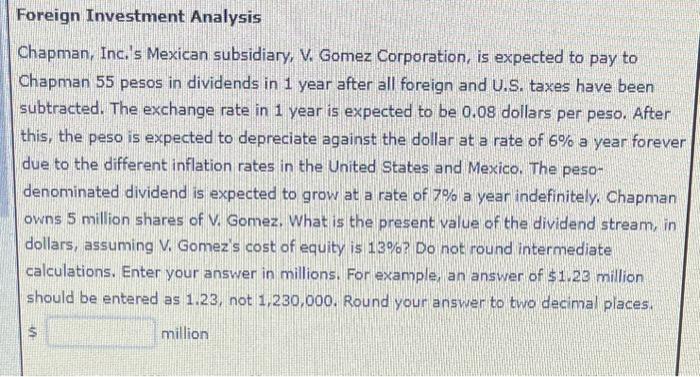

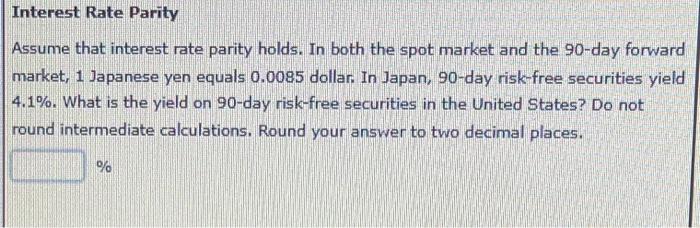

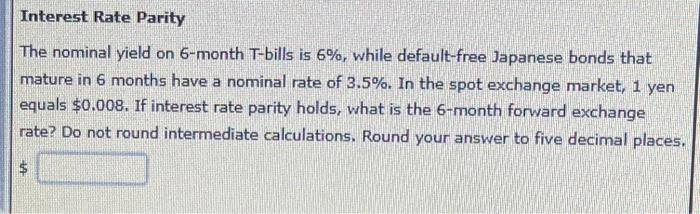

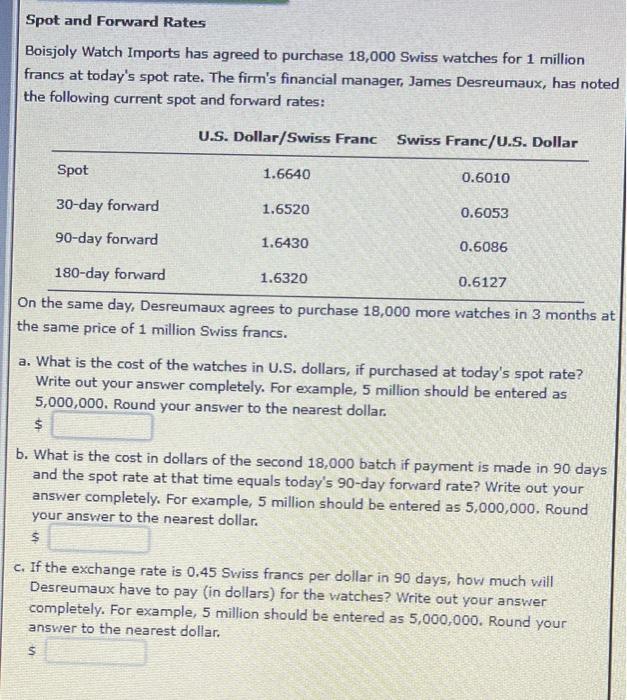

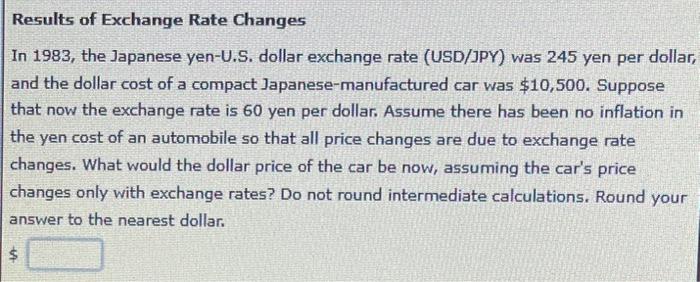

Foreign Investment Analysis Chapman, Inc.'s Mexican subsidiary, V. Gomez Corporation, is expected to pay to Chapman 55 pesos in dividends in 1 year after all foreign and U.S. taxes have been subtracted. The exchange rate in 1 year is expected to be 0.08 dollars per peso. After this, the peso is expected to depreciate against the dollar at a rate of 6% a year foreve due to the different inflation rates in the United States and Mexico. The pesodenominated dividend is expected to grow at a rate of 7% a year indefinitely. Chapman owns 5 million shares of V. Gomez. What is the present value of the dividend stream, in dollars, assuming V. Gomez's cost of equity is 13% ? Do not round intermediate calculations. Enter your answer in millions. For example, an answer of $1.23 million should be entered as 1.23, not 1,230,000. Round your answer to two decimal places. 5 million Interest Rate Parity Assume that interest rate parity holds. In both the spot market and the 90-day forward market, 1 Japanese yen equals 0.0085 dollar. In Japan, 90-day risk-free securities yield 4.1\%. What is the yield on 90-day risk-free securities in the United States? Do not round intermediate calculations. Round your answer to two decimal places. % Interest Rate Parity The nominal yield on 6-month T-bills is 6%, while default-free lapanese bonds that mature in 6 months have a nominal rate of 3.5%. In the spot exchange market, 1 yen equals $0.008. If interest rate parity holds, what is the 6-month forward exchange rate? Do not round intermediate calculations. Round your answer to five decimal places. $ Spot and Forward Rates Boisjoly Watch Imports has agreed to purchase 18,000 Swiss watches for 1 million francs at today's spot rate. The firm's financial manager, James Desreumaux, has noted the following current spot and forward rates: On the same day, Desreumaux agrees to purchase 18,000 more watches in 3 months at the same price of 1 million Swiss francs. a. What is the cost of the watches in U.S. dollars, if purchased at today's spot rate? Write out your answer completely. For example, 5 million should be entered as 5,000,000. Round your answer to the nearest dollar. b. What is the cost in dollars of the second 18,000 batch if payment is made in 90 days and the spot rate at that time equals today's 90-day forward rate? Write out your answer completely. For example, 5 million should be entered as 5,000,000. Round your answer to the nearest dollar. 5 c. If the exchange rate is 0.45 Swiss francs per dollar in 90 days, how much will Desreumaux have to pay (in dollars) for the watches? Write out your answer completely. For example, 5 million should be entered as 5,000,000. Round your answer to the nearest dollar. 5 Results of Exchange Rate Changes In 1983, the Japanese yen-U.S. dollar exchange rate (USD/JPY) was 245 yen per dollar, and the dollar cost of a compact Japanese-manufactured car was $10,500. Suppose that now the exchange rate is 60 yen per dollar. Assume there has been no inflation in the yen cost of an automobile so that all price changes are due to exchange rate changes. What would the dollar price of the car be now, assuming the car's price changes only with exchange rates? Do not round intermediate calculations. Round your answer to the nearest dollar