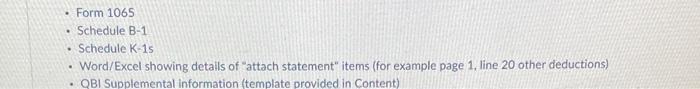

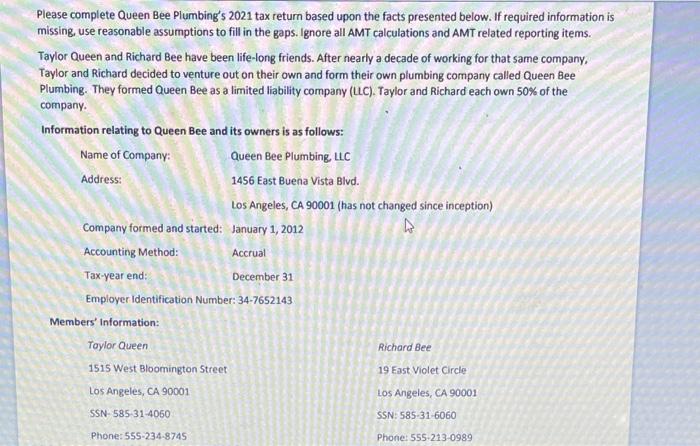

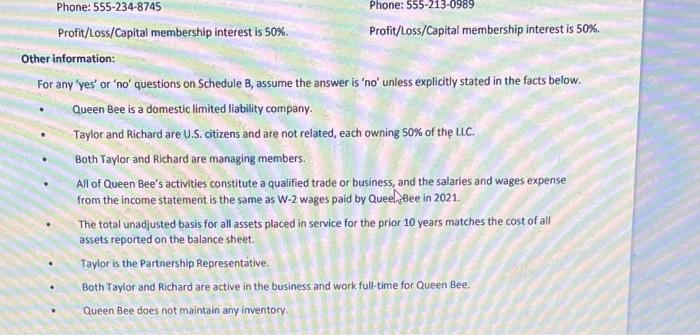

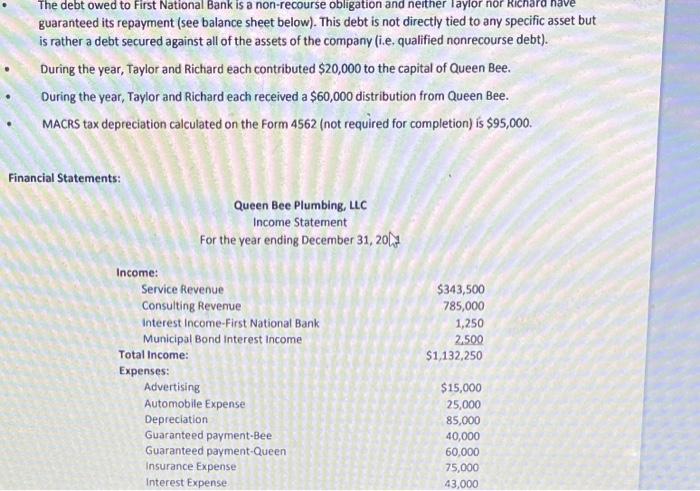

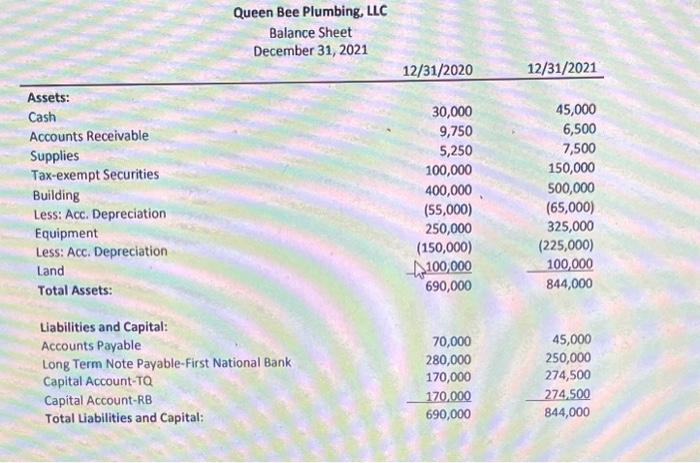

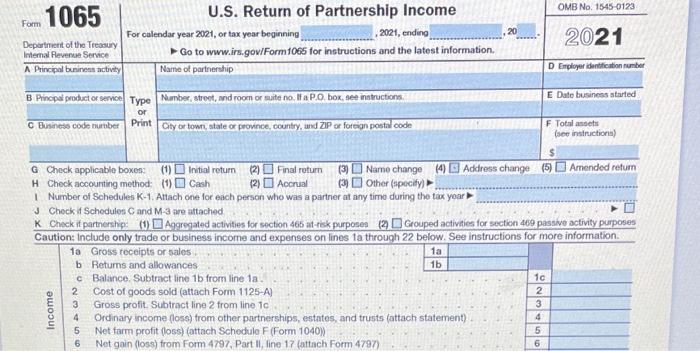

- Form 1065 - Schedule B-1 - Schedule K-15 - Word/ Excel showing details of "attach statement" items (for example page 1, line 20 other deductions) - QBI Supplemental information (template provided in Content) Please complete Queen Bee Plumbing's 2021 tax return based upon the facts presented below. If required information is missing, use reasonable assumptions to fill in the gaps. Ignore all AMT calculations and AMT related reporting items. Taylor Queen and Richard Bee have been life-long friends. After nearly a decade of working for that same company, Taylor and Richard decided to venture out on their own and form their own plumbing company called Queen Bee Plumbing. They formed Queen Bee as a limited liability company (LLC). Taylor and Richard each own 50% of the company. Information relating to Queen Bee and its owners is as follows: Profit/Loss/Capital membership interest is 50%. Profit/Loss/Capital membership interest is 50%. Other information: For any 'yes' or 'no' questions on Schedule B, assume the answer is 'no' unless explicitly stated in the facts below. Queen Bee is a domestic limited liability company. - Taylor and Richard are U.S. citizens and are not related, each owning S0\% of th UC. Both Taylor and Richard are managing members. All of Queen Bee's activities constitute a qualified trade or business, and the salaries and wages expense from the income statement is the same as W2 wages paid by Queeh 8 ee in 2021. The total unadjusted basis for all assets placed in service for the prior 10 years matches the cost of all assets reported on the balance sheet. - Taylor is the Partnership Representative. - Both Taylor and Richard are active in the business and work full-time for Queen Bee. Queen Bee does not maintain any inventory. The debt owed to First National Bank is a non-recourse obligation and neither laylor nor kichara nave guaranteed its repayment (see balance sheet below). This debt is not directly tied to any specific asset but is rather a debt secured against all of the assets of the company (i.e, qualified nonrecourse debt). During the year, Taylor and Richard each contributed $20,000 to the capital of Queen Bee. During the year, Taylor and Richard each received a $60,000 distribution from Queen Bee. MACRS tax depreciation calculated on the form 4562 (not required for completion) is $95,000. Queen Bee Plumbing, LLC Balance Sheet December 31, 2021 \begin{tabular}{lrr} \hline Assets: & & \\ Cash & 30,000 & 45,000 \\ Accounts Receivable & 9,750 & 6,500 \\ Supplies & 5,250 & 7,500 \\ Tax-exempt Securities & 100,000 & 150,000 \\ Building & 400,000 & 500,000 \\ Less: Acc. Depreciation & (55,000) & (65,000) \\ Equipment & 250,000 & 325,000 \\ Less: Acc. Depreciation & (150,000) & (225,000) \\ Land & 100,000 & 100,000 \\ Total Assets: & 690,000 & 844,000 \\ Liabilities and Capital: & & \\ Accounts Payable & 70,000 & 45,000 \\ Long Term Note Payable-First National Bank & 280,000 & 250,000 \\ Capital Account-TQ & 170,000 & 274,500 \\ Capital Account-RB & 170,000 & 274,500 \\ Total Liabilities and Capital: & 690,000 & 844,000 \end{tabular} Q Check applicably boxes: (1) Initial retum (2) Final rotum (3) Name change (4) . Address change () Amended retum H Chock accounting method: (1) Gash (2) Accrual (3) Other (specify) I Number of Schedules K-1. Attach one for each person who was a partrier at any time during the tax yoar J Check it Schedules C and M3 are attached K Check it partnership: (1) Agqregated activities for section 465 at-rick purposes (2) ( Grouped activities for section 469 passive activity purposes Caution: include only trade or business income and expenses on lines la through 22 below. See instructions for more information. 1 a Gross receipts or sales. b Returns and allowances. c Balance, Subtract line 1b from line 1a. Q 2 Cost of goods sold (attach Form 1125-A) Gross profit. Subtract line 2 from line 1c Ordinary income (loss) trom other partnerships, estates, and trusts (attach statement) Net farm profit (loss) (attach Schodule F(Form 1040)) 6 Net gain (loss) from Form 4797, Part II, line 17 (attach Form 4797) \begin{tabular}{|c|c|c|c|} \hline 1a & & \\ \hline 1b & & \\ & & \\ \cline { 1 - 3 } & & 1c & \\ \hline \end{tabular} - Form 1065 - Schedule B-1 - Schedule K-15 - Word/ Excel showing details of "attach statement" items (for example page 1, line 20 other deductions) - QBI Supplemental information (template provided in Content) Please complete Queen Bee Plumbing's 2021 tax return based upon the facts presented below. If required information is missing, use reasonable assumptions to fill in the gaps. Ignore all AMT calculations and AMT related reporting items. Taylor Queen and Richard Bee have been life-long friends. After nearly a decade of working for that same company, Taylor and Richard decided to venture out on their own and form their own plumbing company called Queen Bee Plumbing. They formed Queen Bee as a limited liability company (LLC). Taylor and Richard each own 50% of the company. Information relating to Queen Bee and its owners is as follows: Profit/Loss/Capital membership interest is 50%. Profit/Loss/Capital membership interest is 50%. Other information: For any 'yes' or 'no' questions on Schedule B, assume the answer is 'no' unless explicitly stated in the facts below. Queen Bee is a domestic limited liability company. - Taylor and Richard are U.S. citizens and are not related, each owning S0\% of th UC. Both Taylor and Richard are managing members. All of Queen Bee's activities constitute a qualified trade