Question

Forbes Festivities, a special events planner, uses a 10 year-old van to deliver decorations and supplies to customers. The company paid $20,000 for the van,

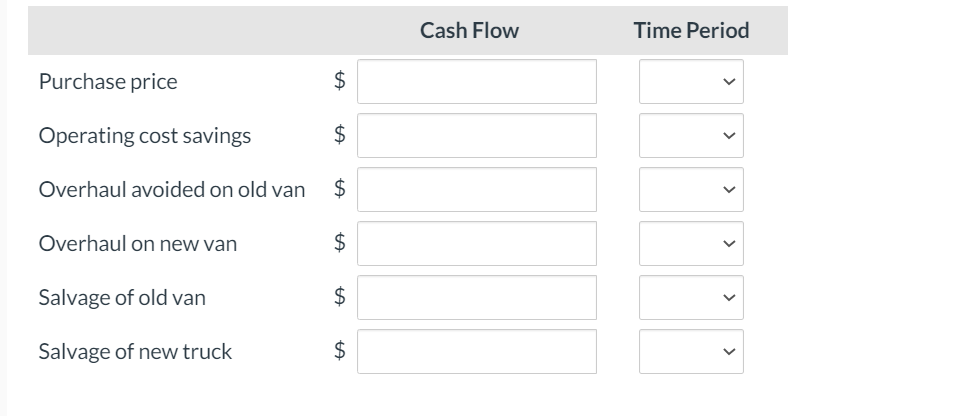

Forbes Festivities, a special events planner, uses a 10 year-old van to deliver decorations and supplies to customers. The company paid $20,000 for the van, which costs $2,300 per month to operate. In 2 years the van will need an extensive overhaul costing $5,300. Colin Forbes, the companys owner, is considering the purchase of a new delivery truck to replace the van. The truck he is looking at will cost $26,000 and has a useful life of 10 years. Based on estimated gas mileage and insurance, Colin calculates that the truck will cost $1,300 per month to operate. It will require a $2,300 overhaul in year 8. Based on current blue-book values, Colin could sell the old van today for $4,100. He estimates that he will be able to sell the new truck for $7,100 at the end of its 10 year life. Identify the amount and timing of the cash flows relevant to Colins decision to replace the delivery van. (If answer is negative then enter with a negative sign preceding the number, e.g. -15,000.)

Forbes Festivities, a special events planner, uses a 10 year-old van to deliver decorations and supplies to customers. The company paid $20,000 for the van, which costs $2,300 per month to operate. In 2 years the van will need an extensive overhaul costing $5,300. Colin Forbes, the companys owner, is considering the purchase of a new delivery truck to replace the van. The truck he is looking at will cost $26,000 and has a useful life of 10 years. Based on estimated gas mileage and insurance, Colin calculates that the truck will cost $1,300 per month to operate. It will require a $2,300 overhaul in year 8. Based on current blue-book values, Colin could sell the old van today for $4,100. He estimates that he will be able to sell the new truck for $7,100 at the end of its 10 year life. Identify the amount and timing of the cash flows relevant to Colins decision to replace the delivery van. (If answer is negative then enter with a negative sign preceding the number, e.g. -15,000.)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started