Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Forensic Accounting: Unraveling Financial Deception Forensic accounting stands as a specialized field within the broader domain of accounting, with its primary focus on the detection

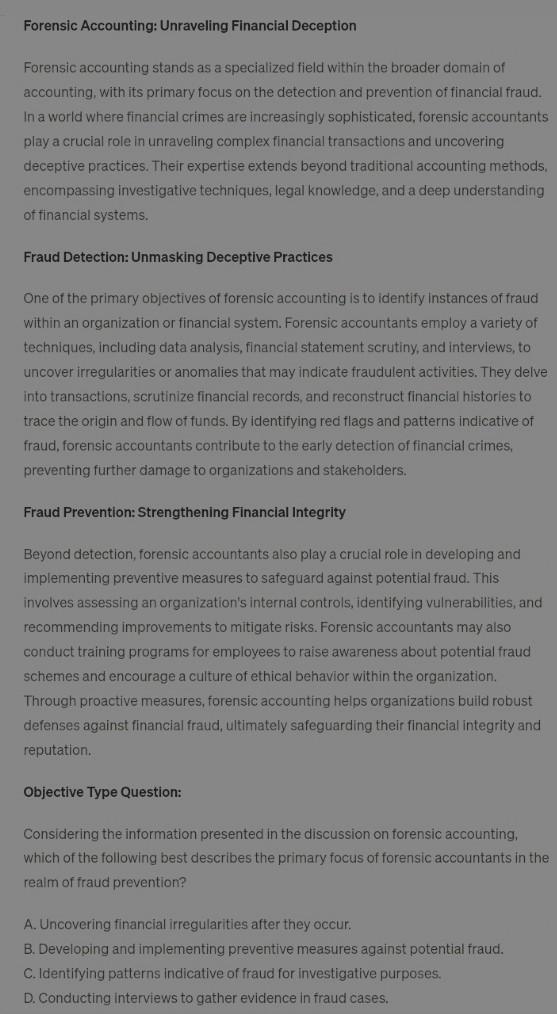

Forensic Accounting: Unraveling Financial Deception Forensic accounting stands as a specialized field within the broader domain of accounting, with its primary focus on the detection and prevention of financial fraud. In a world where financial crimes are increasingly sophisticated, forensic accountants play a crucial role in unraveling complex financial transactions and uncovering deceptive practices. Their expertise extends beyond traditional accounting methods, encompassing investigative techniques, legal knowledge, and a deep understanding of financial systems. Fraud Detection: Unmasking Deceptive Practices One of the primary objectives of forensic accounting is to identify instances of fraud within an organization or financial system. Forensic accountants employ a variety of techniques, including data analysis, financial statement scrutiny, and interviews, to uncover irregularities or anomalies that may indicate fraudulent activities. They delve into transactions, scrutinize financial records, and reconstruct financial histories to trace the origin and flow of funds. By identifying red flags and patterns indicative of fraud, forensic accountants contribute to the early detection of financial crimes, preventing further damage to organizations and stakeholders. Fraud Prevention: Strengthening Financial Integrity Beyond detection, forensic accountants also play a crucial role in developing and implementing preventive measures to safeguard against potential fraud. This involves assessing an organization's internal controls, identifying vulnerabilities, and recommending improvements to mitigate risks. Forensic accountants may also conduct training programs for employees to raise awareness about potential fraud schemes and encourage a culture of ethical behavior within the organization. Through proactive measures, forensic accounting helps organizations build robust defenses against financial fraud, ultimately safeguarding their financial integrity and reputation. Objective Type Question: Considering the information presented in the discussion on forensic accounting, which of the following best describes the primary focus of forensic accountants in the realm of fraud prevention? A. Uncovering financial regularities after they occur. B. Developing and implementing preventive measures against potential fraud. C. Identifying patterns indicative of fraud for investigative purposes. D. Conducting interviews to gather evidence in fraud cases

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started