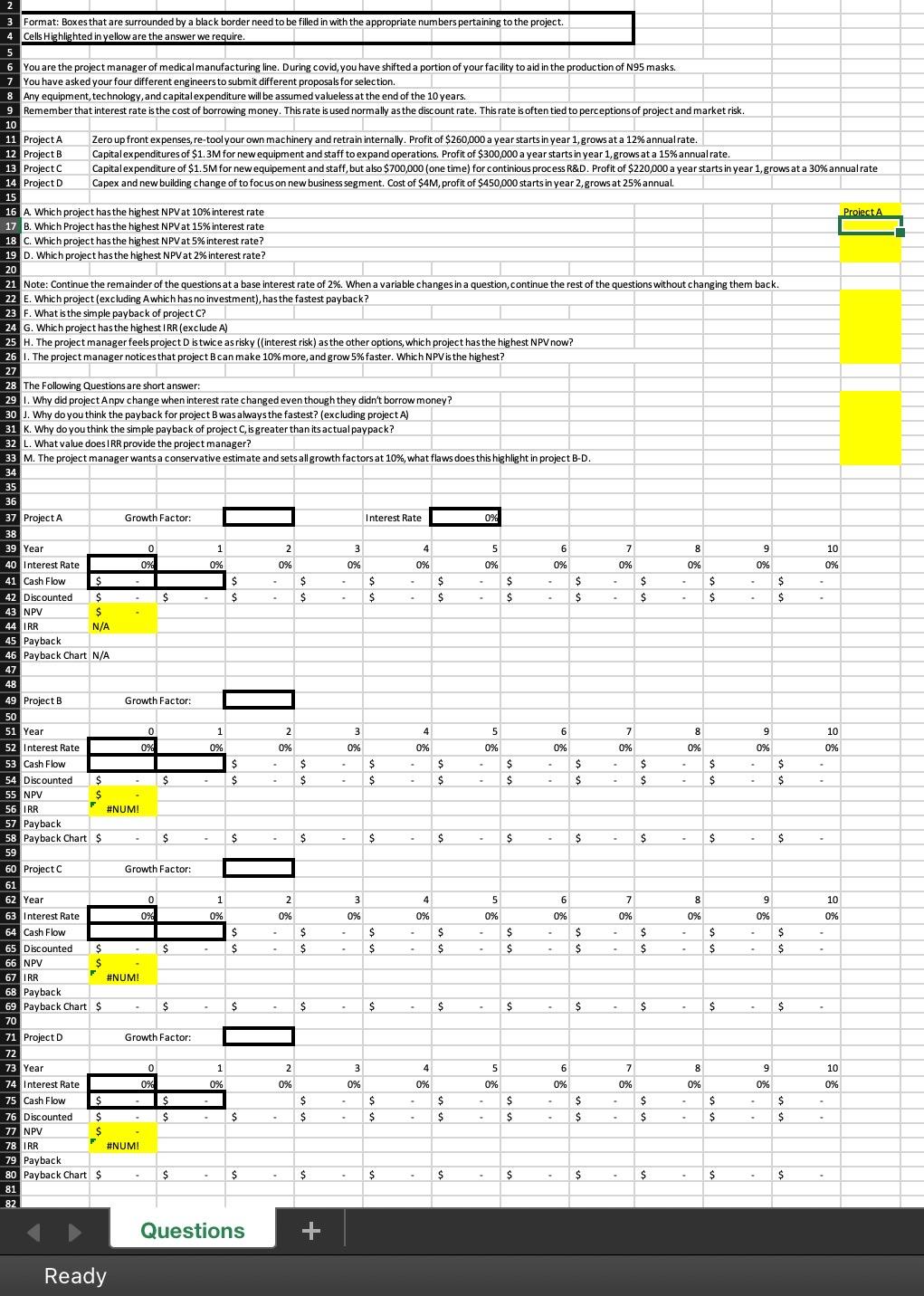

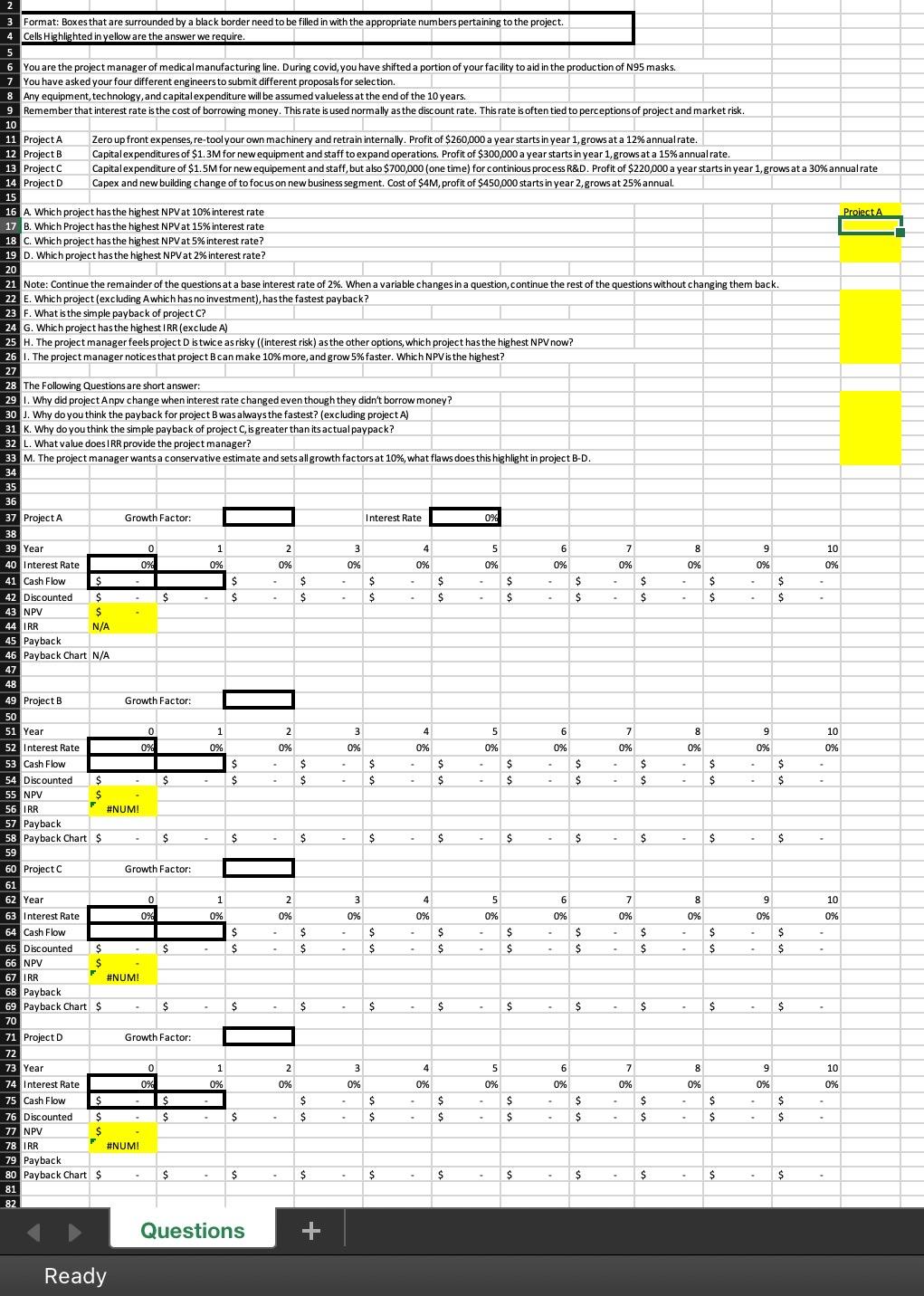

Format: Boxes that are surrounded by a black border need to be filled in with the appropriate numbers pertaining to the project. 4 Cells Highlighted in yellow are the answer we require. 5 6 You are the project manager of medical manufacturing line. During covid, you have shifted a portion of your facility to aid in the production of N95 masks. 7 You have asked your four different engineers to submit different proposals for selection. 8 Any equipment, technology, and capital expenditure will be assumed valueless at the end of the 10 years. 9 Remember that interest rate is the cost of borrowing money. This rate is used normally as the discount rate. This rate is often tied to perceptions of project and market risk. 10 11 Project A Zero upfront expenses, re-tool your own machinery and retrain internally. Profit of $260,000 a year starts in year 1, grows at a 12% annual rate. 12 Project B Capital expenditures of $1.3M for new equipment and staff to expand operations. Profit of $300,000 a year starts in year 1, grows at a 15% annual rate. 13 Project C Capitalexpenditure of $1.5M for new equipement and staff, but also $700,000 (one time) for continious process R&D. Profit of $220,000 a year starts in year 1, grows at a 30% annual rate 14 Project D Capex and new building change of to focus on new business segment. Cost of $4M, profit of $450,000 starts in year 2, grows at 25% annual. 15 16 A Which project has the highest NPV at 10% interest rate Proiect A 42 17 B. Which Project has the highest NPV at 15% interest rate 18 C. Which project has the highest NPV at 5% interest rate? 19 D. Which project has the highest NPV at 2% interest rate? 2 21 Note: Continue the remainder of the questions at a base interest rate of 2%. When a variable changes in a question, continue the rest of the questions without changing them back E. Which project (excluding Awhich has no investment), has the fastest payback? 