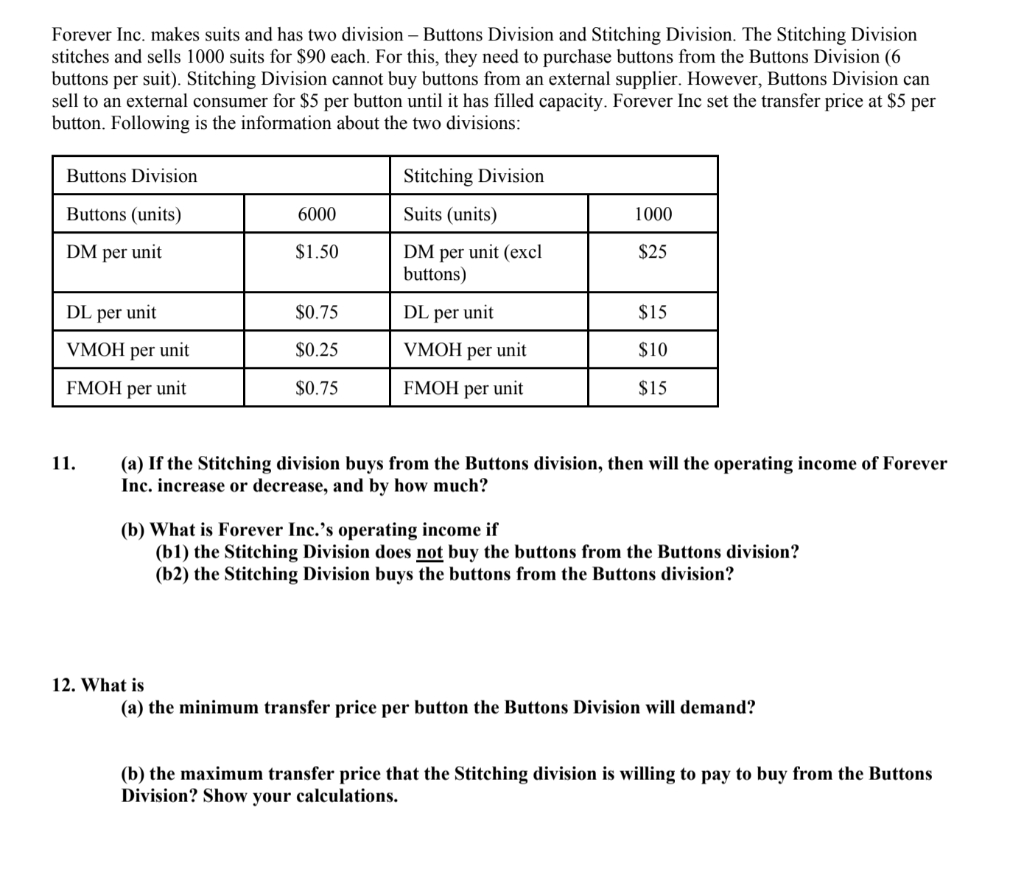

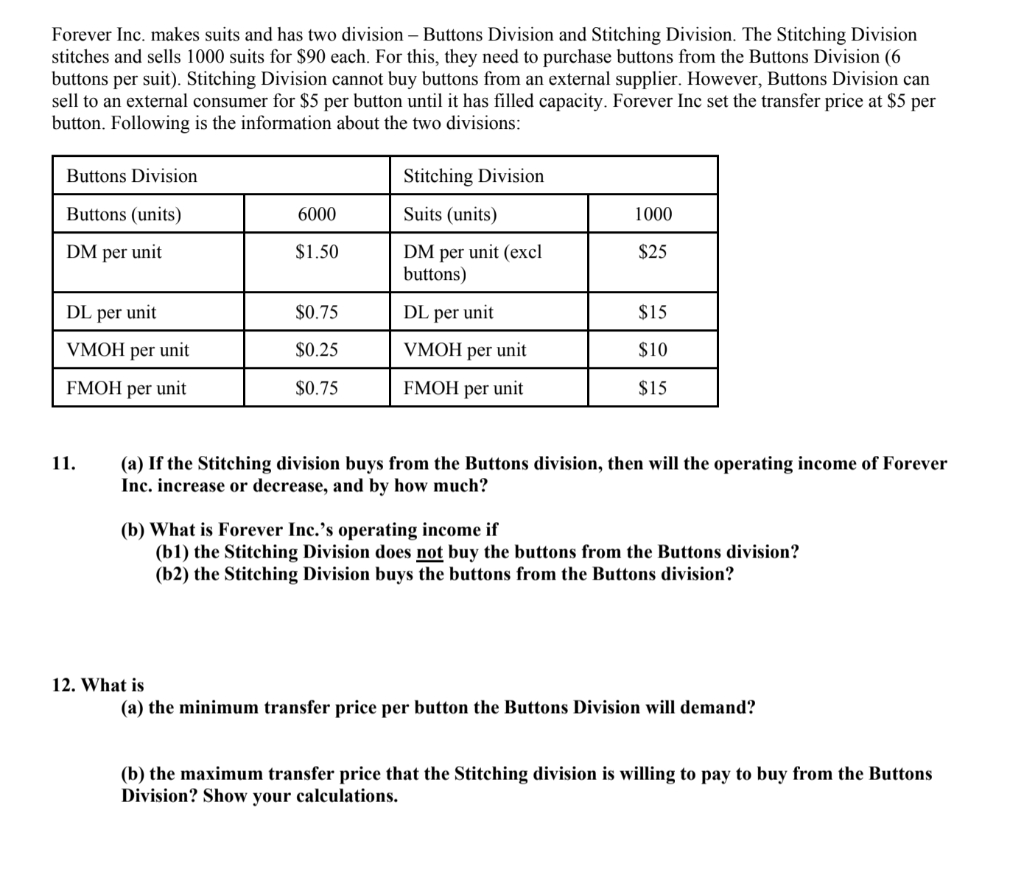

Forever Inc. makes suits and has two division - Buttons Division and Stitching Division. The Stitching Division stitches and sells 1000 suits for $90 each. For this, they need to purchase buttons from the Buttons Division (6 buttons per suit). Stitching Division cannot buy buttons from an external supplier. However, Buttons Division can sell to an external consumer for $5 per button until it has filled capacity. Forever Inc set the transfer price at $5 per button. Following is the information about the two divisions: Buttons Division Stitching Division Buttons (units) 6000 Suits (units) 1000 DM per unit $1.50 $25 DM per unit (excl buttons) DL per unit $0.75 $15 $10 VMOH per unit DL per unit VMOH per unit FMOH per unit $0.25 FMOH per unit $0.75 $15 11. (a) If the Stitching division buys from the Buttons division, then will the operating income of Forever Inc. increase or decrease, and by how much? (b) What is Forever Inc.'s operating income if (b1) the Stitching Division does not buy the buttons from the Buttons division? (b2) the Stitching Division buys the buttons from the Buttons division? 