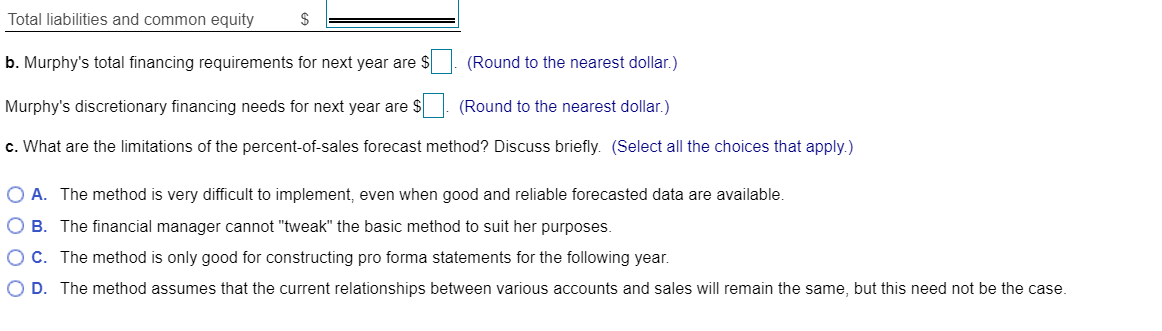

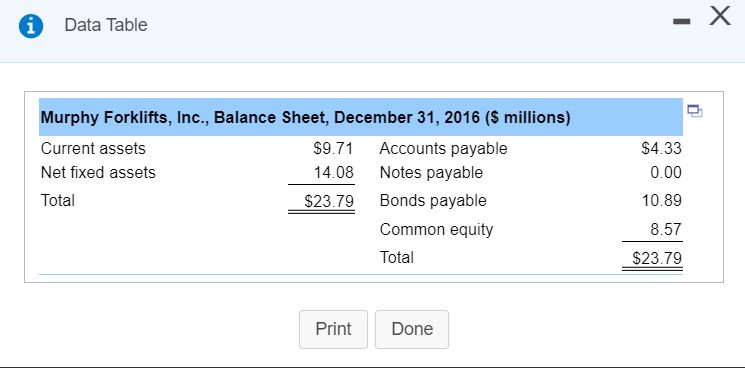

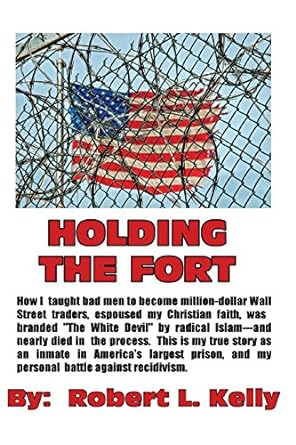

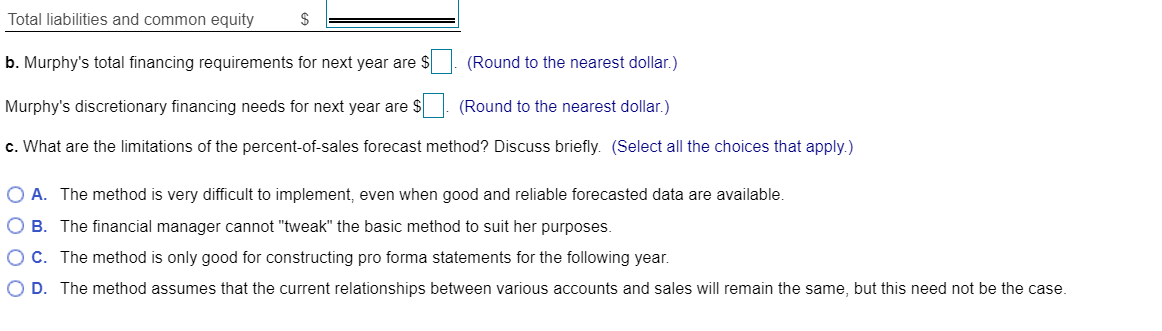

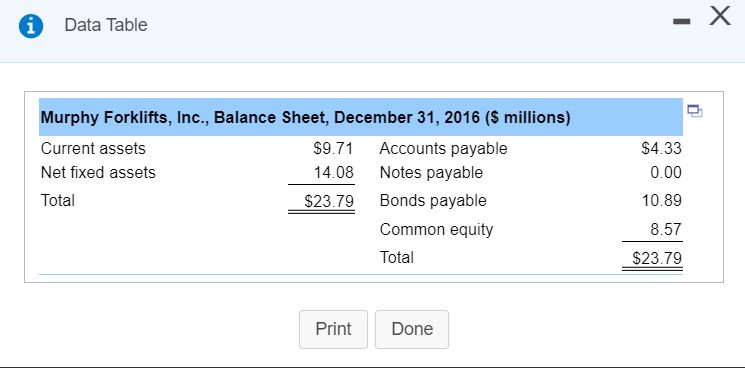

(Forecasting financing needs) The current balance sheet of the Murphy Forklifts, Inc., is as follows: Murphy had sales for the year ended December 31, 2016, of $51.75 million. The firm follows a policy of paying all net earnings out to its common stockholders in cash dividends. Thus, Murphy generates no funds from its earnings that can be used to expand its operations. (Assume that depreciation expense is equal to the cost of replacing worn-out assets.). Hint. Make sure to round all intermediate calculations to at least five decimal places. a. If Murphy anticipates sales of $99.92 million during the coming year, develop a pro forma balance sheet for the firm for December 31, 2017. Assume that current assets are a percent of sales, net fixed assets remain unchanged, and accounts payable vary as a percentage of sales. Use notes payable as a balancing entry b. How much new financing will Murphy need next year? c. What are the limitations of the percent-of-sales forecast method? Discuss briefly. a. If Murphy anticipates sales of $99.92 million during the coming year, develop a pro forma balance sheet for the firm for December 31, 2017. Assume that current assets are a percent of sales, net fixed assets remain unchanged, and accounts payable vary as a percentage of sales. Use notes payable as a balancing entry. (Round to the nearest dollar.) Murphy Forklifts, Inc. Pro Forma Balance Sheet as of 12/31/17 Current assets $ Net fixed assets Total assets $ Accounts payable Notes payable Bonds payable Common equity Total liabilities and common equity $ Total liabilities and common equity S b. Murphy's total financing requirements for next year are $| (Round to the nearest dollar.) Murphy's discretionary financing needs for next year are $ (Round to the nearest dollar.) c. What are the limitations of the percent-of-sales forecast method? Discuss briefly. (Select all the choices that apply.) O A. The method is very difficult to implement, even when good and reliable forecasted data are available. OB. The financial manager cannot "tweak" the basic method to suit her purposes. O C. The method is only good for constructing pro forma statements for the following year. OD. The method assumes that the current relationships between various accounts and sales will remain the same, but this need not be the case. Data Table i . U $4.33 0.00 Murphy Forklifts, Inc., Balance Sheet, December 31, 2016 ($ millions) Current assets $9.71 Accounts payable Net fixed assets 14.08 Notes payable Total $23.79 Bonds payable Common equity Total 10.89 8.57 $23.79 Print Done