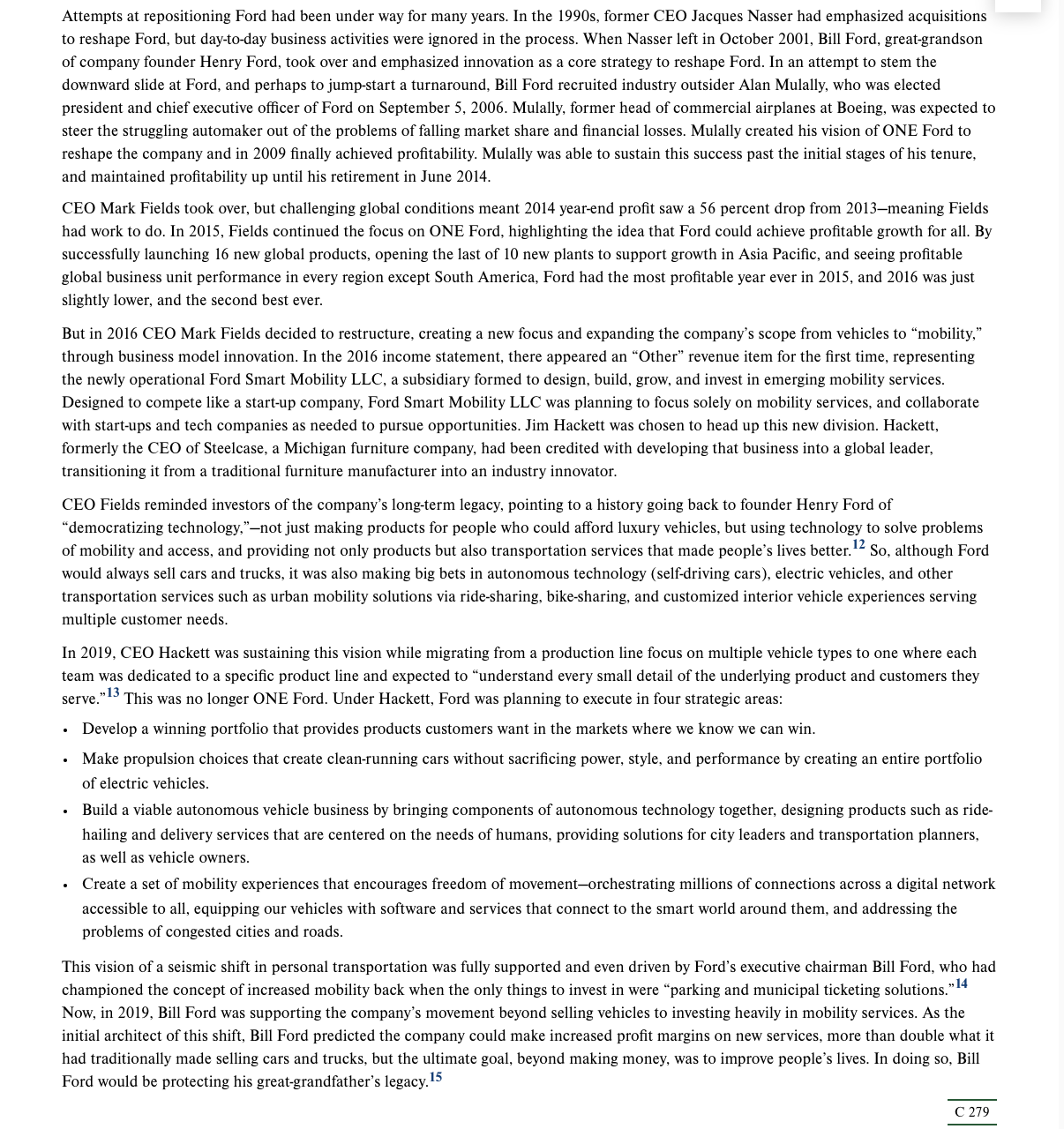

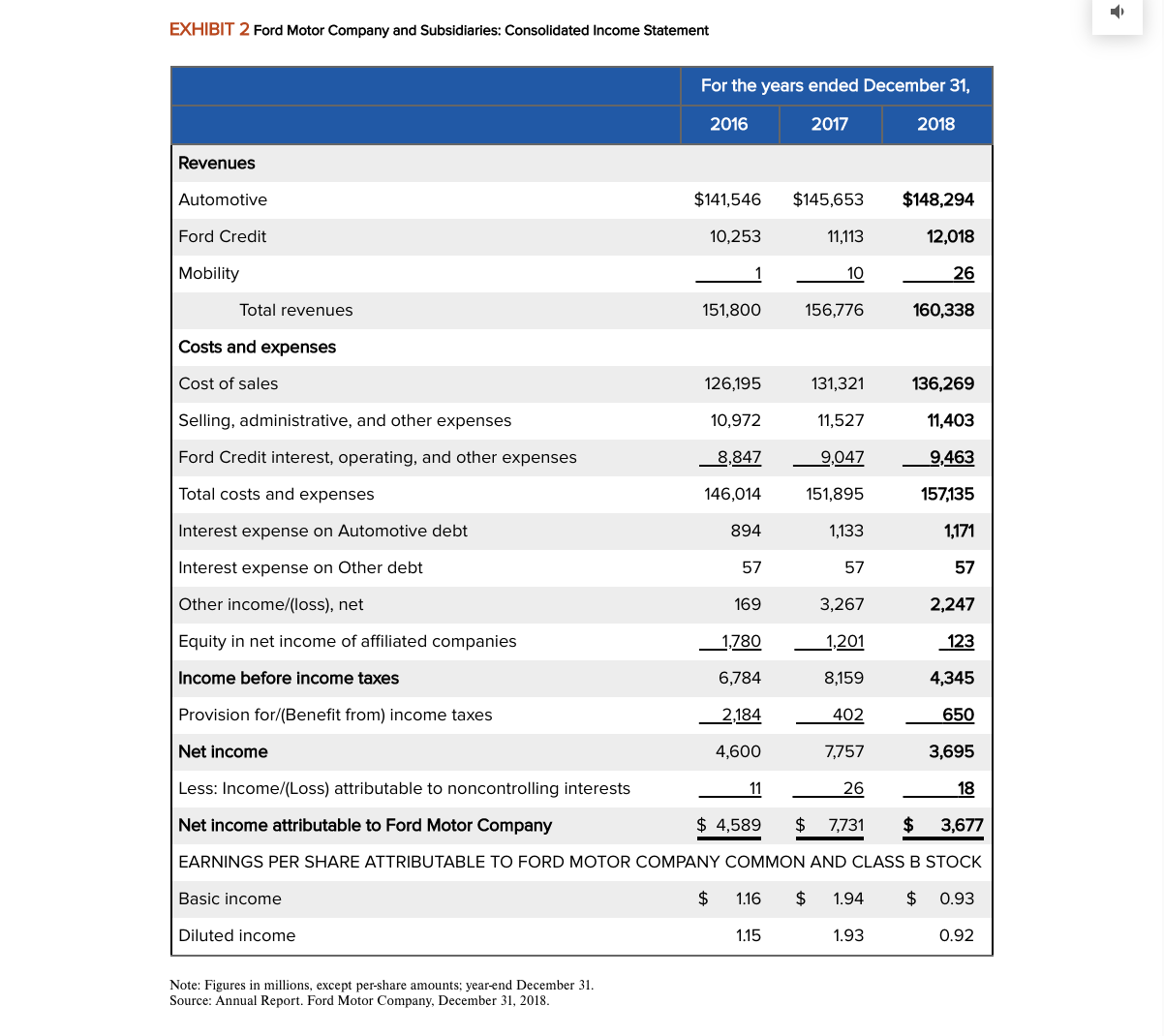

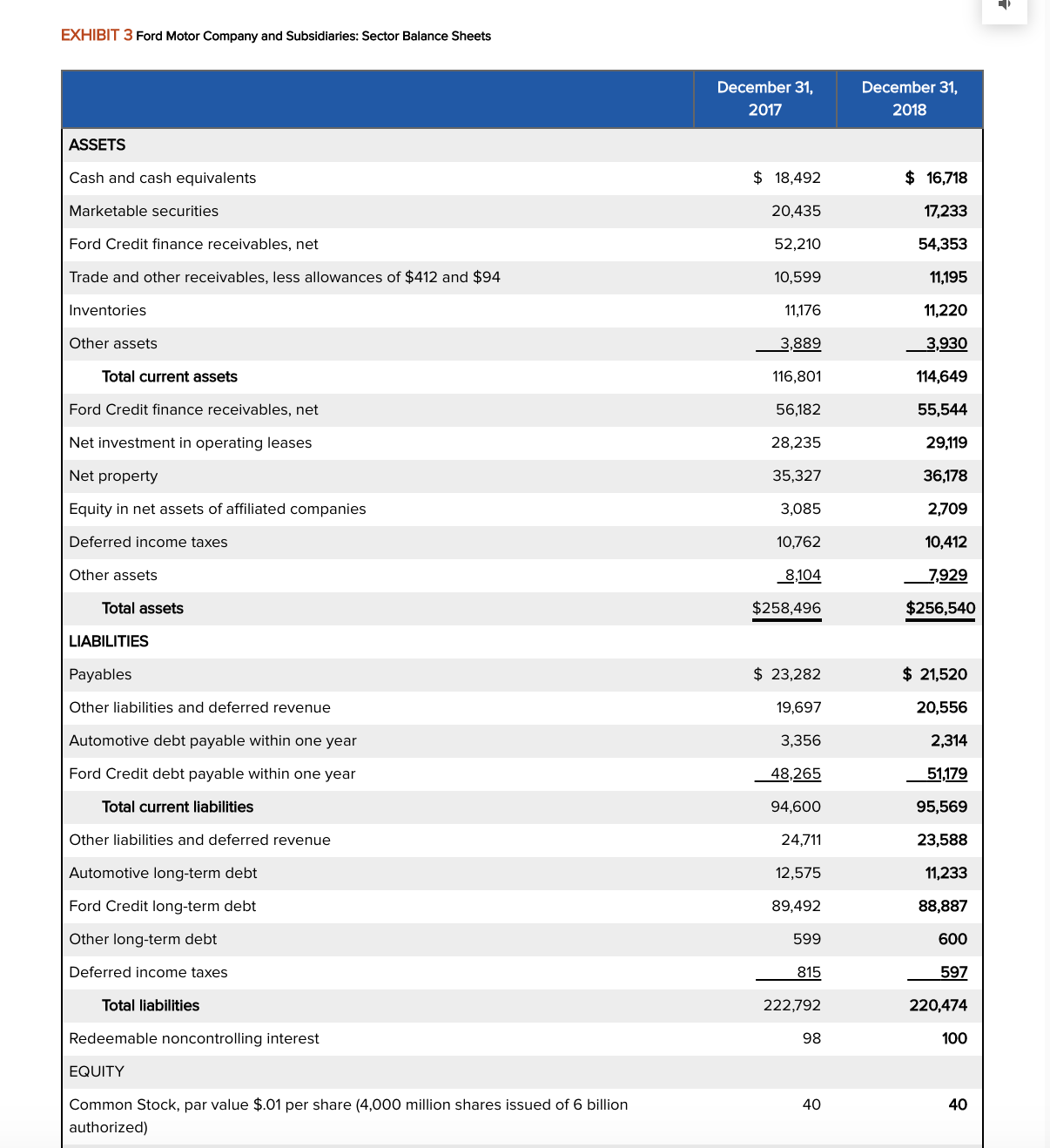

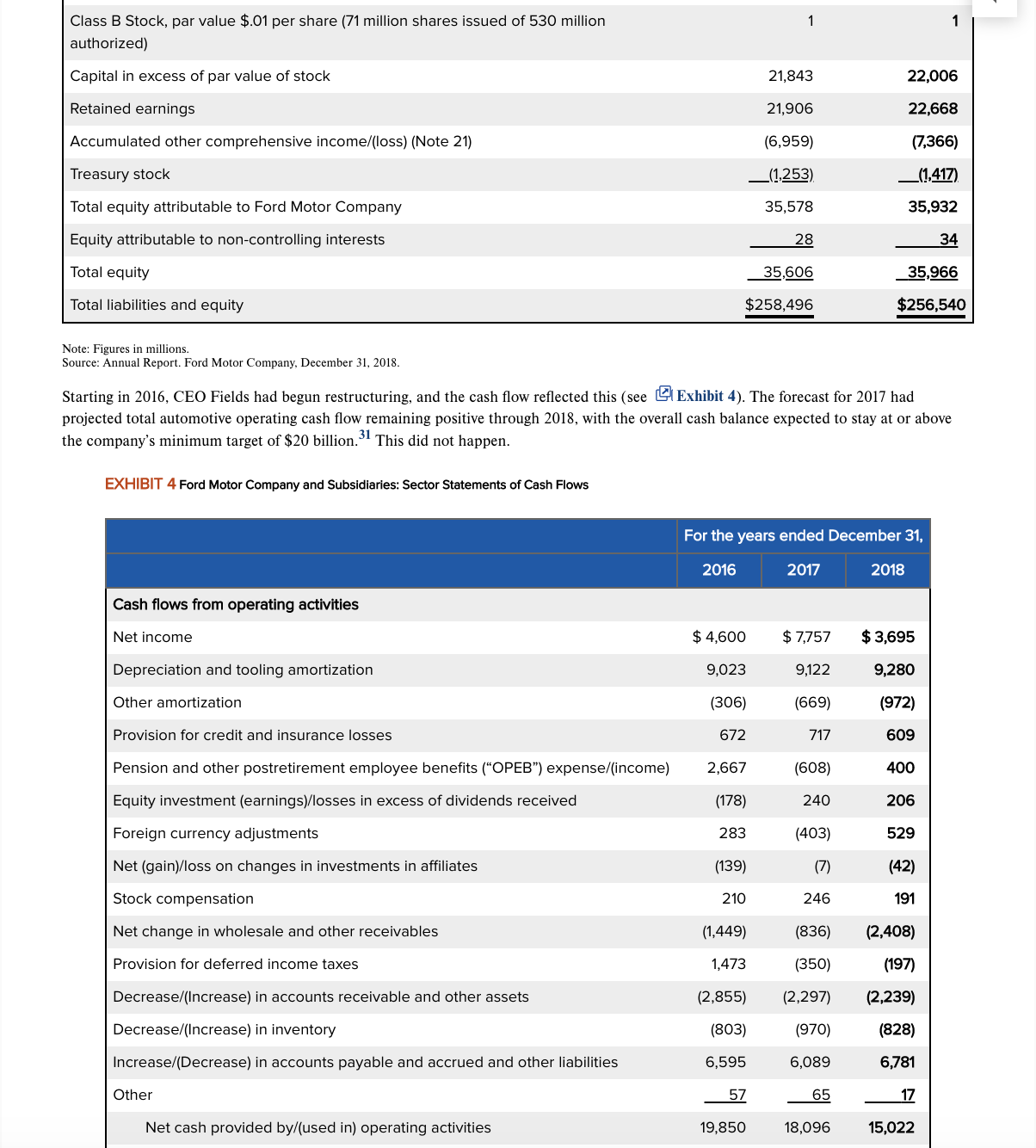

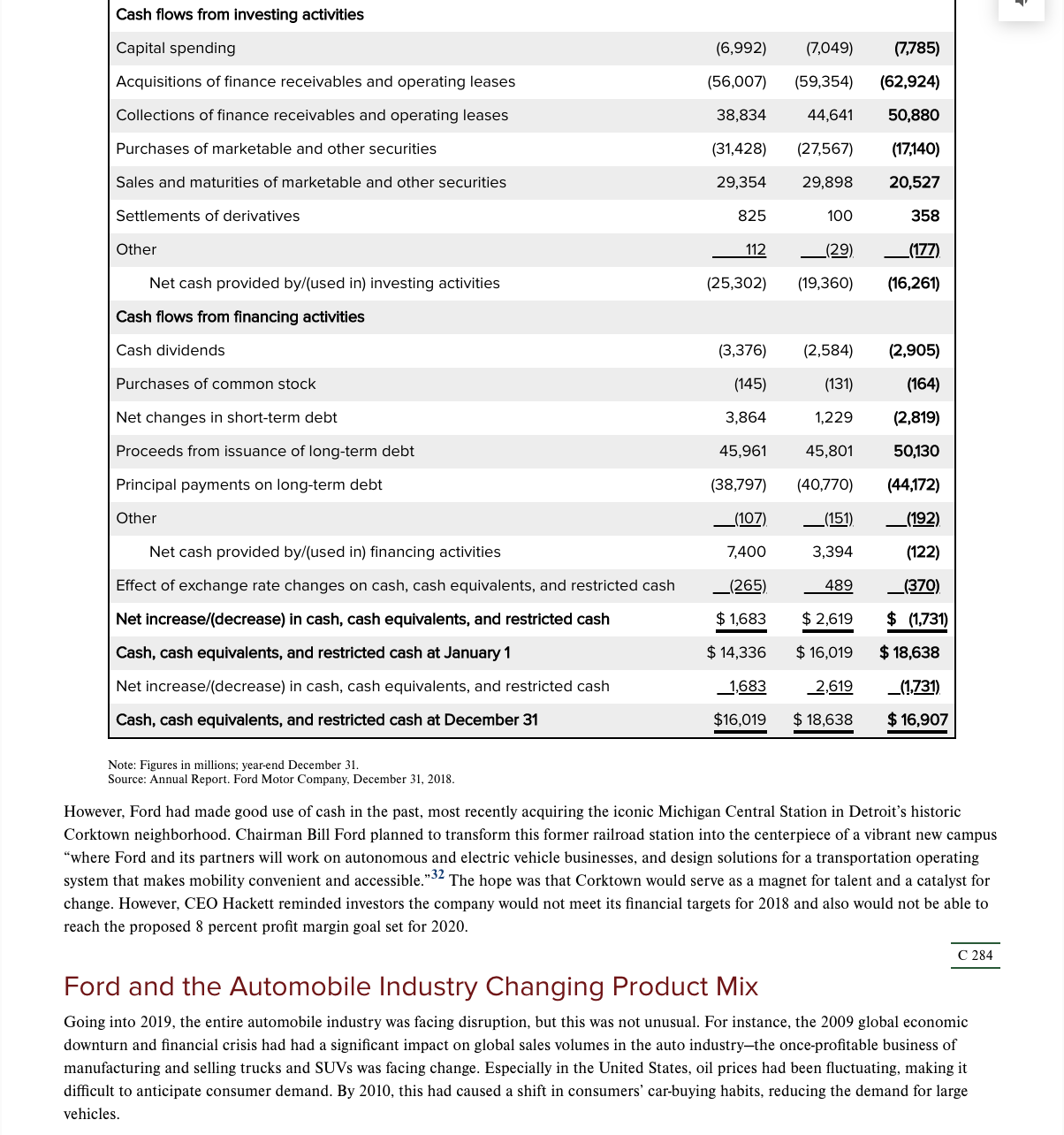

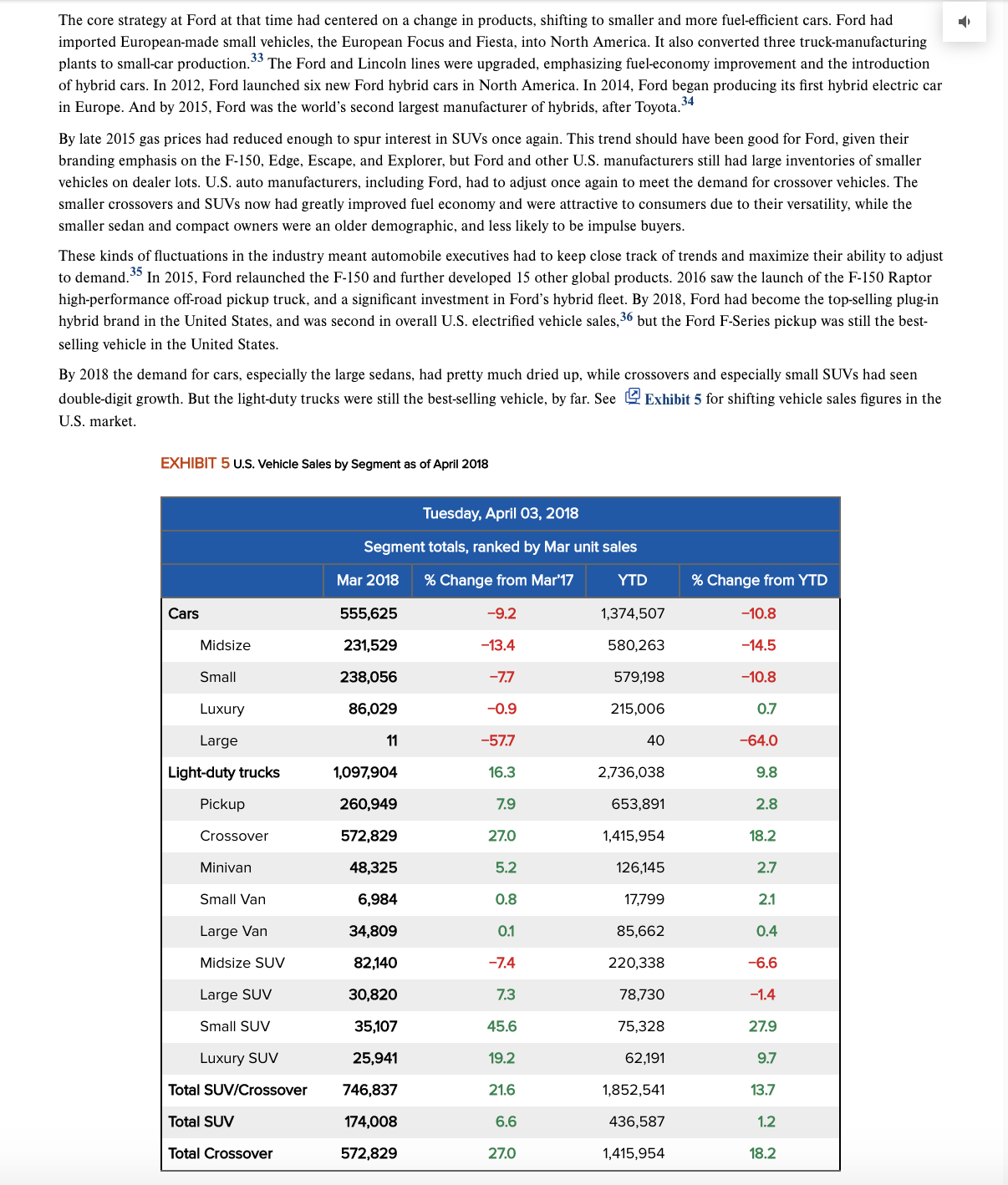

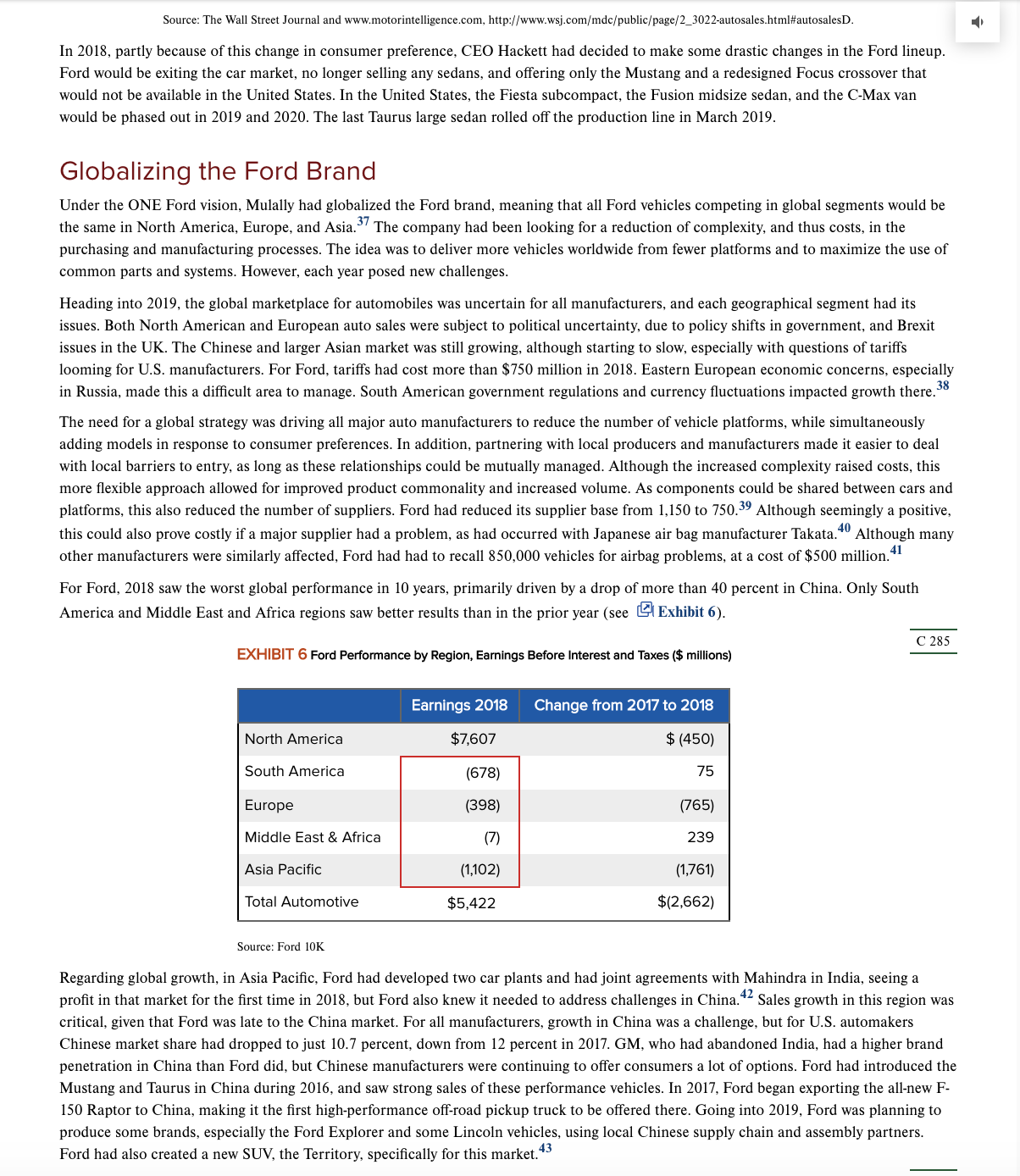

FORD: AN ALJTO COMPANY IN TRANSITION In January 2019, the Ford Motor Company celebrated as the F-Series line of pickups became the top-selling trucks in the United States for the 42nd consecutive year. This line of trucks also marked 37 years as the best-selling vehicle in the United States overall. In 2018, the F- Series, which included the Super Duty and the F-150 Raptor, sold 909,330 vehiclesjust 30,181 units short of the all-time record set in 2004.1 Jim Farley. Ford executive vice president and president, Global Markets, pointed to the F-Series as a \"juggernaut\" that \"leads the world in sales, capability, and smart technology, setting the bar others follow."2 But would truck sales alone help the increasingly depressed auto market, where the overall industry had already seen a drop in sales of 2.6 percent in the rst months of 2019? This was the biggest decline since the recession of 2009, and there appeared to be no relief in sight.3 Something would have to change. Bold leadership was needed. The ability to anticipate customers' needs was crucial to any company's long-term success, but it was especially important in the capital- intensive, consumer-driven, globally competitive automobile industry. As the major players from Asia, Europe, and the United States jockeyed for position in the sales of traditional trucks and cars, smaller, more innovative companies such as Tesla, Elio Motors,4 and start-up Faraday Futures were creating concept cars that addressed consumers' interests in alternative fuels, low operational costs, and self-driving autonomous designs that promised to leave the passenger free to use in-transit time for other more productive pursuits. The auto industry was going through a \"signicant secular change" that was hard to predict. The trend seemed to be going toward less car ownership and, as the industry became more niche focused, rapid technological changes meant it was essential to be able to refresh the product portfolio rapidly in order to maintain market share.5 Responding to this trend, Mark Fields, CEO of Ford from 2014 to 2017, had said Ford would be using innovation \"not only to create advanced new vehicles but also to help change the way the world moves by solving today's growing global transportation challenges.\"6 Self- driving cars were reported to be coming as early as 2019 to the global roadways; and Ford Motor Company had made a commitment to this business, testing its eet of 100 autonomous cars in Florida, Pennsylvania, and Michigan-I But in 2019 Ford was still at least two years away from releasing a long-range electric vehicle while General Motors (GM) had already brought the Bolt to market. Given the increasing disruption in the industry, and the obligation to return value to understandably concerned investors, Ford had some signicant decisions to make, one of which was selecting the right leader for this business. Executive Chairman Bill Ford had said \"this is a time of unprecedented change. And a time of great change, in my mind, requires a transformational leader.\"s Ford was feeling pressure from investors, who had seen the stock price steadily decline from a high of over 17.50 in 2014 to a low of under 10.00 in 2017. In 2017, Ford had asked Fields to resign and promoted Jim Hackett to the CEO position. Hackett, previously head of Ford Smart Mobility LLCa subsidiary of Ford formed to accelerate the company's plans to design, build, grow, and invest in emerging mobility services such as autonomous vehiclesbelieved in the need for transformation. Hackett had said \"breakthrough technologies are transforming nearly every aspect of the vehicles we build and how people use them, demanding a rethink of how we design transportation systems.\"9 But Hackett was Ford's third CEO in ve years. Why was this job so difcult? Fields had gotten the CEO job in July 2014 after the retirement of Alan Mulally, widely hailed as one of the \"ve most signicant corporate leaders of the last decade," and architect of Ford's eight-year turnaround from the brink of bankruptcy in 2006.10 It was Mulally who had created the vision that drove Ford's revitalization\"ONE Ford.\" The ONE Ford message was intended to communicate consistency across all departments, all segments of the company, requiring people to work together as one team, with one plan, and one goal: \"an exciting viable Ford delivering protable growth for all."ll Mulally worked to create a culture of accountability and collaboration across the company. His vision was to leverage Ford's unique automotive knowledge and assets to build cars and trucks that people wanted and valued, and he managed to arrange the nancing necessary to pay for it all. The 2009 economic downturn that caused a nancial catastrophe for U.S. automakers trapped General Motors and Chrysler in emergency government loans, but Ford was able to avoid bankruptcy because of Mulally's actions. Mulally had groomed Mark Fields as his successor since 2012, instilling condence among the company's stakeholders that Ford C 273 