Format:

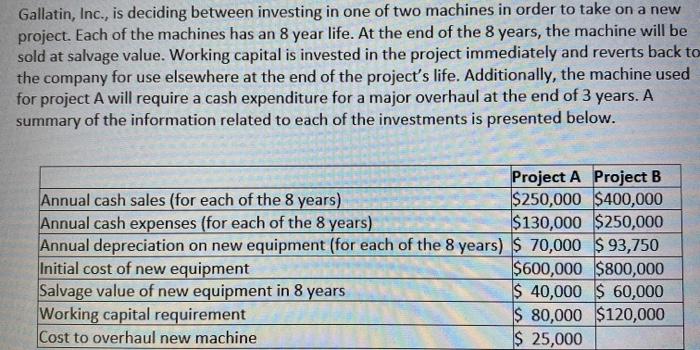

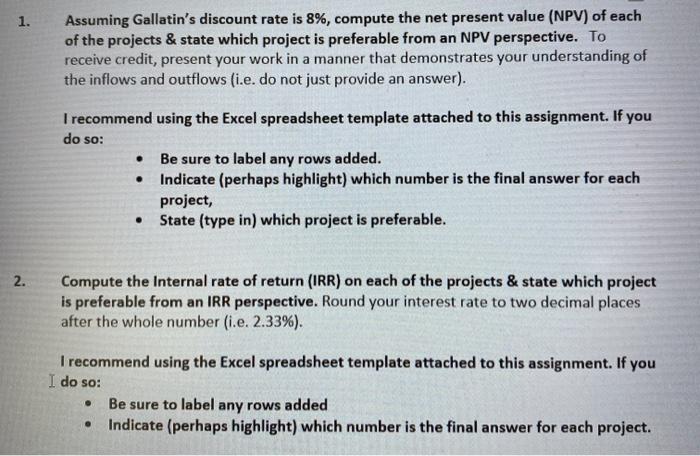

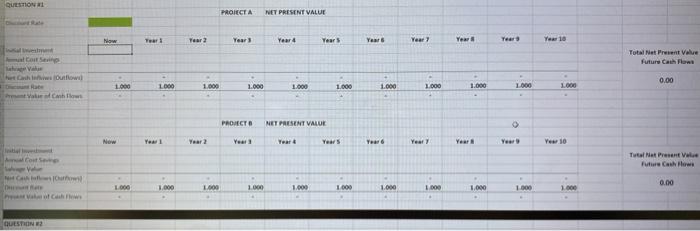

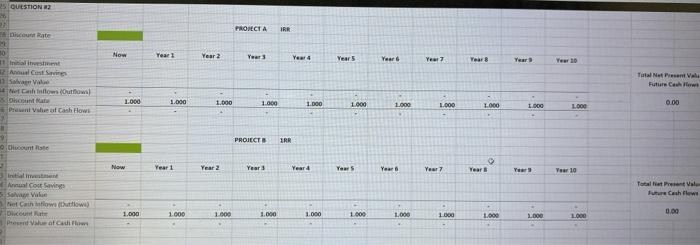

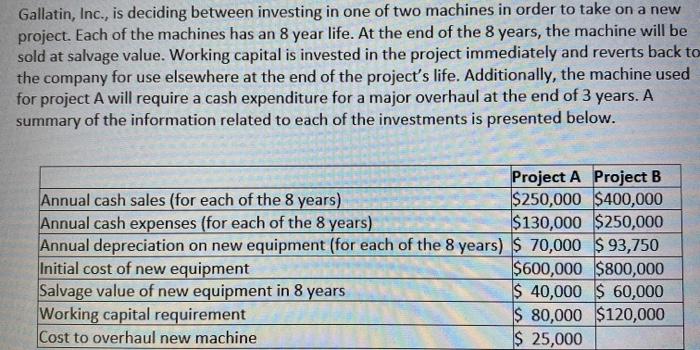

Gallatin, Inc., is deciding between investing in one of two machines in order to take on a new project. Each of the machines has an 8 year life. At the end of the 8 years, the machine will be sold at salvage value. Working capital is invested in the project immediately and reverts back to the company for use elsewhere at the end of the project's life. Additionally, the machine used for project A will require a cash expenditure for a major overhaul at the end of 3 years. A summary of the information related to each of the investments is presented below. Project A Project B Annual cash sales (for each of the 8 years) $250,000 $400,000 Annual cash expenses (for each of the 8 years) $130,000 $250,000 Annual depreciation on new equipment (for each of the 8 years) $ 70,000 $ 93,750 Initial cost of new equipment $600,000 $800,000 Salvage value of new equipment in 8 years $ 40,000 $ 60,000 Working capital requirement $ 80,000 $120,000 Cost to overhaul new machine $ 25,000 1. Assuming Gallatin's discount rate is 8%, compute the net present value (NPV) of each of the projects & state which project is preferable from an NPV perspective. To receive credit, present your work in a manner that demonstrates your understanding of the inflows and outflows (i.e. do not just provide an answer). I recommend using the Excel spreadsheet template attached to this assignment. If you do so: . Be sure to label any rows added. Indicate (perhaps highlight) which number is the final answer for each project, State (type in) which project is preferable. . 2. Compute the Internal rate of return (IRR) on each of the projects & state which project is preferable from an IRR perspective. Round your interest rate to two decimal places after the whole number (.e. 2.33%). I recommend using the Excel spreadsheet template attached to this assignment. If you I do so: Be sure to label any rows added Indicate (perhaps highlight) which number is the final answer for each project. . PROIECTA NET PRESENT VALUE Now Tear Tear Years Yeard Years Years Year Year Years Year 10 Total Nutrient Valve the Outflow 0.00 1.000 1.000 1.000 1.000 1.000 1.000 1.000 1.000 1.000 1000 Chow PROJECTE NET PRESENT VALUE Now Yea Year Year 4 Years Te Year Year 10 outs Tal Next Presente Future Cat Flow 0.00 1.000 1.000 1.000 1.000 1.000 1000 1.000 1.000 1.000 1.000 1.000 QUESTION 25 QUESTION PROJECT A IRR Don Rate 30 Now Year Year 2 Years Year Years Year Yes Year 8 Year Year 10 TlNet Presenta Future Cat Am Custries 11 Svar Val Not Go (Outflow Sonuna Prentshoof Cash Flow 1.000 1.000 1.000 1.000 1.000 1.000 1.000 1.000 TO 1.000 0.00 PROJECT ERR Courite Now Year 1 Year 2 Years Year Years Yaar Year Year Year 10 Totalt Present Vale Future Cash Flow Institut Arual costat Se Value Diet Caintatiowo brutowy On Pred value of the 1.000 1.000 1.000 1.000 1.000 1.000 1.000 1.000 0.00 1.000 2.000 1.000