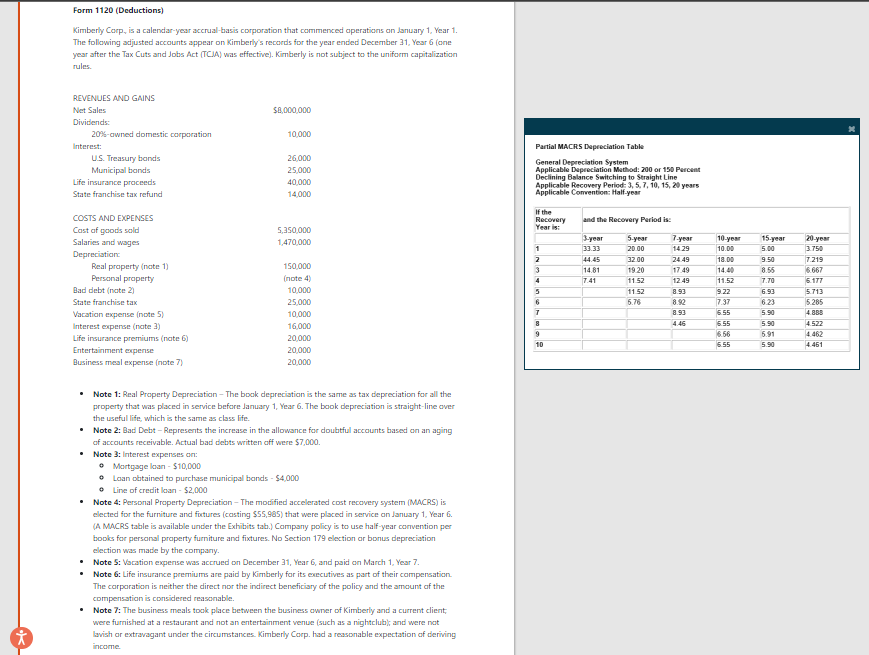

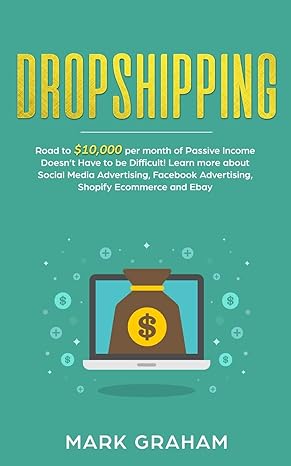

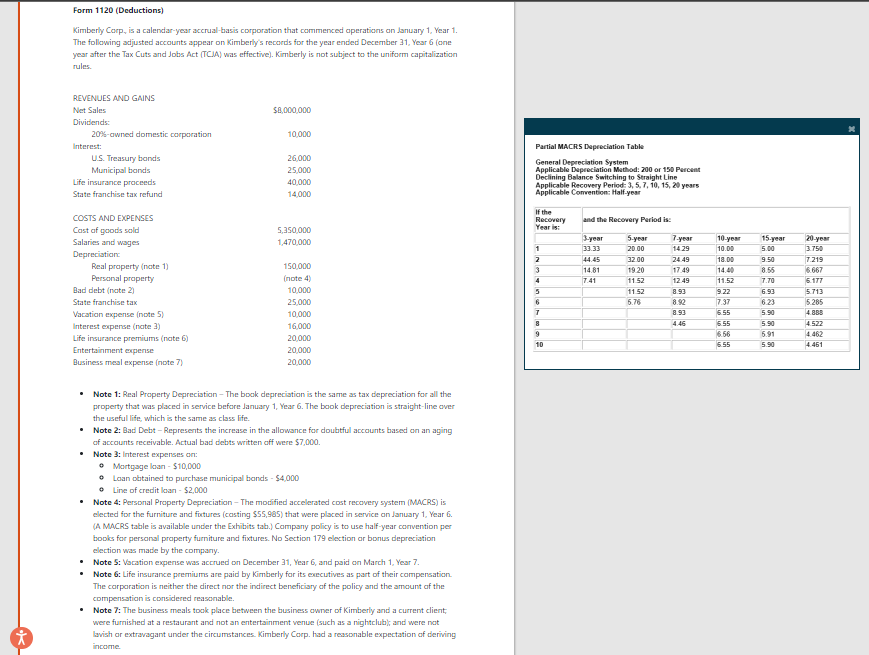

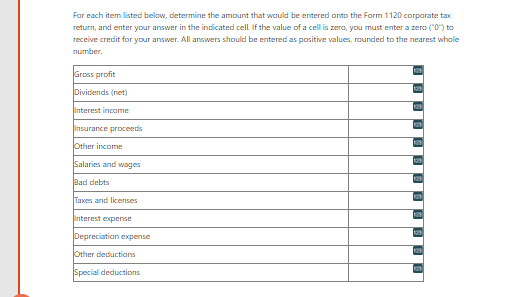

Form 1120 (Deductions) Kimberly Corp. is a calendar-year accrual-basis corporation that commenced aperations on January 1, Year 1. The following adjusted accounts appear on Kimberly's records for the year ended December 21 Year 6 (one year after the Tax Cuts and Jobs Act (TCJA) was effective). Kimberly is not subject to the uniform capitalization rules $8.000.000 10,000 REVENUES AND GAINS Net Sales Dividends: 20%-owned domestic corporation Interest: US Treasury bands Municipal bands Life insurance proceeds State franchise tax refund 26,000 25.000 40,000 14,000 Partial MACRS Depreciation Table General Depreciation System Applicable Depreciation Method: 200 or 150 percent Declining Balance Switching to Straight Line Applicable Recovery Period: 3,5.7, 10, 15, 20 years Applicable Convention: Half-year If the Recovery Year is: and the Recovery Periodis: 5,350.000 1,470,000 7-year 10 year 15-year 20 year 3-year 33.33 44.45 14.81 7.41 1 2 3 4 5.00 9.50 COSTS AND EXPENSES Cast of goods sold Salaries and wages Depreciation Real property (nate 1) Personal property Bad debt (note 2 State franchise tax Vacation expense (note 5) Interest expense (nate 3) Life insurance premiums (nate 6) Entertainment expense Business meal expense (note 7) 5-year 20.00 32.00 1920 11.52 1152 5.76 855 14.29 24.49 17.49 12.49 8.93 8.92 8.93 4.46 150.000 (note 4) 10,000 25.000 10,000 16,000 20,000 20,000 20,000 5 10.00 18.DO 14.40 11.52 9.22 7.37 5.55 5.55 6,56 5.55 3.750 7.219 6.667 5.177 5.713 5.285 4.888 4.522 4462 4.461 7.70 6.93 6.23 5.90 5.90 5.91 5.90 6 7 8 9 10 Note 1: Real Property Depreciation - The book depreciation is the same as tax depreciation for all the property that was placed in service before January 1, Year 6. The book depreciation is straight-line over the useful life, which is the same as class life. Note 2: Bad Debt-Represents the increase in the allowance for doubtfuil accounts based on an aging of accounts receivable. Actual bad debts written off were $7,000. Note 3: Interest expenses on: Mortgage loan $10,000 Loan obtained to purchase municipal bands - $4,000 Line of credit loan $2,000 Note 4: Personal Property Depreciation - The modified accelerated cost recovery system (MACRS) is elected for the furniture and fictures (casting $55.985) that were placed in service on January 1, Year 6. (A MACRS table is available under the Exhibits tab.) Company