would be able to continue to be protable once Mulally stepped down. Even with this preparation, CEO Fields had faced an industry affected by general economic conditions over which he had little control and a changing technological and sociocultural environment where consumer preferences were diicult to predict. And rivals were coming from unexpected directions. Fields had to be able to anticipate and address numerous challenges as he tried to position the company for continued success. Ultimately, Fields was not able to do so. Attempts at repositioning Ford had been under way for many years. In the 1990s, former CEO Jacques Nasser had emphasized acquisitions to reshape Ford, but day-to-day business activities were ignored in the process. When Nasser left in October 2001, Bill Ford, great-grandson of company founder Henry Ford, took over and emphasized innovation as a core strategy to reshape Ford. In an attempt to stem the downward slide at Ford, and perhaps to jump-start a turnaround, Bill Ford recruited industry outsider Alan Mulally, who was elected president and chief executive ofcer of Ford on September 5, 2006. Mulally, former head of commercial airplanes at Boeing, was expected to steer the struggling automaker out of the problems of falling market share and nancial losses. Mulally created his vision of ONE Ford to reshape the company and in 2009 nally achieved protability. Mulally was able to sustain this success past the initial stages of his tenure, and maintained protability up until his retirement in June 2014. CEO Mark Fields took over, but challenging global conditions meant 2014 yearend prot saw a 56 percent drop from 20137meaning Fields had work to do. In 2015, Fields continued the focus on ONE Ford, highlighting the idea that Ford could achieve protable growth for all. By successfully launching 16 new global products, opening the last of 10 new plants to support growth in Asia Pacic, and seeing protable global business unit performance in every region except South America, Ford had the most protable year ever in 2015, and 2016 was just slightly lower, and the second best ever. But in 2016 CEO Mark Fields decided to restructure, creating a new focus and expanding the company's scope from vehicles to \"mobility," through business model innovation. In the 2016 income statement, there appeared an \"Other" revenue item for the rst time, representing the newly operational Ford Smart Mobility LLC, a subsidiary formed to design, build, grow, and invest in emerging mobility services. Designed to compete like a start-up company, Ford Smart Mobility LLC was planning to focus solely on mobility services, and collaborate with start-ups and tech companies as needed to pursue opportunities. Jim Hackett was chosen to head up this new division. Hackett, formerly the CEO of Steelcase, a Michigan furniture company, had been credited with developing that business into a global leader, transitioning it from a traditional furniture manufacturer into an industry innovator. CEO Fields reminded investors of the company's long-term legacy, pointing to a history going back to founder Henry Ford of \"democratizing technology,\"not just making products for people who could afford luxury vehicles, but using technology to solve problems of mobility and access, and providing not only products but also transportation services that made people's lives better.12 So, although Ford would always sell cars and trucks, it was also making big bets in autonomous technology (self-driving cars), electric vehicles, and other transportation services such as urban mobility solutions via ride-sharing, bike-sharing, and customized interior vehicle experiences serving multiple customer needs. In 2019, CEO Hackett was sustaining this vision while migrating from a production line focus on multiple vehicle types to one where each team was dedicated to a specic product line and expected to \"understand every small detail of the underlying product and customers they serve." 13 This was no longer ONE Ford. Under Hackett, Ford was planning to execute in four strategic areas: - Develop a winning portfolio that provides products customers want in the markets where we know we can win. - Make propulsion choices that create clean-running cars without sacricing power, style, and performance by creating an entire portfolio of electric vehicles. - Build a viable autonomous vehicle business by bringing components of autonomous technology together, designing products such as ride- hailing and delivery services that are centered on the needs of humans, providing solutions for city leaders and transportation planners, as well as vehicle owners. - Create a set of mobility experiences that encourages freedom of movementorchestrating millions of connections across a digital network accessible to all, equipping our vehicles with software and services that connect to the smart world around them, and addressing the problems of congested cities and roads. This vision of a seismic shift in personal transportation was fully supported and even driven by Ford's executive chairman Bill Ford, who had championed the concept of increased mobility back when the only things to invest in were \"parking and municipal ticketing solutions.