Answered step by step

Verified Expert Solution

Question

1 Approved Answer

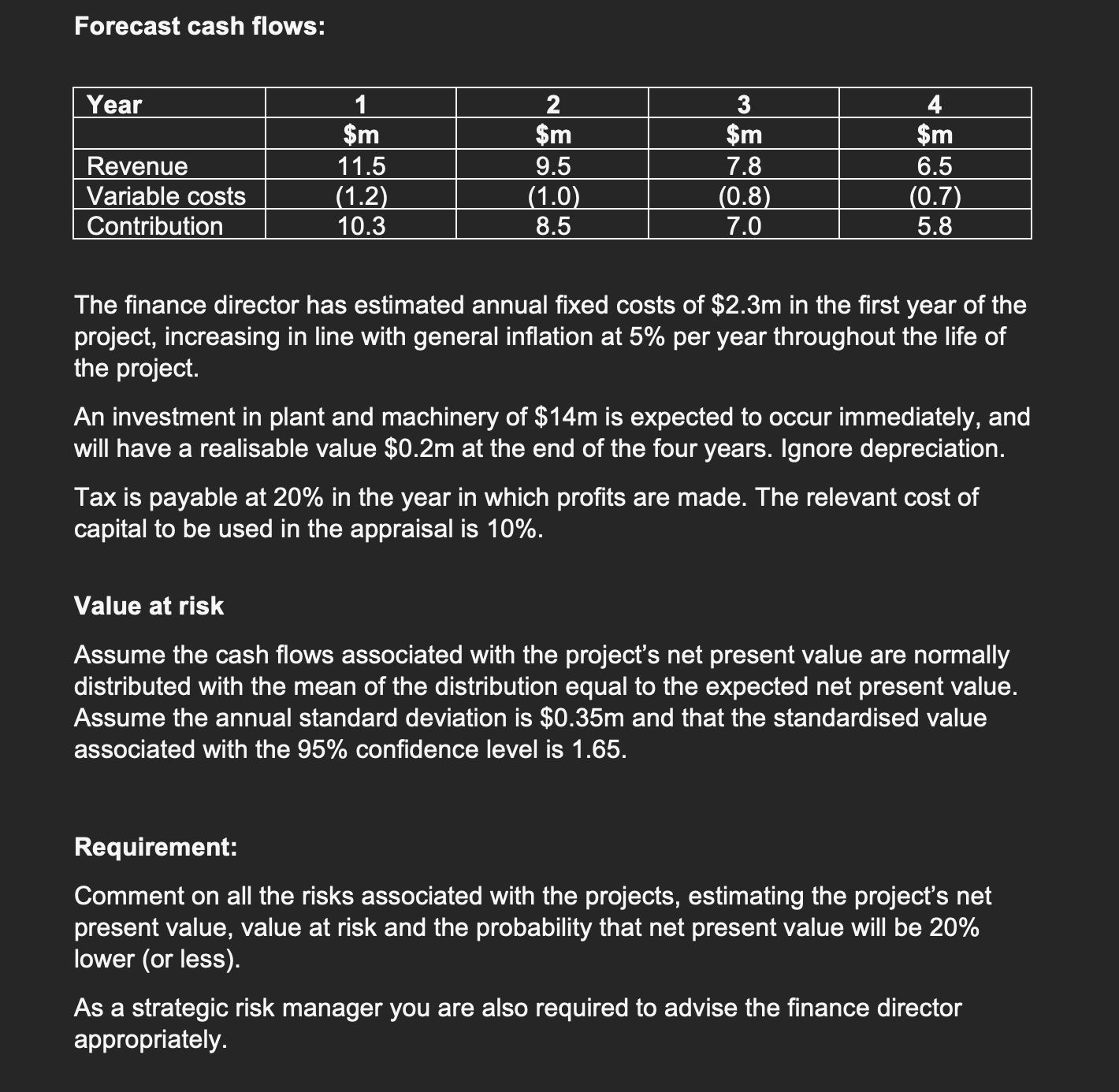

Forecast cash flows: Year 1 2 3 4 $m $m $m $m Revenue 11.5 9.5 7.8 6.5 Variable costs (1.2) (1.0) (0.8) (0.7) Contribution

Forecast cash flows: Year 1 2 3 4 $m $m $m $m Revenue 11.5 9.5 7.8 6.5 Variable costs (1.2) (1.0) (0.8) (0.7) Contribution 10.3 8.5 7.0 5.8 The finance director has estimated annual fixed costs of $2.3m in the first year of the project, increasing in line with general inflation at 5% per year throughout the life of the project. An investment in plant and machinery of $14m is expected to occur immediately, and will have a realisable value $0.2m at the end of the four years. Ignore depreciation. Tax is payable at 20% in the year in which profits are made. The relevant cost of capital to be used in the appraisal is 10%. Value at risk Assume the cash flows associated with the project's net present value are normally distributed with the mean of the distribution equal to the expected net present value. Assume the annual standard deviation is $0.35m and that the standardised value associated with the 95% confidence level is 1.65. Requirement: Comment on all the risks associated with the projects, estimating the project's net present value, value at risk and the probability that net present value will be 20% lower (or less). As a strategic risk manager you are also required to advise the finance director appropriately.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started