policy is to use half-year convention per books for personal property furniture and fixtures. No Section 179 election or bonus depreciation election was made by the company. Note 5: Vacation expense was accrued on December 31, Year 6, and paid on March 1, Year 7. Note 6: Life insurance premiums are paid by Kimberly for its executives as part of their compensation The corporation is neither the direct nor the indirect beneficiary of the policy and the amount of the compensation is considered reasonable Note 7: The business meals took place between the business owner of Kimberly and a current client were furnished at a restaurant and not an entertainment venue (such as a nightclubs and were not Lavish or extravagant under the circumstances. Kimberly Corp. had a reasonable expectation of deriving income i For each itern listed below, determine the amount that would be entered onto the farm 1120 corporate tax return, and enter your answer in the indicated cell. If the value of a cell is zero, you must enter a zero (0%) to receive credit for your answer. All answers should be entered as positive values, rounded to the nearest whole number Gross profit Dividends (net) interest income Insurance proceeds Other income Salaries and wages Bad debts Taxes and licenses Interest expense Depreciation expense Other deductions Special deductions Form 1120 (Deductions) Kimberly Corp. is a calendar-year accrual-basis corporation that commenced aperations on January 1, Year 1. The following adjusted accounts appear on Kimberly's records for the year ended December 21 Year 6 (one year after the Tax Cuts and Jobs Act (TCJA) was effective). Kimberly is not subject to the uniform capitalization rules $8.000.000 10,000 REVENUES AND GAINS Net Sales Dividends: 20%-owned domestic corporation Interest: US Treasury bands Municipal bands Life insurance proceeds State franchise tax refund 26,000 25.000 40,000 14,000 Partial MACRS Depreciation Table General Depreciation System Applicable Depreciation Method: 200 or 150 percent Declining Balance Switching to Straight Line Applicable Recovery Period: 3,5.7, 10, 15, 20 years Applicable Convention: Half-year If the Recovery Year is: and the Recovery Periodis: 5,350.000 1,470,000 7-year 10 year 15-year 20 year 3-year 33.33 44.45 14.81 7.41 1 2 3 4 5.00 9.50 COSTS AND EXPENSES Cast of goods sold Salaries and wages Depreciation Real property (nate 1) Personal property Bad debt (note 2 State franchise tax Vacation expense (note 5) Interest expense (nate 3) Life insurance premiums (nate 