\" 14 Now, in 2019, Bill Ford was supporting the company's movement beyond selling vehicles to investing heavily in mobility services. As the initial architect of this shift, Bill Ford predicted the company could make increased prot margins on new services, more than double what it had traditionally made selling cars and trucks, but the ultimate goal, beyond making money, was to improve people's lives. In doing so, Bill Ford would be protecting his great-grandfather's legacy.\" C 279 C 279 ', History of the Ford Motor Company At the beginning of 2019, Ford Motor Company, based in Dearborn, Michigan, had about 199,000 employees and 61 plants worldwide. It manufactured or distributed the automotive brands Ford and Lincoln across six continents, and provided nancial services via Ford Motor Credit. It was also aggressively pursuing emerging opportunities with investments in electrication, autonomous vehicles, and consumer mobility. It was the only company in the industry where the company name still honored the vision and innovative legacy of its founder, Henry Ford. American engineer and industrial icon Henry Ford had been a true innovator. He did not invent the automobile or the assembly line, but through his ability to recognize opportunities, articulate a vision, and inspire others to join him in fullling that vision, he was responsible for making signicant changes in the trajectory of the automobile industry and even in the history of manufacturing in America. Starting with the invention of the self-propelled Quadricycle in 1896, Ford had developed other vehiclesprimarily racing carswhich attracted a series of interested investors. In 1903, 12 investors backed him in the creation of a company to build and sell horseless carriages, and Ford Motor Company was born. Starting with the Model A, the company had produced a series of successful vehicles, but in 1908 Henry Ford wanted to create a better, cheaper \"motorcar for the great multitude.\""5 Working with a group of hand-picked employees, he designed the Model T. The design was so successful, and demand so great that Ford decided to investigate methods for increasing production and lowering costs. Borrowing concepts from other industries, by 1913 Ford had developed a moving assembly line for automobile manufacture. Although the work was so demanding that it created high employee turnover, the production process was signicantly more efcient, reducing chassis assembly time from 12 V2 hours to 2 hours 40 minutes. In 1904, Ford expanded into Canada, and by 1925 Ford had assembly plants in Europe, Argentina, South Africa, and Australia. By the end of 1919, Ford was producing 50 percent of all the cars in the United States, and the assembly line disruption in the industry had led to the demise of most of Ford's rivals." The Automotive Industry and Ford Leadership Changes The automotive industry in the United States had always been a highly competitive, cyclical business. By 2019 there was a wide variety of product offerings from a growing number of manufacturers, including the electric car lineup from Tesla Motors, self-styled as \"not just an automaker, but also a technology and design company with a focus on energy innovation."18 The total number of cars and trucks sold to retail buyers, or \"industry demand," varied substantially from year to year depending on general economic situations, the cost of purchasing and operating cars and trucks, and the availability of credit and fuel. Because cars and trucks were durable items, consumers could wait to replace them and, based on the most recent report, the average age of light vehicles on U.S. roads was over 12 years, with domestic nameplate vehicles 3.6 years older than foreign ones.19 Partly due to this, replacement demand was forecasted to stay fairly at. Any increase in sales would be aided by an improvement in the general economic situation, reduced gasoline prices, and lower interest rates for car loans. However, sales in U.S. markets had not belonged only to U.S. manufacturers for some time. [n the United States, Ford's market share had dropped over timefrom almost 25 percent in 1999 to 14.4 percent in 2018,20 with major blows to market share in the light-vehicle segment. Going into 2019, Ford claimed the third spot in the U.S. market, just behind Toyota (see Q Exhibit 1). EXHIBIT 1 Sales and Share of U.S. Total Market by Manufacturer, 2018 Market share BMW Mazda Tesla Daimler Group 1.74% 1.15% Volkswagen Group 2.06% 2.06% (excluding Lamborghini) 3.69% Subaru Corporation 3.94% General Motors 17.02% Hyundai-Kia 7.42% Honda Motor Company Toyota Motor Corporation 9.1% 14.63% Nissan Motor Company/ Ford Motor Company Mitsubishi FCA/Chrysler 14.44% 9.35% Group 12.98% Source: statista.com Originally dominated by the "Big 3" Detroit-based car companies-Ford, General Motors, and Fiat/Chrysler-competition in the United States had intensified since the 1980s, when Japanese carmakers began gaining a foothold in the market. To counter the problem of being viewed as foreign, Japanese companies Nissan, Toyota, and Honda had set up production facilities in the United States and thus gained acceptance from American consumers. Production quality and lean production were judged to be the major weapons that Japanese carmakers used to gain an advantage over American carmakers. Starting in 2003, because of innovative production processes that yielded better