Question

Format the ratios as fixed or percent with the appropriate number of decimals. To get you started on the first ratio (Return on Investment, net

Format the ratios as fixed or percent with the appropriate number of decimals. To get you started on the first ratio (Return on Investment, net income is calculated as the sum of the revenue and expense accounts. Average Owners' Equity is (Beginning Owners' Equity plus Ending Owners' Equity) divided by 2. Beginning owners' equity was $627,453

PLEASE CALCULATE

1) ROI Return on Investment = Net Income/Avg. Owners Equity = x%

2) GM% Gross Margin % = Gross Margin/Net Sales = x%

3) CR Current Ratio = Current Assets/Current Liabilities = x

Consider notes payable in the long term.

4) DE Debt-to-Equity = Total liabilities/owners' equity = x%

5) EPS Net Income / # of Common Stock outstanding = x

CS Outstanding = 5000 shares

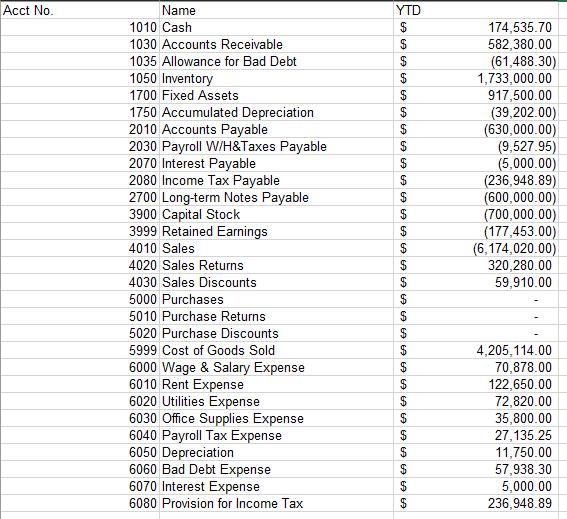

Acct No. Name 1010 Cash 1030 Accounts Receivable 1035 Allowance for Bad Debt 1050 Inventory 1700 Fixed Assets 1750 Accumulated Depreciation 2010 Accounts Payable 2030 Payroll W/H&Taxes Payable 2070 Interest Payable 2080 Income Tax Payable 2700 Long-term Notes Payable 3900 Capital Stock 3999 Retained Earnings 4010 Sales 4020 Sales Returns 4030 Sales Discounts 5000 Purchases 5010 Purchase Returns 5020 Purchase Discounts 5999 Cost of Goods Sold 6000 Wage & Salary Expense 6010 Rent Expense 6020 Utilities Expense 6030 Office Supplies Expense 6040 Payroll Tax Expense 6050 Depreciation 6060 Bad Debt Expense 6070 Interest Expense 6080 Provision for Income Tax YTD $ 69 69 69 69 69 69 69 69 69 69 69 69 69 69 69 69 69 69 69 69 69 69 69 69 69 69 69 69 69 $ $ $ $ 174,535.70 582,380.00 (61,488.30) 1,733,000.00 917,500.00 (39,202.00) (630,000.00) (9,527.95) (5,000.00) (236,948.89) (600,000.00) (700,000.00) (177,453.00) (6,174,020.00) 320,280.00 59,910.00 4,205,114.00 70,878.00 122,650.00 72,820.00 35,800.00 27,135.25 11,750.00 57,938.30 5,000.00 236,948.89

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started