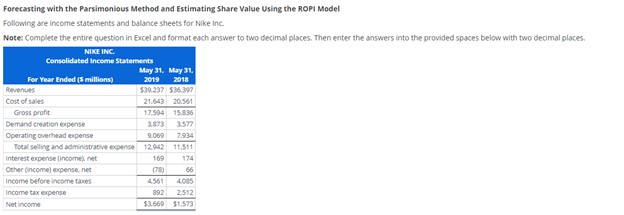

Forecasting with the Parsimonious Method and Estimating Share Value Using the ROPI Model Following are income statements and balance sheets for Nike Inc. Note:

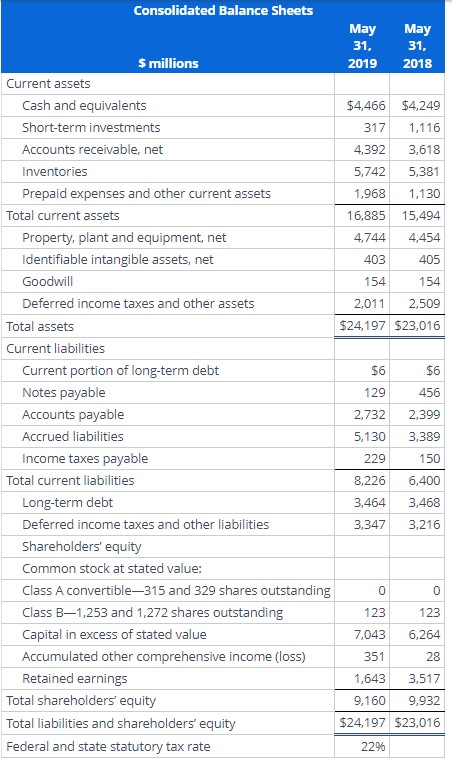

Forecasting with the Parsimonious Method and Estimating Share Value Using the ROPI Model Following are income statements and balance sheets for Nike Inc. Note: Complete the entire question in Excel and format each answer to two decimal places. Then enter the answers into the provided spaces below with two decimal places. NIKE INC. Consolidated Income Statements For Year Ended (5 millions) Revenues May 31, May 31, 2019 2018 $39.237 $36.397 Cost of sales 21,643 20.561 Gross profit 17.594 15.836 Demand creation expense 3.873 3.577 Operating overhead expense 9.069 7.934 Total selling and administrative expense 12.942 11.511 Interest expense (income), net 169 174 Other (income) expense, net (78) 66 4561 4005 Income before income taxes Income tax expense Net income 892 2.512 $3.669 $1.573 Consolidated Balance Sheets May May 31, 31, $ millions 2019 2018 Current assets Cash and equivalents $4,466 $4,249 Short-term investments 317 1,116 Accounts receivable, net 4,392 3,618 Inventories 5,742 5,381 Prepaid expenses and other current assets 1,968 1,130 Total current assets 16,885 15,494 Property, plant and equipment, net 4,744 4,454 Identifiable intangible assets, net 403 405 Goodwill 154 154 Deferred income taxes and other assets 2,011 2,509 Total assets $24,197 $23,016 Current liabilities Current portion of long-term debt Notes payable Accounts payable Accrued liabilities $6 $6 129 456 2,732 2,399 5,130 3,389 Income taxes payable 229 150 Total current liabilities 8,226 6,400 Long-term debt 3,464 3,468 Deferred income taxes and other liabilities 3,347 3,216 Shareholders' equity Common stock at stated value: Class A convertible-315 and 329 shares outstanding 0 0 Class B-1,253 and 1,272 shares outstanding 123 123 Capital in excess of stated value Accumulated other comprehensive income (loss) 7,043 6,264 351 28 1,643 3,517 Retained earnings Total shareholders' equity Total liabilities and shareholders' equity Federal and state statutory tax rate 9,160 9,932 $24,197 $23,016 22% b. Compute net operating profit after tax (NOPAT) for 2019 assuming a federal and state statutory tax rate of 22%. NOPAT 3,559 x

Step by Step Solution

There are 3 Steps involved in it

Step: 1

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started