quality for American consumers, Toyota vehicles had unquestionably become "a better value proposition" than Detroit's products. Back in 1999, Ford Motor Company had been in good shape, having attained a U.S. market share of 24.8 percent, and had seen profits reach a remarkable $7.2 billion ($5.86 per share) with pre-tax income of $11 billion. At that time people even speculated that Ford would soon overtake General Motors as the world's number-one automobile manufacturer. " But soon Toyota, through its innovative technology, management philosophy of continuous improvement, and cost arbitrage due to its presence in multiple geographic locations, was threatening to overtake GM and Ford.In addition, unfortunately, the prots at Ford in 1999 had come at the expense of not investing in Ford's future. Jacques Nasser, the CEO at that time, had focused on corporate acquisition and diversication rather than new vehicle development. By the time Chairman Bill Ford had stepped in and red Nasser in 2001. Ford was seeing decline in both market share and protability. By 2005, market share had dropped to 18.6 percent and Ford had skidded out of control, losing $1.6 billion (pre-ta'x) in North American prots. It was obvious Ford needed a change in order to adapt and survive. Since taking the CEO position in 2001, Bill Ford had tried several times to nd a qualied successor, claiming that to undertake major changes in Ford's dysfunctional culture, an outsider might be more qualied than even the most procient auto industry insider.23 In 2006, Alan Mulally was selected as the new CEO and was expected to accomplish \"nothing less than undoing a strongly C 230 entrenched management system put into place by Henry Ford II almost 40 years ago\"a system of regional efdoms around the world that had sapped the company's ability to compete in a global industry, a system that Chairman Bill Ford could not or would not unwind by himself.\" Mulally set his own priorities for xing Ford: Ford needed to pay more attention to cutting costs and transforming the way it did business than to traditional measurements such as market share.25 The vision was to have a smaller and more protable Ford. The overall strategy was to use restructuring as a tool to obtain operating protability at lower volume and create a mix of products that better appealed to the market. By 201], Ford had closed or sold a quarter of its plants and cut its global workforce by more than a third. It also slashed labor and healthcare costs, plowing the money back into the design of some well-received new products, like the Ford Fusion sedan and Ford Edge crossover. This put Ford in a better position to compete, especially taking into consideration that General Motors and Chrysler had led for bankruptcy in 2009, and Toyota had recently announced a major recall of its vehicles for \"unintended acceleration" problems.26 Ford's sales grew at double the rate of the rest of the industry in 2010, but entering 2011 its rivals' problems seemed to be in the rearview mirror, and General Motors, especially, was on the rebound. Mulally had set three prioritiesrst, to determine the brands Ford would offer; second to be \"best in class for all its vehicles\"; and third to make sure that those vehicles would be accepted and adaptlable] by consumers around the globe: \"If a model was developed for the U.S. market, it needed to be adaptable to car buyers in other countries"?Jr Mulally said that the \"real opportunity going forward is to integrate and leverage our Ford assets around the world\" and decide on the best mix of brands in the company's portfolio.28 The \"best mix of brands" was addressed going into 2011. Brands such as Jaguar, Land Rover, Aston Martin, and Volvo were all sold 011', and the Mercury brand was discontinued. Ford also had an equity interest in Mazda Motor Corporation, which it reduced substantially in 2010, retaining only a 3.5 percent share of ownership; it was nally sold off in 2015. This left the company with only the Ford and Lincoln brands, but the Lincoln offerings had struggled against Cadillac and other rivals for the luxury car market. In 2014, thanks to Mulally's vision and perseverance, Ford maintained its position. Ford had introduced 24 vehicles around the C 231 world, but although still protable, net income was down $4 billion from 2013. Even though Ford maintained its number two position in Europe, behind Volkswagen, major losses had occurred in that sector, primarily due to Russian economic instabilities. South America had also seen losses due to currency devaluation and changing government rules. In addition, Ford's push into Asia-Pacic, specically China, was behind schedule. North American sales, while still strong, had resulted in operating margin reductions due to recalls and costs associated with the relaunch of the F-150. The one bright spot was in nancial services. Ford Motor Credit, the nancing company that loans people money to buy new cars, saw its best results since 2011.29 Going into 2015 the nancials, especially the balance sheet, appeared strong and because of this the company was able to reinstate and subsequently boost the dividend to shareholders, rewarding those investors who had stayed the course. However, this did not last. From 2016 into 2019, the nancials began to falter. CEO Hackett admitted 2018 was a \"disappointing year?