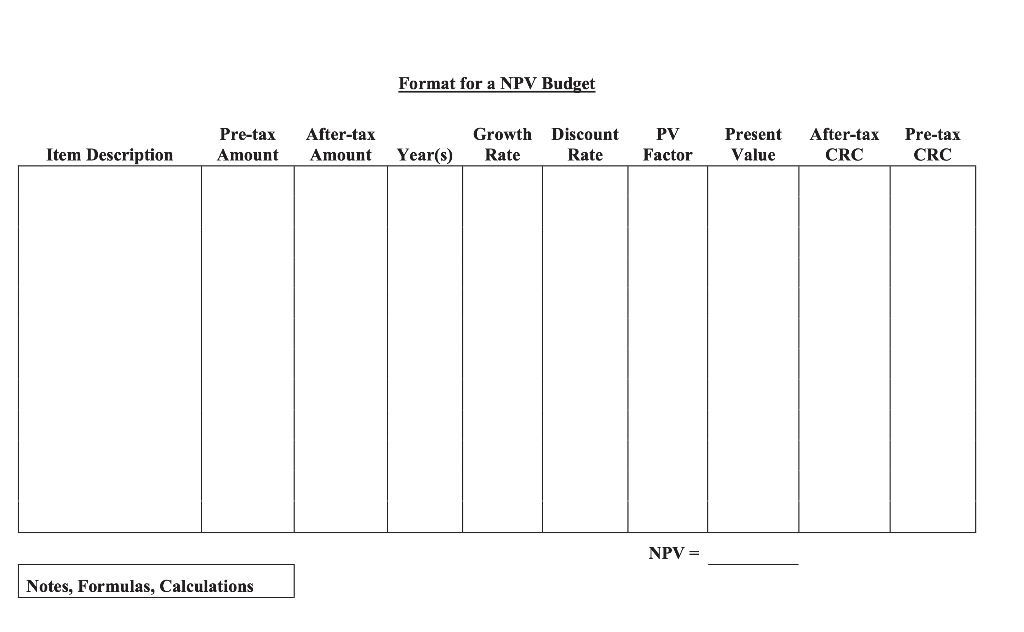

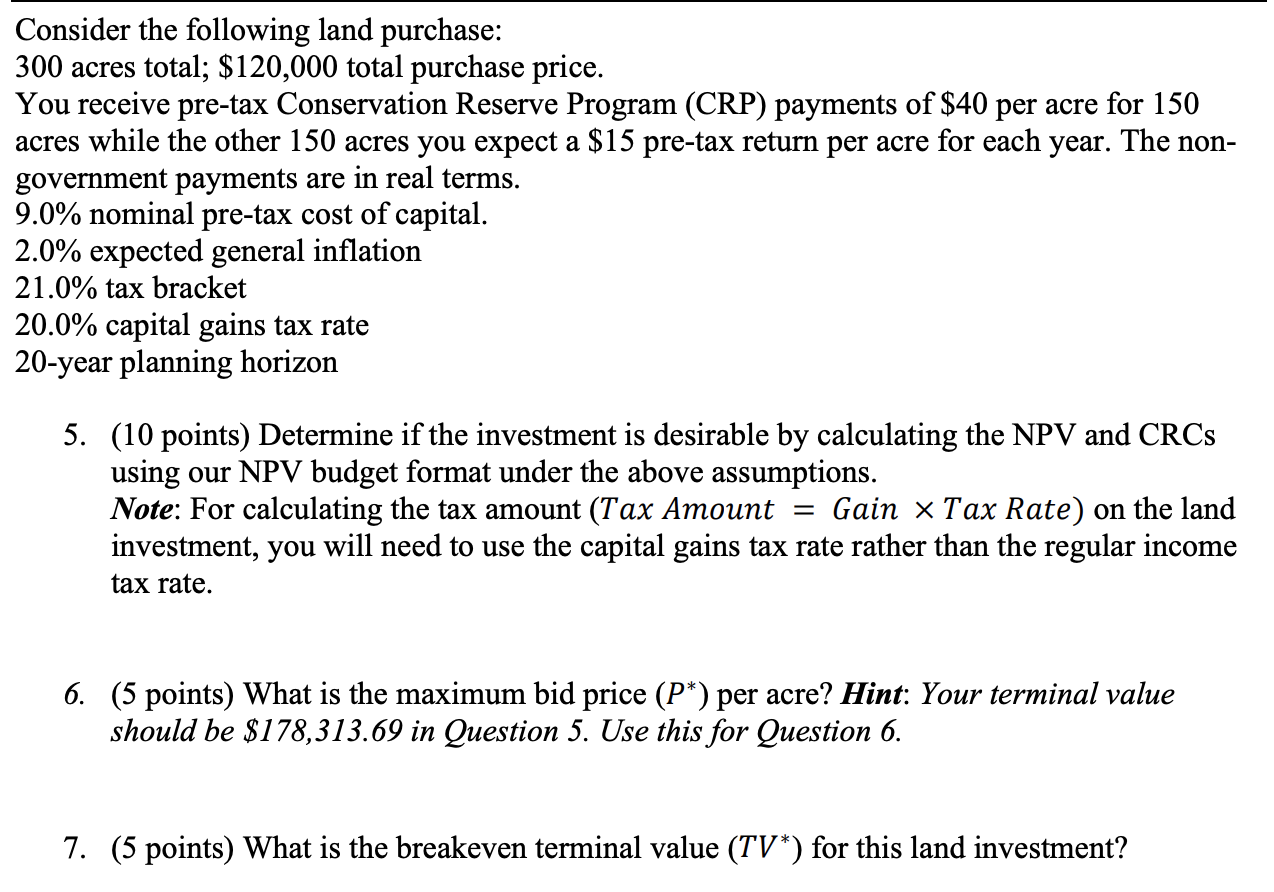

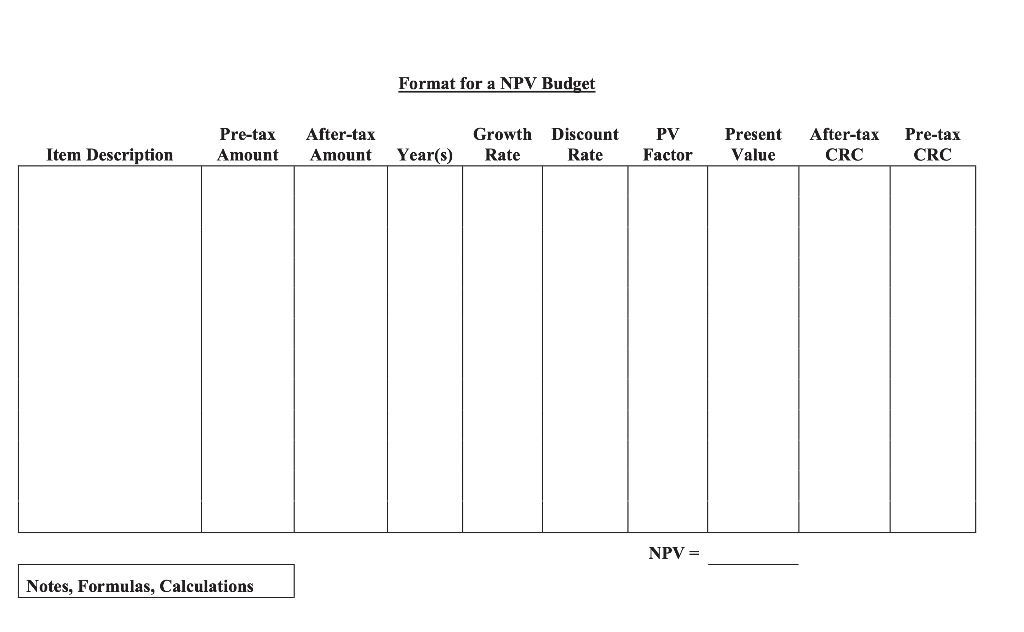

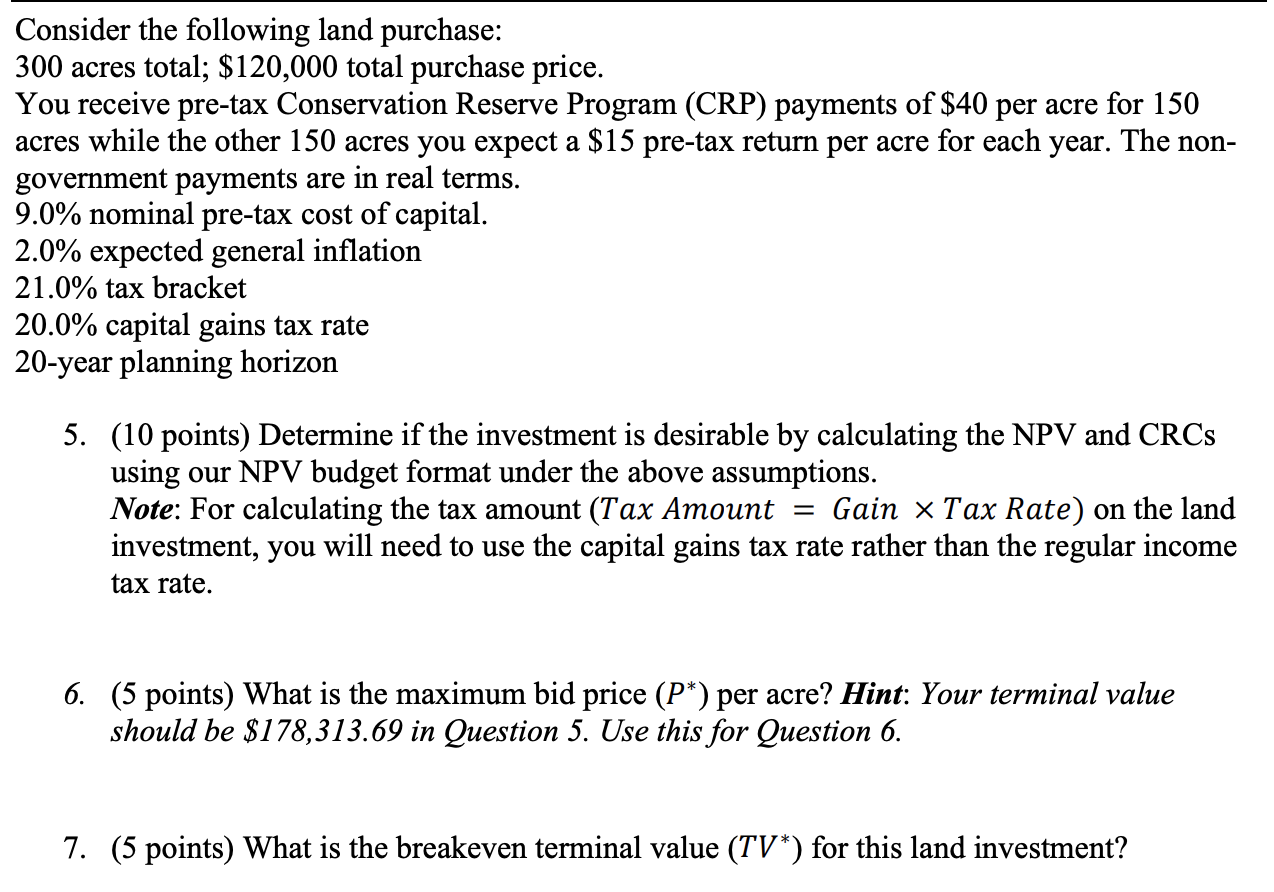

Format for a NPV Budget Pre-tax Amount After-tax Amount Growth Rate Discount Rate PV Factor Item Description Present Value After-tax CRC Pre-tax CRC Year(s) NPV = Notes, Formulas, Calculations Consider the following land purchase: 300 acres total; $120,000 total purchase price. You receive pre-tax Conservation Reserve Program (CRP) payments of $40 per acre for 150 acres while the other 150 acres you expect a $15 pre-tax return per acre for each year. The non- government payments are in real terms. 9.0% nominal pre-tax cost of capital. 2.0% expected general inflation 21.0% tax bracket 20.0% capital gains tax rate 20-year planning horizon 5. (10 points) Determine if the investment