23 F. What is the simple payback of project C? 24 G. Which project has the highest IRR (exclude A) 25 H. The project manager feels project Dis twice as risky ((interest risk) as the other options, which project has the highest NPV now? 26 1. The project manager notices that project B can make 10% more, and grow 5% faster. Which NPV is the highest? 28 The Following Questions are short answer: 29. Why did project Anpv change when interest rate changed even though they didn't borrow money? 30 J. Why do you think the payback for project B was always the fastest? (excluding project A) 31 K. Why do you think the simple payback of project C, is greater than its actual paypack? L. What value does IRR provide the project manager? 33 M. The project manager wants a conservative estimate and sets all growth factors at 10%, what flaws does this highlight in project B-D. 27 34 35 36 Growth Factor: Interest Rate 02 0 2 3 4 5 6 7 9 10 1 0% 8 0% RC 0% 0% 0% 0% 0% 0% 0% 0% 0% $ - - 37 Project A 38 39 Year 40 Interest Rate 41 Cash Flow $ 42 Discounted $ 43 NPV 44 IRR N/A 45 Payback 46 Payback Chart N/A 47 $ $ $ $ $ $ $ $ $ $ $ $ $ $ $ $ $ $ - - 48 1 3 4 8 10 2 0% 5 0% 6 0% 7 0% 9 0% 0% 0% 0% 0% 0% $ $ $ $ $ $ $ $ $ $ $ $ $ $ $ $ $ $ - - - - - - $ $ - $ $ $ - $ - $ $ - $ 49 Project B Growth Factor: 50 51 Year 52 Interest Rate 0% 53 Cash Flow 54 Discounted $ $ 55 NPV $ 56 IRR #NUM! 57 Payback 58 Payback Chart $ $ 59 60 Project C Growth Factor: 61 62 Year 0 63 Interest Rate 0% 64 Cash Flow 65 Discounted $ $ 66 NPV $ 67 IRR #NUM! 68 Payback 69 Payback Chart $ $ 70 2 5 6 8 9 10 1 0% 3 0% 4 0% 7 0% 0% 0% 0% 0% 0% 0% - - - $ $ $ $ $ $ nu $ $ $ $ $ $ nu $ $ $ $ $ $ $ $ $ $ $ $ $ $ $ $ 1 2 3 4 6 7 5 0% 8 0% 9 0% 10 0% 0% 0% 0% 0% 0% 0% - - 71 Project D Growth Factor: 72 73 Year 0 74 Interest Rate 0% 75 Cash Flow $ 76 Discounted $ $ 77 NPV $ 78 I RR #NUM! 79 Payback 80 Payback Chart $ $ 81 $ $ $ $ $ $ $ $ $ $ $ $ $ $ $ $ $ - - - - $ $ $ $ $ $ $ $ $ 82 Questions + Ready Format: Boxes that are surrounded by a black border need to be filled in with the appropriate numbers pertaining to the project. 