6) Entertainment expense Business meal expense (note 7) 5-year 20.00 32.00 1920 11.52 1152 5.76 855 14.29 24.49 17.49 12.49 8.93 8.92 8.93 4.46 150.000 (note 4) 10,000 25.000 10,000 16,000 20,000 20,000 20,000 5 10.00 18.DO 14.40 11.52 9.22 7.37 5.55 5.55 6,56 5.55 3.750 7.219 6.667 5.177 5.713 5.285 4.888 4.522 4462 4.461 7.70 6.93 6.23 5.90 5.90 5.91 5.90 6 7 8 9 10 Note 1: Real Property Depreciation - The book depreciation is the same as tax depreciation for all the property that was placed in service before January 1, Year 6. The book depreciation is straight-line over the useful life, which is the same as class life. Note 2: Bad Debt-Represents the increase in the allowance for doubtfuil accounts based on an aging of accounts receivable. Actual bad debts written off were $7,000. Note 3: Interest expenses on: Mortgage loan $10,000 Loan obtained to purchase municipal bands - $4,000 Line of credit loan $2,000 Note 4: Personal Property Depreciation - The modified accelerated cost recovery system (MACRS) is elected for the furniture and fictures (casting $55.985) that were placed in service on January 1, Year 6. (A MACRS table is available under the Exhibits tab.) Company policy is to use half-year convention per books for personal property furniture and fixtures. No Section 179 election or bonus depreciation election was made by the company. Note 5: Vacation expense was accrued on December 31, Year 6, and paid on March 1, Year 7. Note 6: Life insurance premiums are paid by Kimberly for its executives as part of their compensation The corporation is neither the direct nor the indirect beneficiary of the policy and the amount of the compensation is considered reasonable Note 7: The business meals took place between the business owner of Kimberly and a current client were furnished at a restaurant and not an entertainment venue (such as a nightclubs and were not Lavish or extravagant under the circumstances. Kimberly Corp. had a reasonable expectation of deriving income i For each itern listed below, determine the amount that would be entered onto the farm 1120 corporate tax return, and enter your answer in the indicated cell. If the value of a cell is zero, you must enter a zero (0%) to receive credit for your answer. All answers should be entered as positive values, rounded to the nearest whole number Gross profit Dividends (net) interest income Insurance proceeds Other income Salaries and wages Bad debts Taxes and licenses Interest expense Depreciation expense Other deductions Special deductions