or business, and the salaries and wages expense from the income statement is the same as W2 wages paid by Queeh 8 ee in 2021. The total unadjusted basis for all assets placed in service for the prior 10 years matches the cost of all assets reported on the balance sheet. - Taylor is the Partnership Representative. - Both Taylor and Richard are active in the business and work full-time for Queen Bee. Queen Bee does not maintain any inventory. The debt owed to First National Bank is a non-recourse obligation and neither laylor nor kichara nave guaranteed its repayment (see balance sheet below). This debt is not directly tied to any specific asset but is rather a debt secured against all of the assets of the company (i.e, qualified nonrecourse debt). During the year, Taylor and Richard each contributed $20,000 to the capital of Queen Bee. During the year, Taylor and Richard each received a $60,000 distribution from Queen Bee. MACRS tax depreciation calculated on the form 4562 (not required for completion) is $95,000. Queen Bee Plumbing, LLC Balance Sheet December 31, 2021 \begin{tabular}{lrr} \hline Assets: & & \\ Cash & 30,000 & 45,000 \\ Accounts Receivable & 9,750 & 6,500 \\ Supplies & 5,250 & 7,500 \\ Tax-exempt Securities & 100,000 & 150,000 \\ Building & 400,000 & 500,000 \\ Less: Acc. Depreciation & (55,000) & (65,000) \\ Equipment & 250,000 & 325,000 \\ Less: Acc. Depreciation & (150,000) & (225,000) \\ Land & 100,000 & 100,000 \\ Total Assets: & 690,000 & 844,000 \\ Liabilities and Capital: & & \\ Accounts Payable & 70,000 & 45,000 \\ Long Term Note Payable-First National Bank & 280,000 & 250,000 \\ Capital Account-TQ & 170,000 & 274,500 \\ Capital Account-RB & 170,000 & 274,500 \\ Total Liabilities and Capital: & 690,000 & 844,000 \end{tabular} Q Check applicably boxes: (1) Initial retum (2) Final rotum (3) Name change (4) . Address change () Amended retum H Chock accounting method: (1) Gash (2) Accrual (3) Other (specify) I Number of Schedules K-1. Attach one for each person who was a partrier at any time during the tax yoar J Check it Schedules C and M3 are attached K Check it partnership: (1) Agqregated activities for section 465 at-rick purposes (2) ( Grouped activities for section 469 passive activity purposes Caution: include only trade or business income and expenses on lines la through 22 below. See instructions for more information. 1 a Gross receipts or sales. b Returns and allowances. c Balance, Subtract line 1b from line 1a. Q 2 Cost of goods sold (attach Form 1125-A) Gross profit. Subtract line 2 from line 1c Ordinary income (loss) trom other partnerships, estates, and trusts (attach statement) Net farm profit (loss) (attach Schodule F(Form 1040)) 6 Net gain (loss) from Form 4797, Part II, line 17 (attach Form 4797) \begin{tabular}{|c|c|c|c|} \hline 1a & & \\ \hline 1b & & \\ & & \\ \cline { 1 - 3 } & & 1c & \\ \hline \end{tabular}