\" (see .Exhibits 2 and 3.) EXHIBIT 2 Ford Mow Company and Subsidiaries: Consolidated Income Statement For the years ended December 31, 2016 Revenues Automotive $141,546 Ford Credit 10,253 Mobility 1 Total revenues 151,800 Costs and expenses Cost of sales 126.195 Selling. administrative. and other expenses 10,972 Ford Credit interest, operating. and other expenses _S. Total costs and expenses 146,014 Interest expense on Automotive debt 894 Interest expense on Other debt 57 Other incomeloss). net Equity in net income of ailiated companies 1,780 Income before income taxes 6,784 Provision for/[Benefit from) income taxes _2, Net Income 4.600 Less: Income/(Loss) attributable to noncontrolling interests 11 Net Income attributable to Ford Motor Company $ 4.589 Basic income $ 1.16 Diluted income 1.15 Note: Figures in millions, except per-share amounts; yearend December 3|. Source: Annual Report. Ford Motor Company, December 3], 2018. 2017 $145,653 11.113 10 131.321 11.527 41% 151.395 1.133 57 3,267 _1.& 8.159 402 7.757 26 $ 7,731 EARNINGS PER SHARE ATTRIBUTABLE TO FORD MOTOR COMPANY COMMON AND CLASS B STOCK $ 1.94 1.93 2018 g 4.345 J 3.695 18 $ 3.677 $ 0.93 0.92 EXHIBIT 3 Ford Motor Company and Subsidiaries: Sector Balance Sheets December 31, December 31, 2017 2018 ASSETS Cash and cash equivalents $ 18,492 $ 16,718 Marketable securities 20,435 17,233 Ford Credit finance receivables, net 52,210 54,353 Trade and other receivables, less allowances of $412 and $94 10,599 11,195 Inventories 11,176 11,220 Other assets 3,889 3,930 Total current assets 116,801 114,649 Ford Credit finance receivables, net 56,182 65,544 Net investment in operating leases 28,235 29,119 Net property 35,327 36,178 Equity in net assets of affiliated companies 3,085 2,709 Deferred income taxes 10,762 10,412 Other assets 8,104 7,929 Total assets $258,496 $256,540 LIABILITIES Payables $ 23,282 $ 21,520 Other liabilities and deferred revenue 19,697 20,556 Automotive debt payable within one year 3,356 2,314 Ford Credit debt payable within one year 48,265 51,179 Total current liabilities 94,600 95,569 Other liabilities and deferred revenue 24,711 23,588 Automotive long-term debt 12,575 11,233 Ford Credit long-term debt 89,492 88,887 Other long-term debt 599 500 Deferred income taxes 815 597 Total liabilities 222,792 220,474 Redeemable noncontrolling interest 98 100 EQUITY Common Stock, par value $.01 per share (4,000 million shares issued of 6 billion 40 40 authorizedClass B Stock, par value $.01 per share (71 million shares issued of 530 million authorized) Capital in excess of par value of stock 21,843 22,006 Retained earnings 21,906 22,668 Accumulated other comprehensive income/(loss) (Note 21) (6,959) (7,366) Treasury stock (1,253) (1,417) Total equity attributable to Ford Motor Company 35,578 35,932 Equity attributable to non-controlling interests 28 34 Total equity 35,606 35,966 Total liabilities and equity $258,496 $256,540 Note: Figures in millions. Source: Annual Report. Ford Motor Company, December 31, 2018. Starting in 2016, CEO Fields had begun restructuring, and the cash flow reflected this (see LI Exhibit 4). The forecast for 2017 had projected total automotive operating cash flow remaining positive through 2018, with the overall cash balance expected to stay at or above the company's minimum target of $20 billion. "This did not happen. EXHIBIT 4 Ford Motor Company and Subsidiaries: Sector Statements of Cash Flows For the years ended December 31, 2016 2017 2018 Cash flows from operating activities Net income $ 4,600 $ 7,757 $ 3,695 Depreciation and tooling amortization 9,023 9,122 9,280 Other amortization 306) (669 (972) Provision for credit and insurance losses 672 717 609 Pension and other postretirement employee benefits ("OPEB") expense/(income) 2,667 (608) 400 Equity investment (earnings)/losses in excess of dividends received (178) 240 206 Foreign currency adjustments 283 (403) 529 Net (gain)/loss on changes in investments in affiliates (139) (7) (42) Stock compensation 210 246 191 Net change in wholesale and other receivables (1,449) (836) (2,408) Provision for deferred income taxes 1,473 (350) 197) Decrease/(Increase) in accounts receivable and other assets (2,855) (2,297) (2,239) Decrease/(Increase) in inventory 803) 970) (828) Increase/(Decrease) in accounts payable and accrued and other liabilities 6,595 6,089 6,781 Other 57 65 17 Net cash provided by/(used in) operating activities 19,850 18,096 15,022Cash ows from Investing activities Capital spending (6,992) (7.049) [7,735] Acquisitions of finance receivables and operating leases (56,007) (59,354) (62,924] Collections of nance receivables and operating leases 38,834 44,641 50,880 Purchases of marketable and other securities (31,428) (27,567) (17,140) Sales and maturities of marketable and other securities 29.354 29.898 20,527 Settlements of derivatives 825 100 358 Other 112 _(2_9} _l7l Net cash provided by/(used in] investing activities [2 5,302) (19,360) (16,261] Cash flows from nancing activities Cash dividends (3,376) (2,584) (2,905) Purchases of common stock [145) (131) (164] Net changes in shortterm debt 3,864 1.229 [2,819] Proceeds from issuance of longterm debt 45,961 45,801 50,130 Principal payments on longterm debt (38.797) (40.770) [44,172] Other _(1L7). _l'). _(112l. Net cash provided byf(used in] nancing activities 7,400 3,394 (122] Effect of exchange rate changes on cash, cash equivalents. and restricted cash _l:-i5}. 