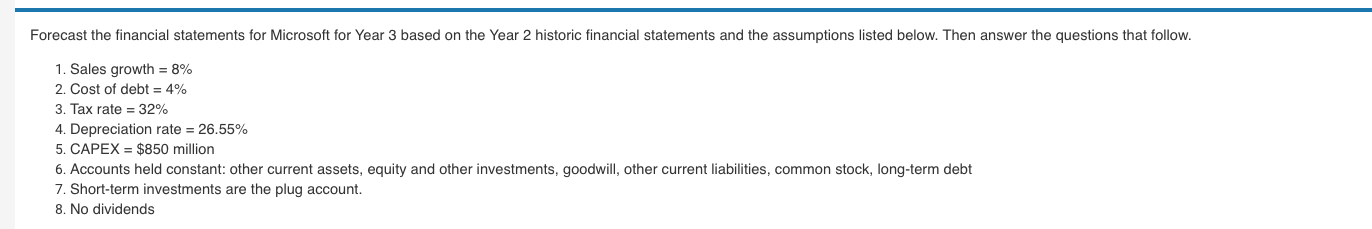

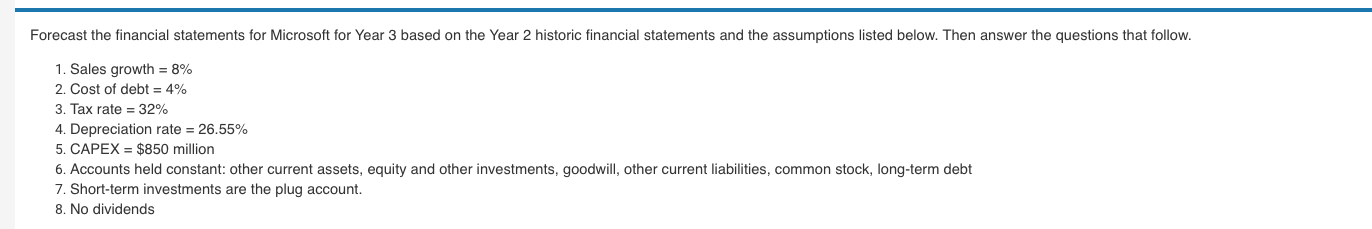

Forecast the financial statements for Microsoft for Year based on the Year 2 historic financial statements and the assumptions listed below. Then answer the questions that follow. 1. Sales growth = 8% 2. Cost of debt = 4% 3. Tax rate = 32% 4. Depreciation rate = 26.55% 5. CAPEX = $850 million 6. Accounts held constant: other current assets, equity and other investments, goodwill, other current liabilities, common stock, long-term debt 7. Short-term investments are the plug account. 8. No dividends Microsoft Corporation Income Statement and Islance Sheet As of December 31, Year 2 (5 millions Year 2 Ratios Year Pivnu 25 Operating Expenses: Globok 5191 11 REY PAP 4907 0.151842 SAXA 642 a20 16,709 Depreciation Ecorce Tural Opaling pera EET Interest Experien 11.605 82 22 Earnings Before TASR 11,513 Provision for Income Taxes Malinen 7,629 ASSETS 1: Axels Year Batan Year Cash 3,00 0.106320 Accounts Recevable 5,129 Oh 5. Total Current Assets 49,249 2,400 Property Plant Ant Net Equhy & Other Investments 16,193 15,133 1.08 Goodwill cm Toral Asia 8,319 LIABILITIES STOCKHOLDERS EQUIT Accounts Papake 1,208 Other 12.20 12,200 Toral Ourent Liai 12,417 Long Term Debt 2.722 2.722 Tonals 1e, 190 Sweet Common Sock 31,847 31,847 Awang Tocal Stockhokars' Equity 52,180 Tural bites and Stockholders Equity ta PART 1 What is the depreciation expense in Yer 39 O $350 $887 $613 PART 2 What is the interest expense for You 37 $95 0 $109 0 $10 O $99 PART 3 What are accounts receivable for Year 3? O $5,129 O $4,719 O $5,539 O $5,050 PART 4 What is not PPLE for Year 37 O $2,268 $9,160 $9,900 0 $1,00R PART 5 What are short-term invasmants for Year 3? 0 $45216 0 $43,547 O $44.750 $46,804 Forecast the financial statements for Microsoft for Year based on the Year 2 historic financial statements and the assumptions listed below. Then answer the questions that follow. 1. Sales growth = 8% 2. Cost of debt = 4% 3. Tax rate = 32% 4. Depreciation rate = 26.55% 5. CAPEX = $850 million 6. Accounts held constant: other current assets, equity and other investments, goodwill, other current liabilities, common stock, long-term debt 7. Short-term investments are the plug account. 8. No dividends Microsoft Corporation Income Statement and Islance Sheet As of December 31, Year 2 (5 millions Year 2 Ratios Year Pivnu 25 Operating Expenses: Globok 5191 11 REY PAP 4907 0.151842 SAXA 642 a20 16,709 Depreciation Ecorce Tural Opaling pera EET Interest Experien 11.605 82 22 Earnings Before TASR 11,513 Provision for Income Taxes Malinen 7,629 ASSETS 1: Axels Year Batan Year Cash 3,00 0.106320 Accounts Recevable 5,129 Oh 5. Total Current Assets 49,249 2,400 Property Plant Ant Net Equhy & Other Investments 16,193 15,133 1.08 Goodwill cm Toral Asia 8,319 LIABILITIES STOCKHOLDERS EQUIT Accounts Papake 1,208 Other 12.20 12,200 Toral Ourent Liai 12,417 Long Term Debt 2.722 2.722 Tonals 1e, 190 Sweet Common Sock 31,847 31,847 Awang Tocal Stockhokars' Equity 52,180 Tural bites and Stockholders Equity ta PART 1 What is the depreciation expense in Yer 39 O $350 $887 $613 PART 2 What is the interest expense for You 37 $95 0 $109 0 $10 O $99 PART 3 What are accounts receivable for Year 3? O $5,129 O $4,719 O $5,539 O $5,050 PART 4 What is not PPLE for Year 37 O $2,268 $9,160 $9,900 0 $1,00R PART 5 What are short-term invasmants for Year 3? 0 $45216 0 $43,547 O $44.750 $46,804