Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Foreign currency NPV approach. Farbucks is thinking of expanding to South Korea. The current indirect rate for dollars and South Korean won is 1,025 won

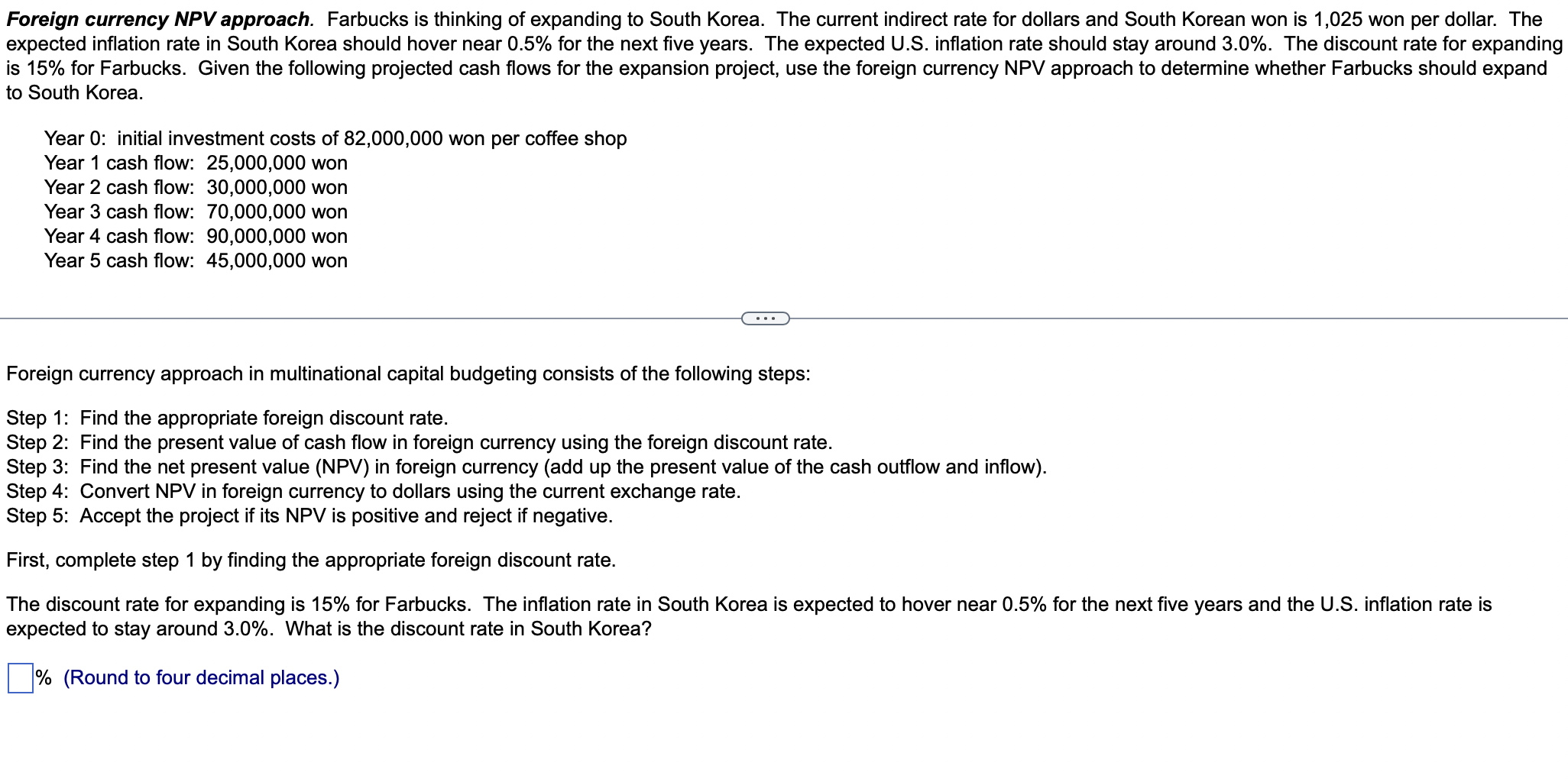

Foreign currency NPV approach. Farbucks is thinking of expanding to South Korea. The current indirect rate for dollars and South Korean won is 1,025 won per dollar. The expected inflation rate in South Korea should hover near 0.5% for the next five years. The expected U.S. inflation rate should stay around 3.0%. The discount rate for expanding is 15% for Farbucks. Given the following projected cash flows for the expansion project, use the foreign currency NPV approach to determine whether Farbucks should expand to South Korea. Year 0: initial investment costs of 82,000,000 won per coffee shop Year 1 cash flow: 25,000,000 won Year 2 cash flow: 30,000,000 won Year 3 cash flow: 70,000,000 won Year 4 cash flow: 90,000,000 won Year 5 cash flow: 45,000,000 won Foreign currency approach in multinational capital budgeting consists of the following steps: Step 1: Find the appropriate foreign discount rate. Step 2: Find the present value of cash flow in foreign currency using the foreign discount rate. Step 3: Find the net present value (NPV) in foreign currency (add up the present value of the cash outflow and inflow). Step 4: Convert NPV in foreign currency to dollars using the current exchange rate. Step 5: Accept the project if its NPV is positive and reject if negative. First, complete step 1 by finding the appropriate foreign discount rate. The discount rate for expanding is 15% for Farbucks. The inflation rate in South Korea is expected to hover near 0.5% for the next five years and the U.S. inflation rate is expected to stay around 3.0%. What is the discount rate in South Korea? % (Round to four decimal places.)

Foreign currency NPV approach. Farbucks is thinking of expanding to South Korea. The current indirect rate for dollars and South Korean won is 1,025 won per dollar. The expected inflation rate in South Korea should hover near 0.5% for the next five years. The expected U.S. inflation rate should stay around 3.0%. The discount rate for expanding is 15% for Farbucks. Given the following projected cash flows for the expansion project, use the foreign currency NPV approach to determine whether Farbucks should expand to South Korea. Year 0: initial investment costs of 82,000,000 won per coffee shop Year 1 cash flow: 25,000,000 won Year 2 cash flow: 30,000,000 won Year 3 cash flow: 70,000,000 won Year 4 cash flow: 90,000,000 won Year 5 cash flow: 45,000,000 won Foreign currency approach in multinational capital budgeting consists of the following steps: Step 1: Find the appropriate foreign discount rate. Step 2: Find the present value of cash flow in foreign currency using the foreign discount rate. Step 3: Find the net present value (NPV) in foreign currency (add up the present value of the cash outflow and inflow). Step 4: Convert NPV in foreign currency to dollars using the current exchange rate. Step 5: Accept the project if its NPV is positive and reject if negative. First, complete step 1 by finding the appropriate foreign discount rate. The discount rate for expanding is 15% for Farbucks. The inflation rate in South Korea is expected to hover near 0.5% for the next five years and the U.S. inflation rate is expected to stay around 3.0%. What is the discount rate in South Korea? % (Round to four decimal places.) Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started