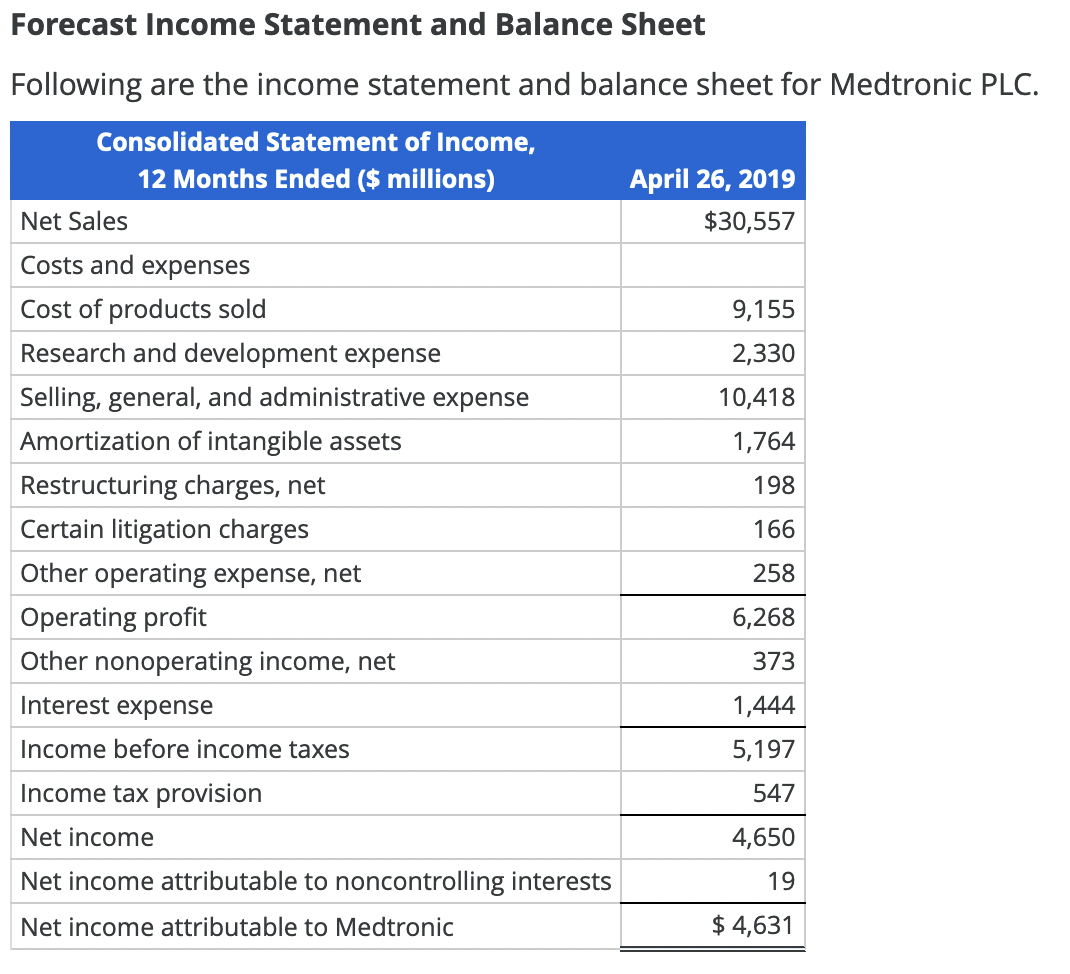

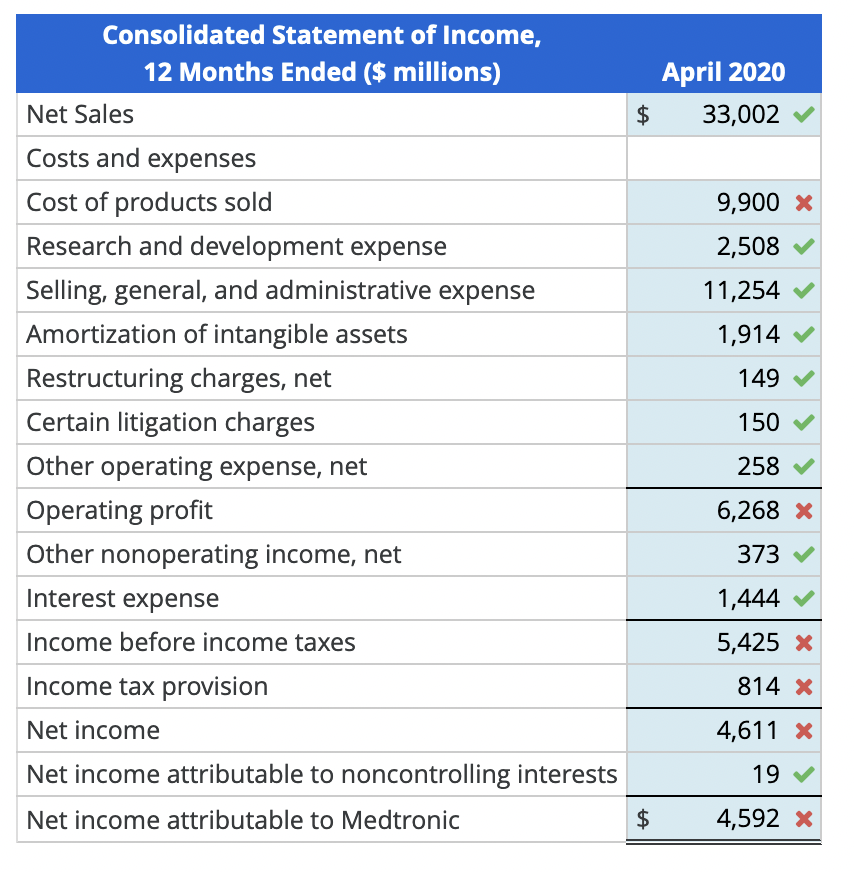

Forecast Income Statement and Balance Sheet Following are the income statement and balance sheet for Medtronic PLC. Consolidated Statement of Income, 12 Months Ended ($ millions) April 26, 2019 Net Sales $30,557 Costs and expenses Cost of products sold 9,155 Research and development expense 2,330 Selling, general, and administrative expense 10,418 Amortization of intangible assets 1,764 Restructuring charges, net 198 Certain litigation charges 166 Other operating expense, net 258 Operating profit 6,268 Other nonoperating income, net 373 Interest expense 1,444 Income before income taxes 5,197 Income tax provision 547 Net income 4,650 Net income attributable to noncontrolling interests 19 Net income attributable to Medtronic $ 4,631 April 2020 $ 33,002 9,900 x 2,508 Consolidated Statement of Income, 12 Months Ended ($ millions) Net Sales Costs and expenses Cost of products sold Research and development expense Selling, general, and administrative expense Amortization of intangible assets Restructuring charges, net Certain litigation charges Other operating expense, net Operating profit Other nonoperating income, net 11,254 1,914 149 150 258 6,268 x 373 Interest expense 1,444 ~ Income before income taxes 5,425 x 814 x Income tax provision Net income Net income attributable to noncontrolling interests 4,611 x 19 Net