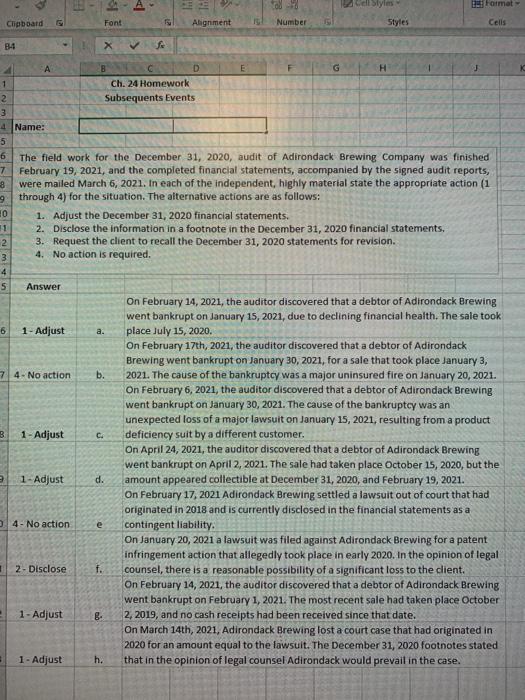

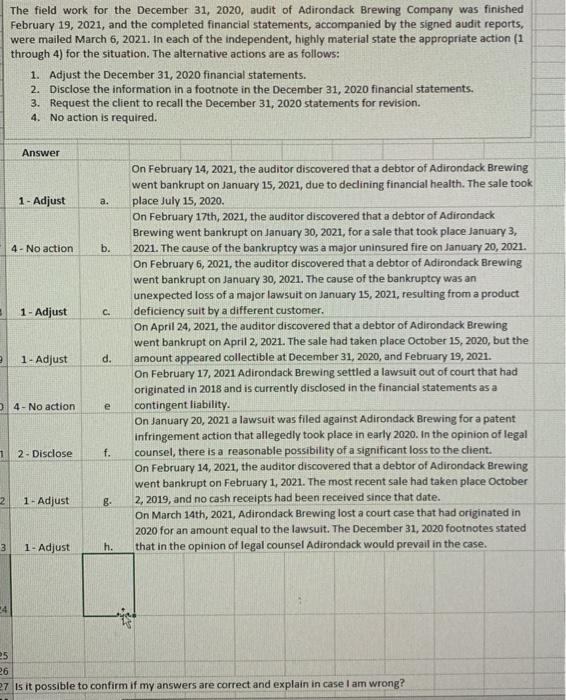

Format Clipboard Font Alignment Number Styles Cells 34 X 1 Ch. 24 Homework 2 Subsequents Events 3 4 Name: 5 6 The field work for the December 31, 2020, audit of Adirondack Brewing Company was finished 7 February 19, 2021, and the completed financial statements, accompanied by the signed audit reports, 8 were mailed March 6, 2021. In each of the independent, highly material state the appropriate action (1 through 4) for the situation. The alternative actions are as follows: 10 1. Adjust the December 31, 2020 financial statements, 11 2. Disclose the information in a footnote in the December 31, 2020 financial statements. 2 3. Request the client to recall the December 31, 2020 statements for revision. 3 4. No action is required. 4 5 Answer On February 14, 2021, the auditor discovered that a debtor of Adirondack Brewing went bankrupt on January 15, 2021, due to declining financial health. The sale took 6 1- Adjust a. place July 15, 2020. On February 17th, 2021, the auditor discovered that a debtor of Adirondack Brewing went bankrupt on January 30, 2021, for a sale that took place January 3, 7 4. No action b. 2021. The cause of the bankruptcy was a major uninsured fire on January 20, 2021. On February 6, 2021, the auditor discovered that a debtor of Adirondack Brewing went bankrupt on January 30, 2021. The cause of the bankruptcy was an unexpected loss of a major lawsuit on January 15, 2021, resulting from a product B 1- Adjust c. deficiency suit by a different customer. On April 24, 2021, the auditor discovered that a debtor of Adirondack Brewing went bankrupt on April 2, 2021. The sale had taken place October 15, 2020, but the 1- Adjust d. amount appeared collectible at December 31, 2020, and February 19, 2021. On February 17, 2021 Adirondack Brewing settled a lawsuit out of court that had originated in 2018 and is currently disclosed in the financial statements as a 4- No action contingent liability On January 20, 2021 a lawsuit was filed against Adirondack Brewing for a patent infringement action that allegedly took place in early 2020. In the opinion of legal 2- Disclose f. counsel, there is a reasonable possibility of a significant loss to the client. On February 14, 2021, the auditor discovered that a debtor of Adirondack Brewing went bankrupt on February 1, 2021. The most recent sale had taken place October 1 - Adjust 8 2, 2019, and no cash receipts had been received since that date. On March 14th, 2021, Adirondack Brewing lost a court case that had originated in 2020 for an amount equal to the lawsuit. The December 31, 2020 footnotes stated 1 - Adjust h. that in the opinion of legal counsel Adirondack would prevail in the case. e The field work for the December 31, 2020, audit of Adirondack Brewing Company was finished February 19, 2021, and the completed financial statements, accompanied by the signed audit reports, were mailed March 6, 2021. In each of the independent, highly material state the appropriate action (1 through 4) for the situation. The alternative actions are as follows: 1. Adjust the December 31, 2020 financial statements. 2. Disclose the information in a footnote in the December 31, 2020 financial statements. 3. Request the client to recall the December 31, 2020 statements for revision. 4. No action is required. Answer 1 - Adjust a. 4 - No action b. 3 1 - Adjust C. 1 - Adjust d. On February 14, 2021, the auditor discovered that a debtor of Adirondack Brewing went bankrupt on January 15, 2021, due to declining financial health. The sale took place July 15, 2020. On February 17th, 2021, the auditor discovered that a debtor of Adirondack Brewing went bankrupt on January 30, 2021, for a sale that took place January 3, 2021. The cause of the bankruptcy was a major uninsured fire on January 20, 2021. On February 6, 2021, the auditor discovered that a debtor of Adirondack Brewing went bankrupt on January 30, 2021. The cause of the bankruptcy was an unexpected loss of a major lawsuit on January 15, 2021, resulting from a product deficiency suit by a different customer. On April 24, 2021, the auditor discovered that a debtor of Adirondack Brewing went bankrupt on April 2, 2021. The sale had taken place October 15, 2020, but the amount appeared collectible at December 31, 2020, and February 19, 2021. On February 17, 2021 Adirondack Brewing settled a lawsuit out of court that had originated in 2018 and is currently disclosed in the financial statements as a contingent liability On January 20, 2021 a lawsuit was filed against Adirondack Brewing for a patent Infringement action that allegedly took place in early 2020. In the opinion of legal counsel, there is a reasonable possibility of a significant loss to the client. On February 14, 2021, the auditor discovered that a debtor of Adirondack Brewing went bankrupt on February 1, 2021. The most recent sale had taken place October 2, 2019, and no cash receipts had been received since that date. On March 14th, 2021, Adirondack Brewing lost a court case that had originated in 2020 for an amount equal to the lawsuit. The December 31, 2020 footnotes stated that in the opinion of legal counsel Adirondack would prevail in the case. 4-No action e 1 2 - Disclose f. 2 1. Adjust g 3 1- Adjust h. 24 18 25 26 27 Is it possible to confirm if my answers are correct and explain in case I am wrong