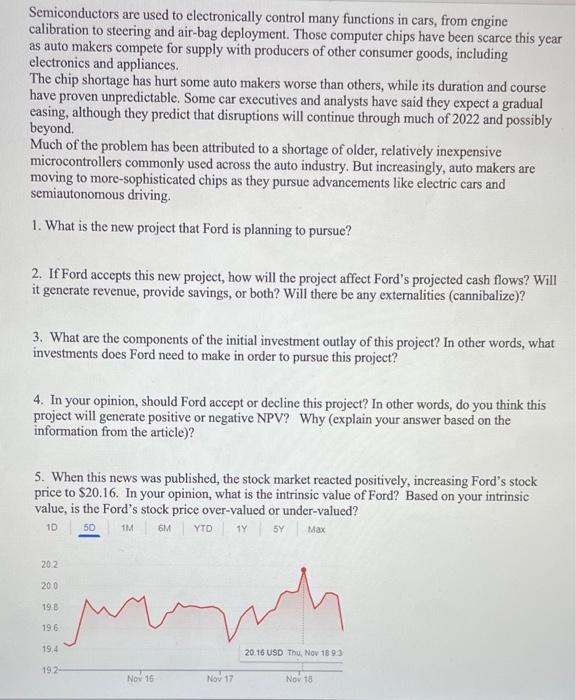

Ford, GM Step Into Chip Business; Stung by semiconductor shortage, Detroit's two biggest car companies are looking to align with computer-chip makers to develop and potentially manufacture chips Colias, Mike; Foldy, Ben. Wall Street Journal (Online); New York, N.Y. [New York, N.Y]. 18 Nov 2021. Detroit's two biggest auto makers Ford Motor Co. and General Motors Co.-are looking to get into the semiconductor business, after a year of computer-chip shortages that snarled their global factory output. Ford on Thursday morning outlined a strategic agreement with U.S.-based semiconductor manufacturer GlobalFoundries Inc. to develop chips, a pact that could eventually lead to joint U.S. production. The moves are the latest examples of how pandemic-related disruptions are prompting companies to exert greater control over their supply chains by moving production closer to home, or in some cases in-house. Multinational companies got an early shock in the health crisis when border closings, local restrictions and lockdowns caused chaos. Some have decided on permanent solutions. Businesses have also continued to face shipping delays and trucking bottlenecks, prompting them to rethink the geography of their supply chains and giving priority to strategies that ensure reliability over the outsourcing models of the past. The semiconductor shortage has scuttled output of millions of planned vehicles industrywide this year. Some car executives have said they are taking steps to get a better handle on their chip supplies, a critical piece of the supply chain into which they have had little visibility. Ford's move would go a step further by eventually bringing some chip development in-house. The Dearborn, Mich., auto maker said designing its own chips could improve some vehicle features such as automated-driving capabilities or battery systems for electric vehicles and potentially help Ford sidestep future shortages. "We feel like we can really boost our product performance and our tech independence at the same time," said Chuck Gray, Ford's vice president of vehicle embedded software and controls. Part of the agreement with GlobalFoundries is intended to enhance near-term chip supplies for Ford, which has been hit especially hard by the supply crunch relative to many other auto makers. The joint-development work is aimed at producing higher-end chips that would go into vehicles several years out, Mr. Gray said. Building a serious chip-design operation will be far from a simple undertaking for Ford. Designing sophisticated semiconductors with their minute transistors is a difficult discipline that typically takes companies years to master. GM and Ford exploring the chip business shows how car companies are selectively bringing key technologies in house to develop expertise in areas they see as critical to their future competitiveness. Better, faster chips, for example, will be needed for everything from multimedia touch screens to remote software updates to fix defects. Working with several semiconductor firms as part of a broader strategy will reduce complexity and improve margins. "We see the semiconductor requirements more than doubling over the next several years" Semiconductors are used to electronically control many functions in cars, from engine calibration to steering and air-bag deployment. Those computer chips have been scarce this year as auto makers compete for supply with producers of other consumer goods, including electronics and appliances. The chip shortage has hurt some auto makers worse than others, while its duration and course have proven unpredictable. Some car executives and analysts have said they expect a gradual easing, although they predict that disruptions will continue through much of 2022 and possibly beyond. Much of the problem has been attributed to a shortage of older, relatively inexpensive microcontrollers commonly used across the auto industry. But increasingly, auto makers are moving to more-sophisticated chips as they pursue advancements like electric cars and semiautonomous driving. 1. What is the new project that Ford is planning to pursue? 2. If Ford accepts this new project, how will the project affect Ford's projected cash flows? Will it generate revenue, provide savings, or both? Will there be any externalities (cannibalize)? 3. What are the components of the initial investment outlay of this project? In other words, what investments does Ford need to make in order to pursue this project? 4. In your opinion, should Ford accept or decline this project? In other words, do you think this project will generate positive or negative NPV? Why (explain your answer based on the information from the article)? 5. When this news was published, the stock market reacted positively, increasing Ford's stock price to $20.16. In your opinion, what is the intrinsic value of Ford? Based on your intrinsic value, is the Ford's stock price over-valued or under-valued? 1M 6M YTD 1y5Y Max 10 50 202 200 198 w 196 19.4 20.16 USD Thu, Nov 18 93 192 Nov 15 Nov 17 Nov 18