489 _(3L01 Net increaselidecreese) in cash, cash equivalents, and restricted cash $ 1,683 $ 2,619 $ (1,731) Cash. cash equivalents. and restricted cash at Jenuary1 $ 14.336 $ 16,019 $ 13,638 Net increase!(decrease) in cash. cash equivalents, and restricted cash _'l. _2, _('!,7A11 Cash, cash equivalents, and restricted cash at December 31 $16,019 m \"all Note: Figures in millions: year-end December 31. Source: Annual Report. Ford Motor Company, December 3], 2018. However, Ford had made good use of cash in the past, most recently acquiring the iconic Michigan Central Station in Detroit's historic Corktown neighborhood. Chairman Bill Ford planned to transform this former railroad station into the centerpiece of a vibrant new campus \"where Ford and its partners will work on autonomous and electric vehicle businesses, and design solutions for a transportation operating system that makes mobility convenient and accessible.\"3'2 The hope was that Corktown would serve as a magnet for talent and a catalyst for change. However, CEO Hackett reminded investors the company would not meet its nancial targets for 2018 and also would not be able to reach the proposed 8 percent prot margin goal set for 2020. C 284 Ford and the Automobile Industry Changing Product Mix Going into 2019, the entire automobile industry was facing disruption, but this was not unusual. For instance, the 2009 global economic downturn and nancial crisis had had a signicant impact on global sales volumes in the auto industrythe once-protable business of manufacturing and selling trucks and SUVs was facing change. Especially in the United States. oil prices had been uctuating. making it di'icult to anticipate consumer demand. By 2010, this had caused a shift in consumers' car-buying habits, reducing the demand for large vehicles. '1' The core strategy at Ford at that time had centered on a change in products, shifting to smaller and more fuel-efficient cars. Ford had imported European-made small vehicles, the European Focus and Fiesta, into North America. It also converted three truck-manufacturing plants to small-car production. "The Ford and Lincoln lines were upgraded, emphasizing fuel-economy improvement and the introduction of hybrid cars. In 2012, Ford launched six new Ford hybrid cars in North America. In 2014, Ford began producing its first hybrid electric car in Europe. And by 2015, Ford was the world's second largest manufacturer of hybrids, after Toyota. By late 2015 gas prices had reduced enough to spur interest in SUVs once again. This trend should have been good for Ford, given their branding emphasis on the F-150, Edge, Escape, and Explorer, but Ford and other U.S. manufacturers still had large inventories of smaller vehicles on dealer lots. U.S. auto manufacturers, including Ford, had to adjust once again to meet the demand for crossover vehicles. The smaller crossovers and SUVs now had greatly improved fuel economy and were attractive to consumers due to their versatility, while the smaller sedan and compact owners were an older demographic, and less likely to be impulse buyers. These kinds of fluctuations in the industry meant automobile executives had to keep close track of trends and maximize their ability to adjust to demand. In 2015, Ford relaunched the F-150 and further developed 15 other global products. 2016 saw the launch of the F-150 Raptor high-performance off-road pickup truck, and a significant investment in Ford's hybrid fleet. By 2018, Ford had become the top-selling plug-in hybrid brand in the United States, and was second in overall U.S. electrified vehicle sales, but the Ford F-Series pickup was still the best- selling vehicle in the United States. By 2018 the demand for cars, especially the large sedans, had pretty much dried up, while crossovers and especially small SUVs had seen double-digit growth. But the light-duty trucks were still the best-selling vehicle, by far. See . Exhibit 5 for shifting vehicle sales figures in the U.S. market. EXHIBIT 5 U.S. Vehicle Sales by Segment as of April 2018 Tuesday, April 03, 2018 Segment totals, ranked by Mar unit sales Mar 2018 % Change from Mar'17 YTD % Change from YTD Cars 655,625 -9.2 1,374,507 -10.8 Midsize 231,529 -13.4 580,263 -14.5 Small 238,056 -7.7 579,198 -10.8 Luxury 86,029 -0.9 215,006 0.7 Large -57.7 40 -64.0 Light-duty trucks 1,097,904 16.3 2,736,038 9.8 Pickup 260,949 7.9 653,891 2.8 Crossover 572,829 27.0 1,415,954 18.2 Minivan 48,325 5.2 126,145 2.7 Small Van 6,984 0.8 17,799 2.1 Large Van 34,809 0.1 85,662 0.4 Midsize SUV 82,140 -7.4 220,338 -6.6 Large SUV 30,820 7.3 78,730 -1.4 Small SUV 35,107 45.6 75,328 27.9 Luxury SUV 25,941 19.2 62,191 9.7 Total SUV/Crossover 746,837 21.6 1,852,541 13.7 Total SUV 174,008 6.6 436,587 1.2 Total Crossover 572,829 27.0 1,415,954 18.2Source: The Wall Street Journal and wwwmotorintelligencecom, http:\"www.wsj.com,imdcfpublicfpagef2_3022-autosaleshtmlitautosalesD. '} In 2018, partly because of this change in consumer preference, CEO Hackett had decided to make some drastic changes in the Ford lineup. Ford would be exiting the car market, no longer selling any sedans. and offering only the Mustang and a redesigned Focus crossover that would not be available in the United States. In the United States, the Fiesta subcompact, the Fusion midsize sedan, and the C-Max van would be phased out in 2019 and 2020. The last Taurus large sedan rolled off the production line in March 2019. Globalizing the Ford Brand Under the ONE Ford vision, Mulally had globalized the Ford brand, meaning that all Ford vehicles competing in global segments would be the same in North America, Europe, and Asia.