Answered step by step

Verified Expert Solution

Question

1 Approved Answer

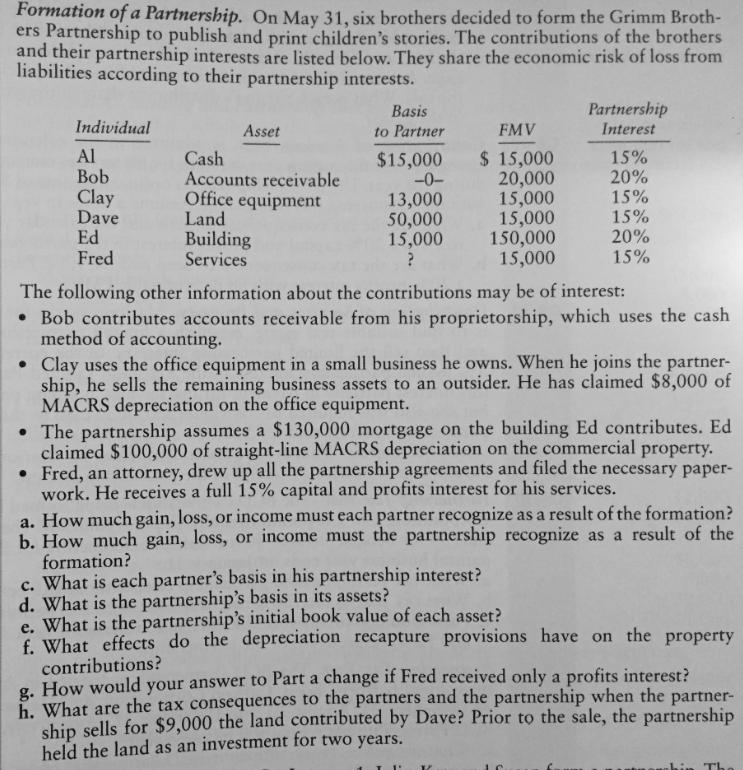

Formation of a Partnership. On May 31, six brothers decided to form the Grimm Broth- ers Partnership to publish and print children's stories. The

Formation of a Partnership. On May 31, six brothers decided to form the Grimm Broth- ers Partnership to publish and print children's stories. The contributions of the brothers and their partnership interests are listed below. They share the economic risk of loss from liabilities according to their partnership interests. Partnership Interest Basis Individual FMV Asset to Partner Al Bob Clay Dave Ed $ 15,000 20,000 15,000 15,000 150,000 15,000 15% 20% 15% Cash Accounts receivable Office equipment Land $15,000 -0- 13,000 50,000 15,000 15% 20% 15% Building Services Fred The following other information about the contributions may be of interest: Bob contributes accounts receivable from his proprietorship, which uses the cash method of accounting. Clay uses the office equipment in a small business he owns. When he joins the partner- ship, he sells the remaining business assets to an outsider. He has claimed $8,000 of MACRS depreciation on the office equipment. The partnership assumes a $130,000 mortgage on the building Ed contributes. Ed claimed $100,000 of straight-line MACRS depreciation on the commercial property. Fred, an attorney, drew up all the partnership agreements and filed the necessary paper- work. He receives a full 15% capital and profits interest for his services. a. How much gain, loss, or income must each partner recognize as a result of the formation? b. How much gain, loss, or income must the partnership recognize as a result of the formation? c. What is each partner's basis in his partnership interest? d. What is the partnership's basis in its assets? e. What is the partnership's initial book value of each asset? f. What effects do the depreciation recapture provisions have on the property contributions? . How would your answer to Part a change if Fred received only a profits interest? h. What are the tax consequences to the partners and the partnership when the partner- shin sells for $9,000 the land contributed by Dave? Prior to the sale, the partnership held the land as an investment for two years.

Step by Step Solution

★★★★★

3.47 Rating (170 Votes )

There are 3 Steps involved in it

Step: 1

Fred recognizes ordinary income compensation of 15000 Ed recognizes 87000 calculated in part c below of capital Sec 1231 gain The other partners do no...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started