Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Forecast pro-forma unlevered income statements for the next 3 years (2020-2022) using percent of sales forecasting (assume it is the beginning of 2020). You

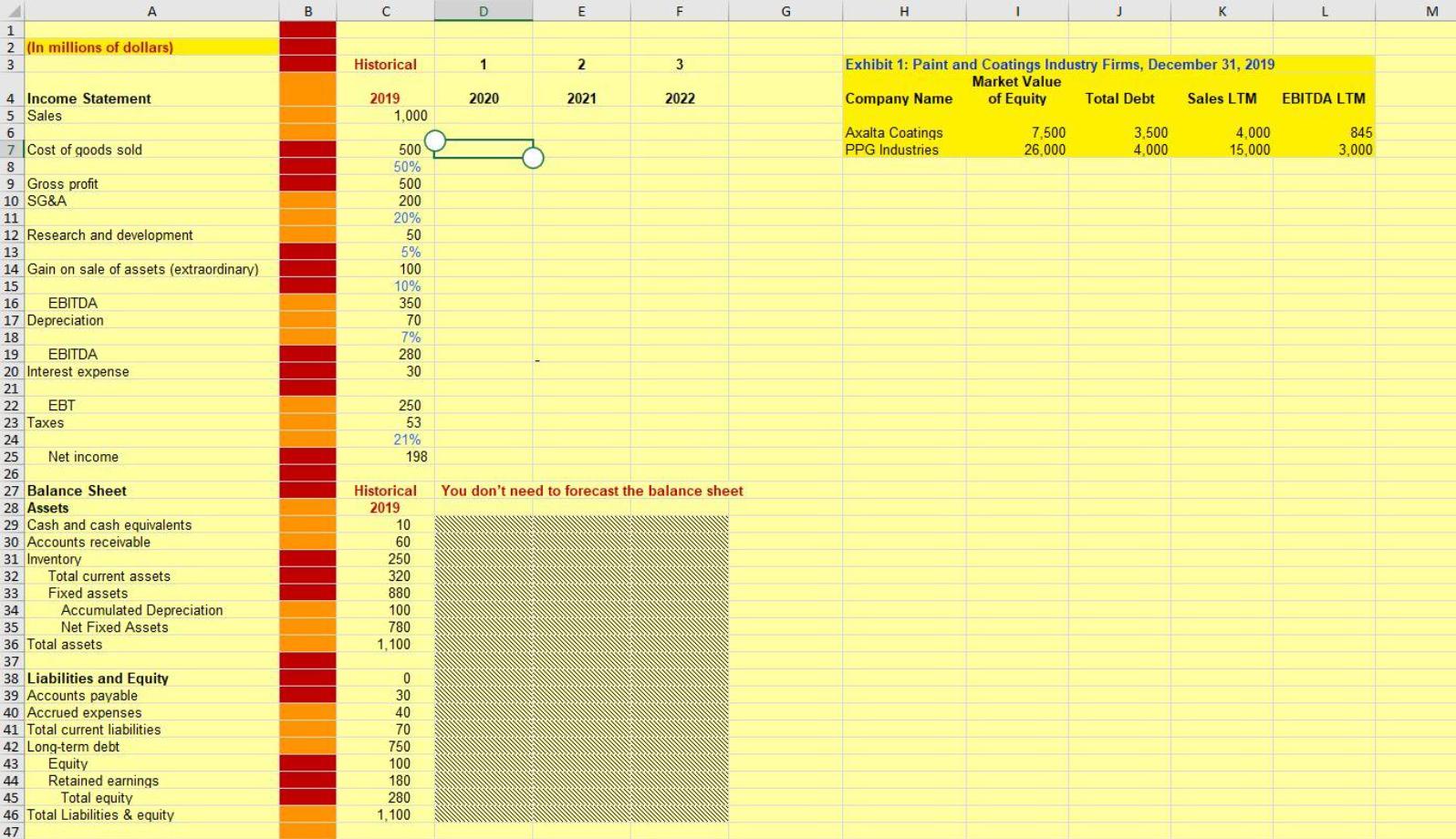

Forecast pro-forma unlevered income statements for the next 3 years (2020-2022) using percent of sales forecasting (assume it is the beginning of 2020). You don't need to forecast the balance sheet. Use the following assumptions: Sales will grow by 2% each year All recurring operating expenses and depreciation are a percent of sales based on 2019 levels. The tax rate is 21%. Find the value per share by discounting the unlevered free cash flows at the WACC assuming that, after year 3 of the forecast, free cash flows will grow by 2%. Assume that working capital is a constant percent of sales based on 2019 levels and capital spending equals depreciation each year. Assume that they will use 50% debt financing and use the WACC from problem 1A above. There are 40 million shares outstanding. (Show work on the 'Problem 1' Excel worksheet.)

Step by Step Solution

★★★★★

3.41 Rating (157 Votes )

There are 3 Steps involved in it

Step: 1

Forecasted Income Statements 20202022 Percent of Sales Method Assumptions Sales growth 2 per year Recurring operating expenses and depreciation Percen...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started