Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Forecasting with the Parsimonious Method and Estimating Share Value Using the DCF Model Following are the income statement and balance sheet for Cisco Sytems for

Forecasting with the Parsimonious Method and Estimating Share Value Using the DCF Model Following are the income statement and balance sheet for Cisco Sytems for the year ended July 30, 2016.

| Cisco Sytems Consolidated Statements of Income | |||

|---|---|---|---|

| Years Ended December ($ millions) | July 30, 2016 | July 25, 2015 | |

| Revenue | |||

| Product | $37,254 | $37,750 | |

| Service | 11,993 | 11,411 | |

| Total revenue | 49,247 | 49,161 | |

| Cost of sales | |||

| Product | 14,161 | 15,377 | |

| Service | 4,126 | 4,103 | |

| Total cost of sales | 18,287 | 19,480 | |

| Gross margin | 30,960 | 29,681 | |

| Operating expenses | |||

| Research and development | 6,296 | 6,207 | |

| Sales and marketing | 9,619 | 9,821 | |

| General and administrative | 1,814 | 2,040 | |

| Amortization of purchased intangible assets | 303 | 359 | |

| Restructuring and other charges | 268 | 484 | |

| Total operating expenses | 18,300 | 18,911 | |

| Operating income | 12,660 | 10,770 | |

| Interest income | 1,005 | 769 | |

| Interest expense | (676) | (566) | |

| Other income (loss), net | (69) | 228 | |

| Interest and other income (loss), net | 260 | 431 | |

| Income before provision for income taxes | 12,920 | 11,201 | |

| Provision for income taxes | 2,181 | 2,220 | |

| Net income | $10,739 | $8,981 | |

| Cisco Sytems Inc. Consolidated Balance Sheets | ||

|---|---|---|

| In millions, except par value | July 30, 2016 | July 25, 2015 |

| Assets | ||

| Current assets | ||

| Cash and cash equivalents | $7,631 | $6,877 |

| Investments | 58,125 | 53,539 |

| Accounts receivable, net of allowance for doubtful accounts of $249 at July 30, 2016 and $302 at July 25, 2015 | 5,847 | 5,344 |

| Inventories | 1,217 | 1,627 |

| Financing receivables, net | 4,272 | 4,491 |

| Other current assets | 1,627 | 1,490 |

| Total current assets | 78,719 | 73,368 |

| Property and equipment, net | 3,506 | 3,332 |

| Financing receivables, net | 4,158 | 3,858 |

| Goodwill | 26,625 | 24,469 |

| Purchased intangible assets, net | 2,501 | 2,376 |

| Deferred tax assets | 4,299 | 4,454 |

| Other assets | 1,844 | 1,516 |

| Total assets | $121,652 | $113,373 |

| Liabilities | ||

| Current liabilities | ||

| Short-term debt | $4,160 | $3,897 |

| Accounts payable | 1,056 | 1,104 |

| Income taxes payable | 517 | 62 |

| Accrued compensation | 2,951 | 3,049 |

| Deferred revenue | 10,155 | 9,824 |

| Other current liabilities | 6,072 | 5,476 |

| Total current liabilities | 24,911 | 23,412 |

| Long-term debt | 24,483 | 21,457 |

| Income taxes payable | 925 | 1,876 |

| Deferred revenue | 6,317 | 5,359 |

| Other long-term liabilities | 1,431 | 1,562 |

| Total liabilities | 58,067 | 53,666 |

| Cisco shareholders' equity Preferred stock, no par value: 5 shaes authorized; none issued and outstanding | -- | -- |

| Common stock and additional paid-in capital, $0.001 par value: 20,000 shares authorized; 5,029 and 5,085 shares issued and outstanding at July 30, 2016 and July 25, 2015, respectively | 44,516 | 43,592 |

