Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Forever Blooms are a company that produces freeze dried flower arrangements that last forever. Their product is distinct as they produce a well-recognised signature

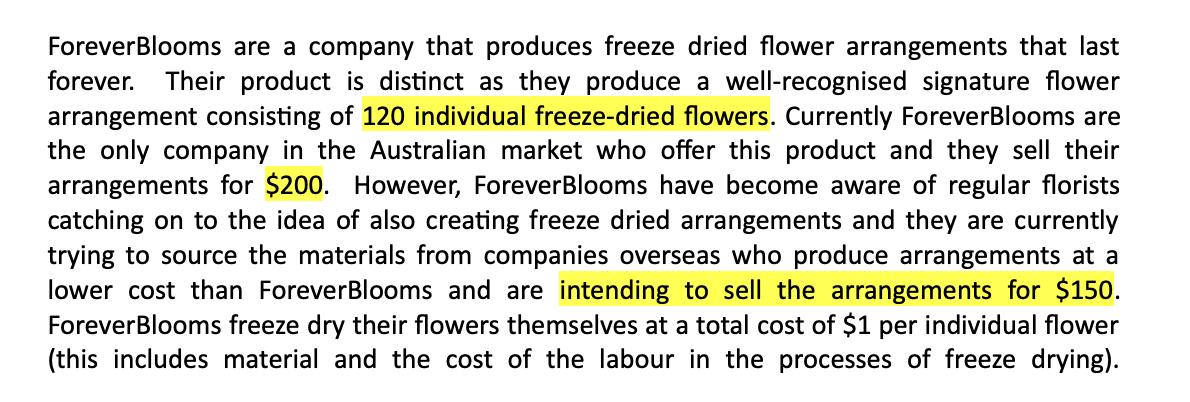

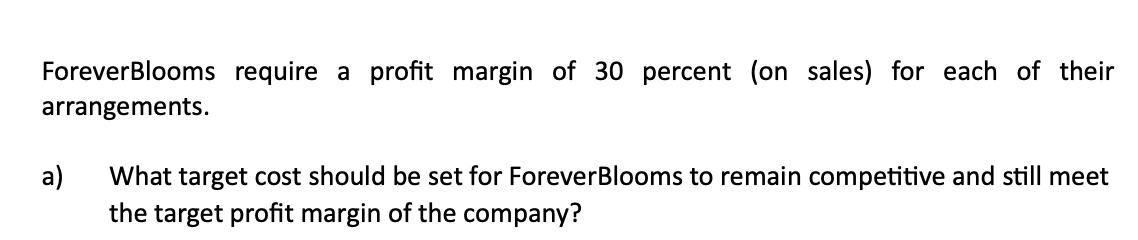

Forever Blooms are a company that produces freeze dried flower arrangements that last forever. Their product is distinct as they produce a well-recognised signature flower arrangement consisting of 120 individual freeze-dried flowers. Currently ForeverBlooms are the only company in the Australian market who offer this product and they sell their arrangements for $200. However, Forever Blooms have become aware of regular florists catching on to the idea of also creating freeze dried arrangements and they are currently trying to source the materials from companies overseas who produce arrangements at a lower cost than Forever Blooms and are intending to sell the arrangements for $150. Forever Blooms freeze dry their flowers themselves at a total cost of $1 per individual flower (this includes material and the cost of the labour in the processes of freeze drying). Forever Blooms require a profit margin of 30 percent (on sales) for each of their arrangements. a) What target cost should be set for ForeverBlooms to remain competitive and still meet the target profit margin of the company?

Step by Step Solution

★★★★★

3.38 Rating (160 Votes )

There are 3 Steps involved in it

Step: 1

To achieve a target profit margin of 30 you can use the following formula Target Cost S...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started