\"r The company had been looking for a reduction of complexity, and thus costs, in the purchasing and manufacturing processes. The idea was to deliver more vehicles worldwide from fewer platforms and to maximize the use of common parts and systems. However, each year posed new challenges. Heading into 2019, the global marketplace for automobiles was uncertain for all manufacturers, and each geographical segment had its issues. Both North American and European auto sales were subject to political uncertainty, due to policy shifts in government, and Brexit issues in the UK. The Chinese and larger Asian market was still growing, although starting to slow, especially with questions of taris looming for U.S. manufacturers. For Ford, tariffs had cost more than $750 million in 2018. Eastern European economic concerns, especially in Russia, made this a di'icult area to manage. South American government regulations and currency uctuations impacted growth there.38 The need for a global strategy was driving all major auto manufacturers to reduce the number of vehicle platforms, while simultaneously adding models in response to consumer preferences. In addition, partnering with local producers and manufacturers made it easier to deal with local barriers to entry, as long as these relationships could be mutually managed. Although the increased complexity raised costs, this more exible approach allowed for improved product commonality and increased volume. As components could be shared between cars and platforms, this also reduced the number of suppliers. Ford had reduced its supplier base from 1,150 to 750.39 Although seemingly a positive, this could also prove costly if a major supplier had a problem, as had occurred with Japanese air bag manufacturer Takata.\"0 Although many other manufacturers were similarly aifected, Ford had had to recall 850,000 vehicles for airbag problems, at a cost of $500 million.\"1 For Ford, 2018 saw the worst global performance in 10 years, primarily driven by a drop of more than 40 percent in China. Only South America and Middle East and Africa regions saw better results than in the prior year (see If\" Exhibit 6). C 285 EXHIBIT 6 Ford Performance by Reglon, Eemhgs Before Interest and Taxes (3 mllllons] Earnings 2018 Change from 2017 to 2018 North America $ (450} South America (573} 75 Europe (398) {765} Middle East & Africa (7) 239 Asia Pacific (1,102) {1,761} Total Automotive $[2,662} Source: Ford 10K Regarding global growth, in Asia Pacic, Ford had developed two car plants and had joint agreements with Mahindra in India, seeing a prot in that market for the rst time in 2018, but Ford also knew it needed to address challenges in China.\"2 Sales growth in this region was critical, given that Ford was late to the China market. For all manufacturers, growth in China was a challenge, but for U.S. automakers Chinese market share had dropped to just 10.7 percent, down from 12 percent in 2017. GM, who had abandoned India, had a higher brand penetration in China than Ford did, but Chinese manufacturers were continuing to oer consumers a lot of options. Ford had introduced the Mustang and Taurus in China during 2016, and saw strong sales of these performance vehicles. In 2017, Ford began exporting the all-new F- 150 Raptor to China, making it the rst high-performance off-road pickup truck to be offered there. Going into 2019, Ford was planning to produce some brands, especially the Ford Explorer and some Lincoln vehicles, using local Chinese supply chain and assembly partners. Ford had also created a new SUV, the Territory, specically for this market."3 Ford was taking a new look at how to address global growth. Europe, once a good market for Ford, had seen market share drop from C 236 over 8 percent in 2010 to barely 6.5 percent in 2018. Although Europe was a strong market for commercial vehicles, the shift would be made from smaller cars to SUVs, crossovers, and electried vehicles. In addition, CEO Hackett had made the decision to close factories in Europe, 44 1 cutting thousands of jobs in Germany, Spain, and the UK, and would review its joint venture in Russia. Unlike its rival General Motors, Ford was addressing performance issues worldwide through cost-cutting strategies and changes to the product mix, while GM's CEO Mary Barra had abandoned the \"growth-at-allcosts strategy,\" and closed money-losing operations in Russia and South Africa. In 2018, GM had exited Europe by selling o' its German-based Open Vauxhall subsidiary to France's PSA Group. In North America, GM was shutting down three plants. And, just like Ford, GM was consolidating its car lineup, stopping production of the Chevrolet Cruze and Impala, and the Volt plug-in hybrid, and discontinuing the Buick LaCrosse, Cadillac XT S, and CT 6.45 Belt-tightening was occurring all over. Looking Ahead Ford Motor Company was the sixth-largest automobile manufacturer in the world, but like all others who produced a multivehicle lineup, Ford was facing considerable uncertainty. Global markets were hard to predict and countries were increasing regulatory requirements for safety and environmental impact. All vehicles were seeing an increase in the amount of onboard technology that required a shift in both engineering and manufacturing priorities. Worldwide manufacturers were making design changes that allowed more lean production and consolidation of suppliers, and consumers were changing how they purchased vehicles and rethinking what they wanted from the transportation experience overall.