Question

Forecast Next 10 Years Current carwashes ( Year 0 ) 50,000 Annual growth carwashes 2.50% Revenue per carwash base $ 10.00 Variable Costs (Current) Utilities

| Forecast Next 10 Years | |

| Current carwashes (Year 0) | 50,000 |

| Annual growth carwashes | 2.50% |

| Revenue per carwash base | $ 10.00 |

| Variable Costs (Current) | |

| Utilities (Elec/gas/water) | $ 0.70 |

| Detergents/Chemicals | 0.30 |

| Maintenance costs | 0.20 |

| Site Labor | 2.00 |

| Total Variable Costs | $ 3.55 |

| Fixed Costs (Current) | |

| Owners' salary | $62,500 |

| Daughter's salary | $47,500 |

| Son's salary | $47,500 |

| Insurance | $10,000 |

| Operating costs | $25,000 |

| Advertising | $16,000 |

| Depreciation | - |

| Total Fixed Costs | $ 208,500 |

| Investment/ Tax Information | |

| Interest Rate | 8.00% |

| Equipment Investment | $290,000 |

| Useful life (years) | 10 |

| Salvage Value | 0 |

| Utilities Cost decrease per carwash | $ 0.15 |

| Maintenance Cost decrease per carwash | $ 0.30 |

| ChainStore's Offer (Current) | $1,825,000 |

| After-Tax Gain on Sale (Current)* | $ 1,428,000 |

| Sales Price in 10 years | $2,700,000 |

| After-Tax Gain on Sale (after 10 years)* | $ 2,128,000 |

| Long Term Capital Gains | 20% |

| Corporate Income Tax Rate | 21% |

| Balance Sheet | ||

| Current | Year 10 | |

| Cash | $ 300,000 | $ 1,595,324 |

| Land | 50,000 | 50,000 |

| Building | 65,000 | 65,000 |

| Accumulated Depr.- Building | (65,000) | (65,000) |

| Equipment (Current) | 500,000 | 790,000 |

| Accumulated Depr.- Equip | (500,000) | (790,000) |

| Total Assets | $ 350,000 | $ 1,645,324 |

| Current Liabilities | $ 10,000 | $ 10,000 |

| Common Stock (Current) | 50,000 | 50,000 |

| Retained Earnings (Current) | 290,000 | 1,585,324 |

| Total Liabilities & Equity | $ 350,000 | $ 1,645,324 |

| Except cash, no changes in working are expected. | ||

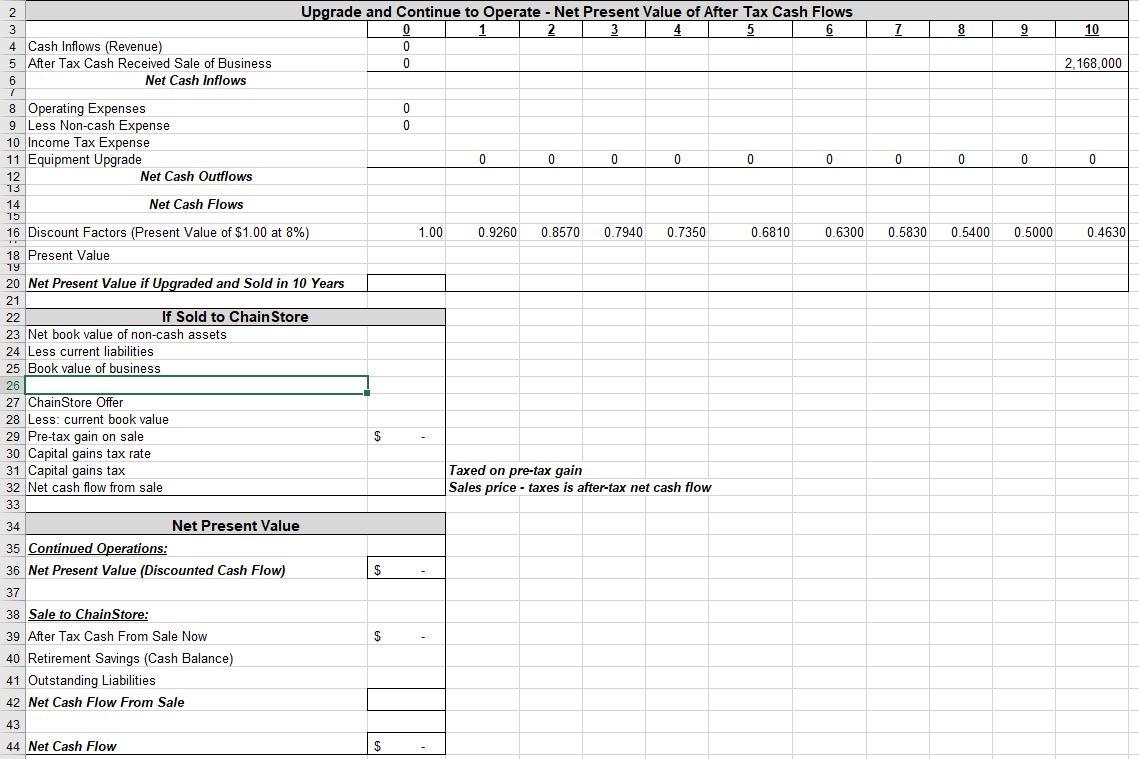

Calculate the net present value of after-tax cash flows after the upgrade. Use $2,168,000 for the amount the Johnsons will receive after-taxes from the sale of the business in 10 years if they choose to upgrade and continue operations. The check figure for net cash flows in Year 1 is $120,739 and $2,358,262 for year 10. Round answers to the nearest whole number. Year 0 would only include the changes made now.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started