is desirable by calculating the NPV and CRCs using our NPV budget format under the above assumptions. Note: For calculating the tax amount (Tax Amount Gain x Tax Rate) on the land investment, you will need to use the capital gains tax rate rather than the regular income tax rate. = 6. (5 points) What is the maximum bid price (P*) per acre? Hint: Your terminal value should be $178,313.69 in Question 5. Use this for Question 6. 7. (5 points) What is the breakeven terminal value (TV*) for this land investment? Format for a NPV Budget Pre-tax Amount After-tax Amount Growth Rate Discount Rate PV Factor Item Description Present Value After-tax CRC Pre-tax CRC Year(s) NPV = Notes, Formulas, Calculations Consider the following land purchase: 300 acres total; $120,000 total purchase price. You receive pre-tax Conservation Reserve Program (CRP) payments of $40 per acre for 150 acres while the other 150 acres you expect a $15 pre-tax return per acre for each year. The non- government payments are in real terms. 9.0% nominal pre-tax cost of capital. 2.0% expected general inflation 21.0% tax bracket 20.0% capital gains tax rate 20-year planning horizon 5. (10 points) Determine if the investment is desirable by calculating the NPV and CRCs using our NPV budget format under the above assumptions. Note: For calculating the tax amount (Tax Amount Gain x Tax Rate) on the land investment, you will need to use the capital gains tax rate rather than the regular income tax rate. = 6. (5 points) What is the maximum bid price (P*) per acre? Hint: Your terminal value should be $178,313.69 in Question 5. Use this for Question 6. 7. (5 points) What is the breakeven terminal value (TV*) for this land investment