Answered step by step

Verified Expert Solution

Question

1 Approved Answer

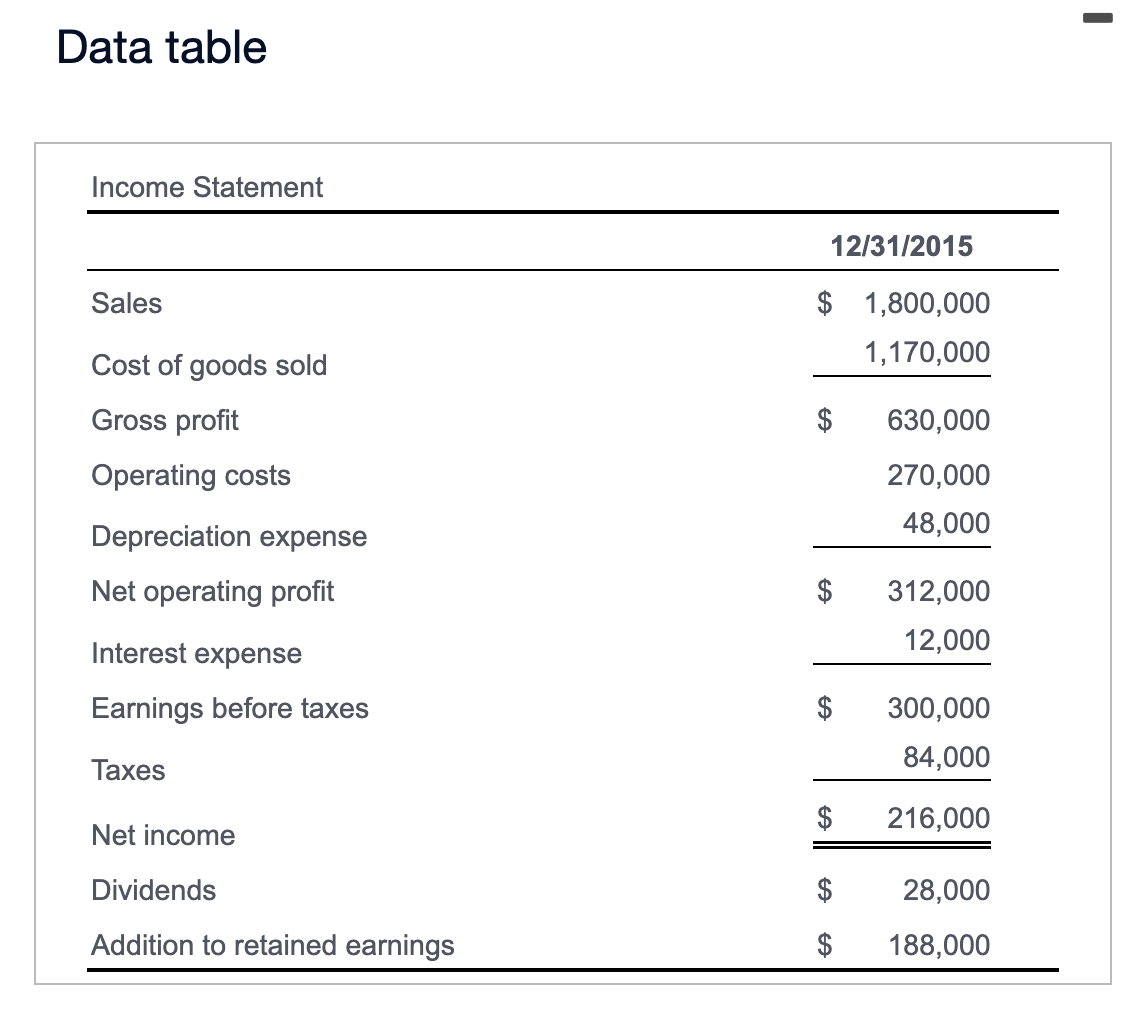

( Forecasting net income ) In November of each year, the CFO of Barker Electronics begins the financial forecasting process to determine the firm's projected

Forecasting net income In November of each year, the CFO of Barker Electronics begins the financial forecasting process to determine the firm's projected needs for new financing during the coming year. Barker is a small electronics manufacturing company located in Moline, Illinois, which is best known as the home of the John Deere Company. The CFO begins the process with the most recent year's income statement, projects sales growth for the coming year, and then estimates net income and finally the additional earnings he can expect to retain and reinvest in the firm. The firm's income statement for follows: LOADING....

The electronics business has been growing rapidly over the past months as the economy recovers, and the CFO estimates that sales will expand by percent in the next year. In addition, he estimates the following relationships between each of the income statement expense items and sales: LOADING.... Note that for the coming year both depreciation expense and interest expense are projected to remain the same as in

a Estimate Barker's net income for and its addition to retained earnings under the assumption that the firm leaves its dividends paid at the level.

b Reevaluate Barker's net income and addition to retained earnings if sales grow at percent over the coming year. However, this scenario requires the addition of new plant and equipment in the amount of $ which increases annual depreciation to $ per year, and interest expense rises to $

COGSSales

Operating ExpensesSales

Depreciation Expense $

Interest Expense $

Tax Rate

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started