Question

FormaTek is an all-equity financed firm with zero debt. FormaTek is an unlevered firm operates in perfect markets and has net operating income (EBIT) of

FormaTek is an all-equity financed firm with zero debt.

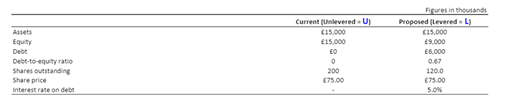

FormaTek is an unlevered firm operates in perfect markets and has net operating income (EBIT) of 1.50 million per year for the foreseeable future. Assume that the required rate of return on assets for firms in this industry is 8 per cent. The firm issues 6 million worth of debt, with a required rate of return of 5 per cent, and uses the proceeds to repurchase outstanding shares. There are no corporate or personal taxes.

The firm is considering changing from its all-equity capital structure to one including substantial financial leverage

By exploring various other recent documents, you have found that the board of directors is considering to take a project to develop COVID-19 rapid test. It requires 400,000 initial investment to start the project. It is expected that this project will bring 115,000 annual revenue for the next 4 years.

Calculate the market value and the required rate of return of FormaTeks share of the unlevered and levered position before the repurchase transaction. Assume NO corporation tax. [10 Marks]

Figures in thousands Proposedlevered - L) 115.000 9,000 6,000 Current (Unlevered. U) (15.000 15,000 ED 0 200 C75.00 Equity Debt Debt-to-equity ratio Shares outstanding Share price Interest rate on debt 120.0 E75.00 5.0%Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started