Question

Ford Motor For this Interactive Assignment, you are going to look at the financial statements for the company you selected and, using the previous quarters

Ford Motor

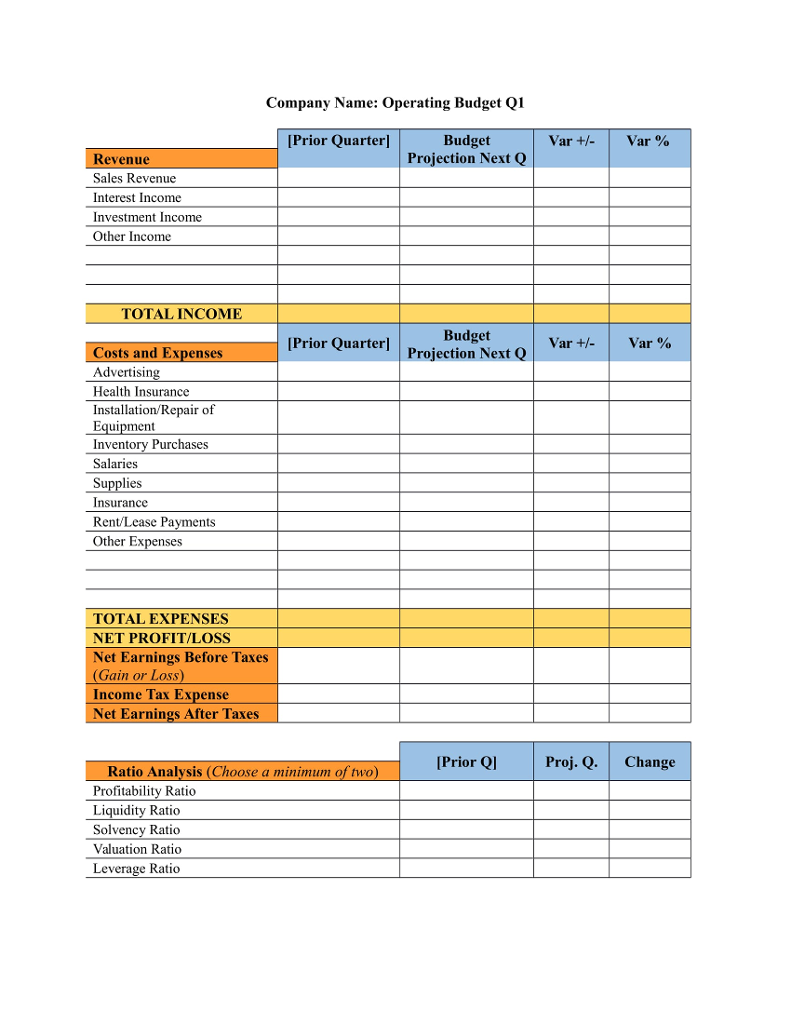

For this Interactive Assignment, you are going to look at the financial statements for the company you selected and, using the previous quarters financial data, interpret the data and propose a budget for the next Quarter based on your current and previous analysis of company performance. Complete the budget template using this Operating Budget Template.

- List your current sales, discounts and allowances, net sales, margins, operating costs, and earning before and after taxes.

- Choose a minimum of two financial ratios (below) and include in your analysis.

- Prepare the next quarters budget based on your interpretation of past data.

Include at least two of the following types of relevant financial ratios in your analysis. Review the online article Analyze Investments Quickly With Ratios (https://www.investopedia.com/articles/stocks/06/ratios.asp). Link to an external site. (Elmerraji, 2017) and Chapter 5 in the Abrahams textbook to help with this portion of the budget:

- Profitability Ratio

- Liquidity Ratio

- Solvency Ratio

- Valuation Ratio

- Leverage Ratio

I need this information for Ford Motor.

Company Name: Operating Budget Q1 Budget Projection Next Q Prior Quarterl Var +/- | Var % Revenue Sales Revenue Interest Income Investment Income Other Income TOTAL INCOME Budget Projection Next Q Prior Quarter] Var +/- Var % Costs and Expenses Advertisin Health Insurance Installation/Repair of ul Inventory Purchases Salaries Supplies Insurance Rent Lease Payments Other Expenses TOTAL EXPENSES NET PROFIT/LOSS Net Earnings Before Taxes Gain or Loss Income Tax Expense Net Earnings After Taxes Prior Ql Proj. Q. Change Ratio Analysis (Choose a minimum of two Profitability Ratio Liquidity Ratio Solvency Ratio Valuation Ratio Leverage Ratio Company Name: Operating Budget Q1 Budget Projection Next Q Prior Quarterl Var +/- | Var % Revenue Sales Revenue Interest Income Investment Income Other Income TOTAL INCOME Budget Projection Next Q Prior Quarter] Var +/- Var % Costs and Expenses Advertisin Health Insurance Installation/Repair of ul Inventory Purchases Salaries Supplies Insurance Rent Lease Payments Other Expenses TOTAL EXPENSES NET PROFIT/LOSS Net Earnings Before Taxes Gain or Loss Income Tax Expense Net Earnings After Taxes Prior Ql Proj. Q. Change Ratio Analysis (Choose a minimum of two Profitability Ratio Liquidity Ratio Solvency Ratio Valuation Ratio Leverage RatioStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started