4 Cells Highlighted in yellow are the answer we require. 5 6 You are the project manager of medical manufacturing line. During covid, you have shifted a portion of your facility to aid in the production of N95 masks. 7 You have asked your four different engineers to submit different proposals for selection. 8 Any equipment, technology, and capital expenditure will be assumed valueless at the end of the 10 years. 9 Remember that interest rate is the cost of borrowing money. This rate is used normally as the discount rate. This rate is often tied to perceptions of project and market risk. 10 11 Project A Zero upfront expenses, re-tool your own machinery and retrain internally. Profit of $260,000 a year starts in year 1, grows at a 12% annual rate. 12 Project B Capital expenditures of $1.3M for new equipment and staff to expand operations. Profit of $300,000 a year starts in year 1, grows at a 15% annual rate. 13 Project C Capitalexpenditure of $1.5M for new equipement and staff, but also $700,000 (one time) for continious process R&D. Profit of $220,000 a year starts in year 1, grows at a 30% annual rate 14 Project D Capex and new building change of to focus on new business segment. Cost of $4M, profit of $450,000 starts in year 2, grows at 25% annual. 15 16 A Which project has the highest NPV at 10% interest rate Proiect A 42 17 B. Which Project has the highest NPV at 15% interest rate 18 C. Which project has the highest NPV at 5% interest rate? 19 D. Which project has the highest NPV at 2% interest rate? 2 21 Note: Continue the remainder of the questions at a base interest rate of 2%. When a variable changes in a question, continue the rest of the questions without changing them back E. Which project (excluding Awhich has no investment), has the fastest payback? 