income attributable to Medtronic $ 4,592 x Forecast Income Statement and Balance Sheet Following are the income statement and balance sheet for Medtronic PLC. Consolidated Statement of Income, 12 Months Ended ($ millions) April 26, 2019 Net Sales $30,557 Costs and expenses Cost of products sold 9,155 Research and development expense 2,330 Selling, general, and administrative expense 10,418 Amortization of intangible assets 1,764 Restructuring charges, net 198 Certain litigation charges 166 Other operating expense, net 258 Operating profit 6,268 Other nonoperating income, net 373 Interest expense 1,444 Income before income taxes 5,197 Income tax provision 547 Net income 4,650 Net income attributable to noncontrolling interests 19 Net income attributable to Medtronic $ 4,631 April 2020 $ 33,002 9,900 x 2,508 Consolidated Statement of Income, 12 Months Ended ($ millions) Net Sales Costs and expenses Cost of products sold Research and development expense Selling, general, and administrative expense Amortization of intangible assets Restructuring charges, net Certain litigation charges Other operating expense, net Operating profit Other nonoperating income, net 11,254 1,914 149 150 258 6,268 x 373 Interest expense 1,444 ~ Income before income taxes 5,425 x 814 x Income tax provision Net income Net income attributable to noncontrolling interests 4,611 x 19 Net income attributable to Medtronic $ 4,592 x