\" Several marked shifts in the overall landscape were occurring: the interest, worldwide, in electric or alternative-fueled vehicles; the development of autonomously controlled cars that were also personally connected to a user who might not be the driver; and the reduction in demand for actual automobile ownership in favor of rental or on-demand transportation options. These shifts created opportunities but also challenges for entrenched car manufacturers. Partnerships were inevitable: GM was partnering with Ly'lt, and Ford with Uber, which had tried out the Ford Fusion autonomous vehicle. Ford had put Amazon's virtual digital assistant Alexa in its cars. Ford had invested in Velodyne, a company that developed lidar remote- sensing technology for selfdriving cars, and in articial intelligence software rm Argo AI. Ford had acquired an app-based, crowd-sourced, ride-sharing service, Chariot, but subsequently shut it down in 2019. Ford had teamed up with Motivate, the global leader in bike-sharing to include the FordPass mobility network in the Ford GoBike commuting transportation option. Through its innovation and research centers, Ford was also developing strategies in eet and data management, route and journey planning, and telematics, using articial intelligence and robotics, all in an effort to help solve congestion and help move people more e'iciently in urban environments.\" In an attempt to gain some competitive advantage, and adopt a leaner business model, Ford had also formed a strategic alliance with Volkswagon to jointly produce vans and pickup trucks, further developing electric and autonomous vehicles. This move by both global auto companies was seen as \"a strategically defensive move to share vehicle architecture-related expenses in an attempt to offset the intensifying competitive pressures and escalating costs facing the auto industry over the next decade."48 These fundamental changes in the industry required leadership that could anticipate trends and allocate resources wisely, all while crafting a vision for the future that could inspire all relevant stakeholders to support and promote the company's success. Alan Mulally's ONE Ford slogan, focused on operational synergies, had helped the automaker avoid bankruptcy and return to a position of nancial strength in the industry. Mark Fields's shift had seemed to be toward TWO Fords, refocusing the company into both an automaker and a transportation services provider. This included plans to offer electric vehicles and experiment with ways to provide innovative solutions to transportation and mobility problems in cities across the globe.\" Hackett was continuing this dual approach, and restructured the company, promoting Joe Hinrichs to president of global automotive operations, while giving Jim Farley responsibility for Ford's selfdriving unit as president of new business, technology, and strategy. This operational split conrmed that Mulally's original ONE Ford vision was no longer a good t for current conditions, and would position either Hinrichs or Farley as a possible successor to Hackett.50 Hackett had given leaders at various levels in the company the ability to choose how the work would get done, hoping to increase level of innovation and leverage talent.51 Unfortunately, investors were not sure about any of this: Ford's stock had fallen by about 40 percent since Mulally's departure. One C 237 analyst pointed out what others were saying: \"They have a lot of the right initiatives; they're doing something in every box. The difference from the Mulally days is there isn't a single message that is more than just public-relations, tying it all together."52 Fields had tried to position the company to take on rivals from other industries, and investors had wondered what bike-sharing and articial intelligence had to do with the car business. As had most US. automobile manufacturers, Ford under Hackett had taken steps to remove sedans from the auto lineup, and invest in retooling to support SUVs and trucks. In 2019, Hackett was also proceeding with an $11 billion global restructuring e'ort in an attempt to reposition Ford for success once again, but at this point the industry was forcing all manufacturers to ask some basic \"53 questions: \"Do people want to own their cars or share them? Drive them or have them driven? Ford and other global automobile companies were betting on the \"mobility\" trend to bring new products and services to a depressed market, but how might this really work? Henry Ford had the initial vision of disruption in personal transportation. Would the let century version of Ford Motor Company be as successful