23 F. What is the simple payback of project C? 24 G. Which project has the highest IRR (exclude A) 25 H. The project manager feels project Dis twice as risky ((interest risk) as the other options, which project has the highest NPV now? 26 1. The project manager notices that project B can make 10% more, and grow 5% faster. Which NPV is the highest? 28 The Following Questions are short answer: 29. Why did project Anpv change when interest rate changed even though they didn't borrow money? 30 J. Why do you think the payback for project B was always the fastest? (excluding project A) 31 K. Why do you think the simple payback of project C, is greater than its actual paypack? L. What value does IRR provide the project manager? 33 M. The project manager wants a conservative estimate and sets all growth factors at 10%, what flaws does this highlight in project B-D. 27 34 35 36 Growth Factor: Interest Rate 02 0 2 3 4 5 6 7 9 10 1 0% 8 0% RC 0% 0% 0% 0% 0% 0% 0% 0% 0% $ - - 37 Project A 38 39 Year 40 Interest Rate 41 Cash Flow $ 42 Discounted $ 43 NPV 44 IRR N/A 45 Payback 46 Payback Chart N/A 47 $ $ $ $ $ $ $ $ $ $ $ $ $ $ $ $ $ $ - - 48 1 3 4 8 10 2 0% 5 0% 6 0% 7 0% 9 0% 0% 0% 0% 0% 0% $ $ $ $ $ $ $ $ $ $ $ $ $ $ $ $ $ $ - - - - - - $ $ - $ $ $ - $ - $ $ - $ 49 Project B Growth Factor: 50 51 Year 52 Interest Rate 0% 53 Cash Flow 54 Discounted $ $ 55 NPV $ 56 IRR #NUM! 57 Payback 58 Payback Chart $ $ 59 60 Project C Growth Factor: 61 62 Year 0 63 Interest Rate 0% 64 Cash Flow 65 Discounted $ $ 66 NPV $ 67 IRR #NUM! 68 Payback 69 Payback Chart $ $ 70 2 5 6 8 9 10 1 0% 3 0% 4 0% 7 0% 0% 0% 0% 0% 0% 0% - - - $ $ $ $ $ $ nu $ $ $ $ $ $ nu $ $ $ $ $ $ $ $ $ $ $ $ $ $ $ $ 1 2 3 4 6 7 5 0% 8 0% 9 0% 10 0% 0% 0% 0% 0% 0% 0% - - 71 Project D Growth Factor: 72 73 Year 0 74 Interest Rate 0% 75 Cash Flow $ 76 Discounted $ $ 77 NPV $ 78 I RR #NUM! 79 Payback 80 Payback Chart $ $ 81 $ $ $ $ $ $ $ $ $ $ $ $ $ $ $ $ $ - - - - $ $ $ $ $ $ $ $ $ 82 Questions + Ready