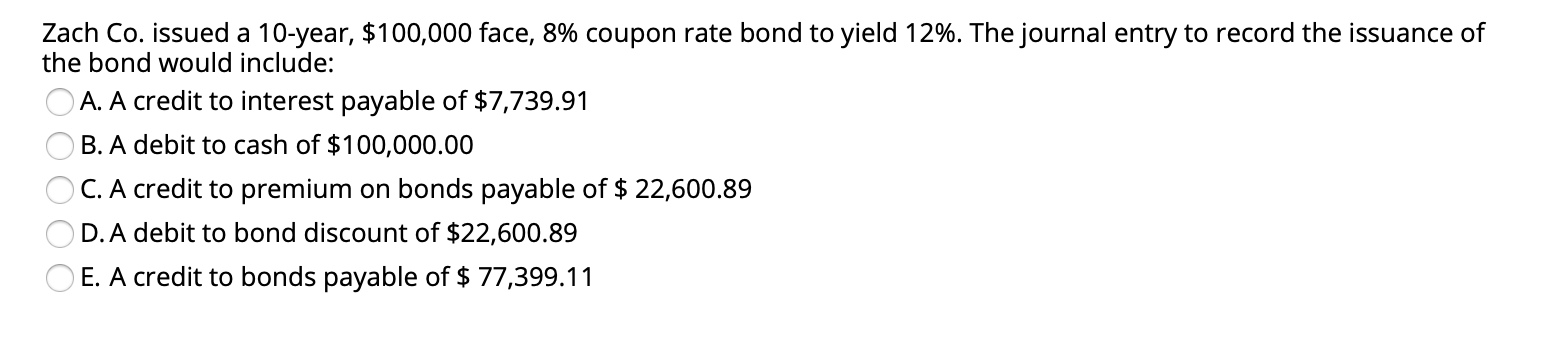

For Zach Company's bonds, if they were issued the first day of 2019 (8% face priced to yield 12%) and the first year's interest was paid on December 31, 20198, the entry to record that interest would include: OA. A credit to cash of $ 8,771.09 OB. A debit to interest expense of $8,000.00 OC. A credit to bond discount of $ 1,287.89 OD. A credit to interest payable of $8,000.00 OE. A debit to bond discount of $ 1,287.89 Still Freeland, the sales (in dollars) of popits necessary to make $120,000 per year is approximately: A. $460,000 B. $405,500 OC. $174,000 OD. $184,000 O E. none of the listed choices Zach Co. issued a 10-year, $100,000 face, 8% coupon rate bond to yield 12%. The journal entry to record the issuance of the bond would include: OA. A credit to interest payable of $7,739.91 OB. A debit to cash of $100,000.00 OC. A credit to premium on bonds payable of $ 22,600.89 OD. A debit to bond discount of $22,600.89 OE. A credit to bonds payable of $ 77,399.11 Freeland Company sells Popits for $20. The following is the projected Income Statement for 2018. Variable costs are the cost of the Popits, $10 each, plus a 10% sales commission paid to the worker. Sales $300,000 Cost of Popits Sold 150,000 Gross Margin 150,000 Operating Expenses Salaries and Commissions 60,000 Rent 24,000 Other Fixed Expenses 10,000 Total Operating Expenses 94,000 Net Income $ 56,000 For Freeland, the number of Popits she needs to sell to break even are A. 8,000 O B. need more information to calculate this OC. 11,750 OD. 6,620 O E. 9,074 On January 1, 2019, Declan Diaper Co. declared a $2.00 per share dividend payable on February 1, to holders of record on January 15. Before the dividend was declared, the company had 200,000 shares of $10 par value stock outstanding. On the date of declaration, the journal entry to record the dividend would include O A. a credit to Dividends Payable of $ 400,000. OB. a credit to Cash of $ 400,000. OC. a debit to Dividends Payable of $ 400,000. OD. There would be no journal entry on this date None of the above O E. a credit to Retained Earnings of $ 400,000. POLJ If Malcom deposits $1,000 in a bank account that pays 4% compounded quarterly, how much will he have in 6 years? A. $ 1,942.05 OB. $ 1,269.73 OC. $ 1,390.12 OD. none of the listed choices O E. $ 1,787.57 On January 1, 2019, Declan Diaper Co. declared a $2.00 per share dividend payable on February 1, to holders of record on January 15. Before the dividend was declared, the company had 200,000 shares of $10 par value stock outstanding. On the date of payment, the journal entry would include a A. a debit to Retained Earnings of $ 400,000. OB. a credit to Retained Earnings of $ 400,000. C. There would be no journal entry on this date. OD. a credit to Cash of $ 400,000. O E. a credit to Dividends Payable of $ 400,000. John is buying a motorhome. He has the following options: Option 1: Purchasing the motorhome for $62,880 from Honest Susie. Under this deal he would pay 10% down and making 60 equal monthly which would include interest at 6%. Not being complete sure of the trustworthiness of Susie, he called the bank and, indeed, 6% was the going rate on such purchases. Option 2: Dealing Dave has offered the bus of $75,000. Under this deal, he would pay no money down and annual interest payments of 2%. Then at the end of the fifth year, he would pay the $75,000 Option 3: Mostly Honest Bill would sell him the bus to $72,000. Under this deal he would put no money down and pay the 72,000 in 48 equal monthly payments that include interest at 3% What would be the monthly payments under Mostly Honest Bill's deal? O A. $ 1,593.67 OB. none of the listed choices OC. $ 1,690.92 OD. $ 4,600.63 OE. $ 2,849.60 Zach Co. issued a 10-year, $100,000 face, 8% coupon rate bond to yield 12%. The journal entry to record the issuance of the bond would include: OA. A credit to interest payable of $7,739.91 OB. A debit to cash of $100,000.00 OC. A credit to premium on bonds payable of $ 22,600.89 OD. A debit to bond discount of $22,600.89 OE. A credit to bonds payable of $ 77,399.11