| Retained earnings | 19,396 | 16,045 |

| Accumulated other comprehensive income (loss) | (326) | 61 |

| Total Cisco shareholders' equity | 63,586 | 59,698 |

| Noncontrolling interests | (1) | 9 |

| Total equity | 63,585 | 59,707 |

| Total liabilities and equity | $121,652 | $113,373 |

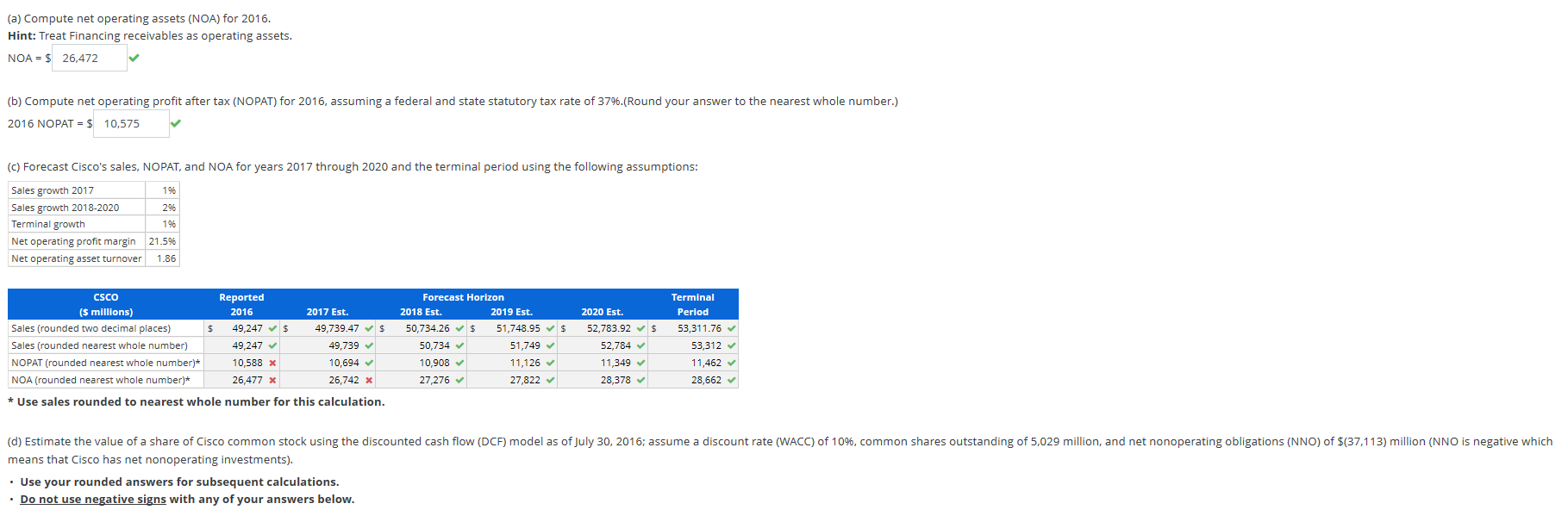

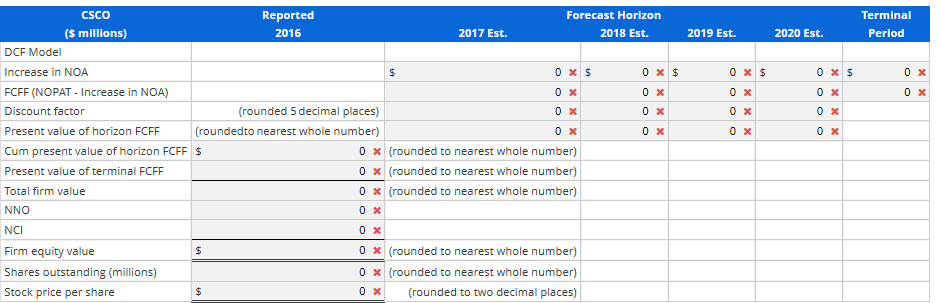

(a) Compute net operating assets (NOA) for 2016. Hint: Treat Financing receivables as operating assets. NOA = $ 26,472 (b) Compute net operating profit after tax (NOPAT) for 2016, assuming a federal and state statutory tax rate of 3796.(Round your answer to the nearest whole number.) 2016 NOPAT = $ 10,575 (C) Forecast Cisco's sales, NOPAT, and NOA for years 2017 through 2020 and the terminal period using the following assumptions: 1% Sales growth 2017 Sales growth 2018-2020 Terminal growth Net operating profit margin Net operating asset turnover 196 21.5% 1.86 $ $ CSCO Reported ($ millions) 2016 2017 Est. Sales (rounded two decimal places) 49,247 $ 49,739.47 $ Sales (rounded nearest whole number) 49,247 49,739 NOPAT (rounded nearest whole number)* 10,588 x 10,694 NOA (rounded nearest whole number)* 26,477 x 26,742 x * Use sales rounded to nearest whole number for this calculation. Forecast Horizon 2018 Est. 2019 Est. 50,734.26 $ 51,748.95 50,734 51,749 10,908 11,126 27,276 27,822 2020 Est. 52,783.92 52,784 11,349 28,378 Terminal Period 53,311.76 53,312 11,462 28,662 (d) Estimate the value of a share of Cisco common stock using the discounted cash flow (DCF) model as of July 30, 2016; assume a discount rate (WACC) of 10%, common shares outstanding of 5,029 million, and net nonoperating obligations (NNO) of $(37,113) million (NNO is negative which means that Cisco has net nonoperating investments). Use your rounded answers for subsequent calculations. . Do not use negative signs with any of your answers below. Terminal Period 2019 Est. 2020 Est. 0 x $ Ox 0x 0 x 0 x $ 0x Ox Ox OX 0 x CSCO Reported Forecast Horizon ($ millions) 2016 2017 Est. 2018 Est. DCF Model Increase in NOA 0 $ Ox $ FCFF (NOPAT - Increase in NOA) 0 x Discount factor (rounded 5 decimal places) 0x 0 x Present value of horizon FCFF (roundedto nearest whole number) 0 x 0 x Cum present value of horizon FCFF $ 0x (rounded to nearest whole number) Present value of terminal FCFF 0x (rounded to nearest whole number) Total firm value 0 x (rounded to nearest whole number) NNO Ox NCI Ox Firm equity value 0 x (rounded to nearest whole number) Shares outstanding (millions) 0 x (rounded to nearest whole number) Stock price per share 0x (rounded to two decimal places) (a) Compute net operating assets (NOA) for 2016. Hint: Treat Financing receivables as operating assets. NOA = $ 26,472 (b) Compute net operating profit after tax (NOPAT) for 2016, assuming a federal and state statutory tax rate of 3796.(Round your answer to the nearest whole number.) 2016 NOPAT = $ 10,575 (C) Forecast Cisco's sales, NOPAT, and NOA for years 2017 through 2020 and the terminal period using the following assumptions: 1% Sales growth 2017 Sales growth 2018-2020 Terminal growth Net operating profit margin Net operating asset turnover 196 21.5% 1.86 $ $ CSCO Reported ($ millions) 2016 2017 Est. Sales (rounded two decimal places) 49,247 $ 49,739.47 $ Sales (rounded nearest whole number) 49,247 49,739 NOPAT (rounded nearest whole number)* 10,588 x 10,694 NOA (rounded nearest whole number)* 26,477 x 26,742 x * Use sales rounded to nearest whole number for this calculation. Forecast Horizon 2018 Est. 2019 Est. 50,734.26 $ 51,748.95 50,734 51,749 10,908 11,126 27,276 27,822 2020 Est. 52,783.92 52,784 11,349 28,378 Terminal Period 53,311.76 53,312 11,462 28,662 (d) Estimate the value of a share of Cisco common stock using the discounted cash flow (DCF) model as of July 30, 2016; assume a discount rate (WACC) of 10%, common shares outstanding of 5,029 million, and net nonoperating obligations (NNO) of $(37,113) million (NNO is negative which means that Cisco has net nonoperating investments). Use your rounded answers for subsequent calculations. . Do not use negative signs with any of your answers below. Terminal Period 2019 Est. 2020 Est. 0 x $ Ox 0x 0 x 0 x $ 0x Ox Ox OX 0 x CSCO Reported Forecast Horizon ($ millions) 2016 2017 Est. 2018 Est. DCF Model Increase in NOA 0 $ Ox $ FCFF (NOPAT - Increase in NOA) 0 x Discount factor (rounded 5 decimal places) 0x 0 x Present value of horizon FCFF (roundedto nearest whole number) 0 x 0 x Cum present value of horizon FCFF $ 0x (rounded to nearest whole number) Present value of terminal FCFF 0x (rounded to nearest whole number) Total firm value 0 x (rounded to nearest whole number) NNO Ox NCI Ox Firm equity value 0 x (rounded to nearest whole number) Shares outstanding (millions) 0 x (rounded to nearest whole number) Stock price per share 0x (rounded to two decimal places)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started