12. What is (a) the minimum transfer price per button the Buttons Division will demand? (b) the maximum transfer price that the Stitching division is willing to pay to buy from the Buttons Division? Show your calculations. Forever Inc. makes suits and has two division - Buttons Division and Stitching Division. The Stitching Division stitches and sells 1000 suits for $90 each. For this, they need to purchase buttons from the Buttons Division (6 buttons per suit). Stitching Division cannot buy buttons from an external supplier. However, Buttons Division can sell to an external consumer for $5 per button until it has filled capacity. Forever Inc set the transfer price at $5 per button. Following is the information about the two divisions: Buttons Division Stitching Division Buttons (units) 6000 Suits (units) 1000 DM per unit $1.50 $25 DM per unit (excl buttons) DL per unit $0.75 $15 $10 VMOH per unit DL per unit VMOH per unit FMOH per unit $0.25 FMOH per unit $0.75 $15 11. (a) If the Stitching division buys from the Buttons division, then will the operating income of Forever Inc. increase or decrease, and by how much? (b) What is Forever Inc.'s operating income if (b1) the Stitching Division does not buy the buttons from the Buttons division? (b2) the Stitching Division buys the buttons from the Buttons division? 12. What is (a) the minimum transfer price per button the Buttons Division will demand? (b) the maximum transfer price that the Stitching division is willing to pay to buy from the Buttons Division? Show your calculations