Question

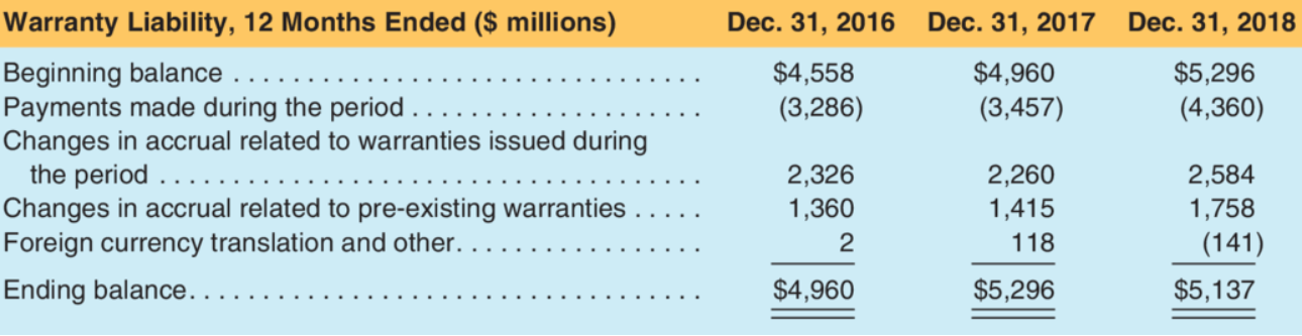

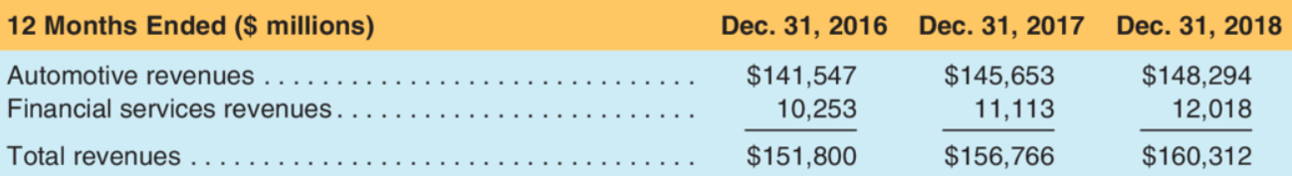

Ford Motor Company reported the following information in its 2018 financial statements. Use these data to answer the requirements. The income statement reports the following

Ford Motor Company reported the following information in its 2018 financial statements. Use these data to answer the requirements.

The income statement reports the following additional information.

a. What is the motivation for analysts to consider reformulating financial statements for warranty expenses?

b. Which type of revenue (Automotive or Financial Services) is related to warranty expense? Explain.

c. Reformulate the income statement for all three years under the assumption that warranty expense is a constant percentage of revenue across all three years. Specifically, compute adjustments to: warranty expense, income tax expense, and net income. Assume the companys tax rate is 22%.

d. Reformulate the balance sheet for all three years. Specifically, compute adjustments to: warranty liabilities, deferred tax assets, and retained earnings. Assume the companys tax rate is 22%

Dec. 31, 2018 Dec. 31, 2016 $4,558 (3,286) Dec. 31, 2017 $4,960 (3,457) $5,296 (4,360) Warranty Liability, 12 Months Ended ($ millions) Beginning balance Payments made during the period ... Changes in accrual related to warranties issued during the period ... Changes in accrual related to pre-existing warranties Foreign currency translation and other. . Ending balance.. 2,326 1,360 2 2,260 1,415 118 2,584 1,758 (141) $5,137 $4,960 $5,296 12 Months Ended ($ millions) Dec. 31, 2016 Dec. 31, 2017 Dec. 31, 2018 Automotive revenues ..... Financial services revenues. $141,547 10,253 $145,653 11,113 $148,294 12,018 Total revenues $151,800 $156,766 $160,312 Dec. 31, 2018 Dec. 31, 2016 $4,558 (3,286) Dec. 31, 2017 $4,960 (3,457) $5,296 (4,360) Warranty Liability, 12 Months Ended ($ millions) Beginning balance Payments made during the period ... Changes in accrual related to warranties issued during the period ... Changes in accrual related to pre-existing warranties Foreign currency translation and other. . Ending balance.. 2,326 1,360 2 2,260 1,415 118 2,584 1,758 (141) $5,137 $4,960 $5,296 12 Months Ended ($ millions) Dec. 31, 2016 Dec. 31, 2017 Dec. 31, 2018 Automotive revenues ..... Financial services revenues. $141,547 10,253 $145,653 11,113 $148,294 12,018 Total revenues $151,800 $156,766 $160,312Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started